Search

Recent comments

- bread and butter....

1 hour 24 min ago - activism....

2 hours 56 min ago - start writing!....

5 hours 39 min ago - beyond arrogance....

5 hours 45 min ago - historians...

5 hours 58 min ago - replaced.....

8 hours 35 min ago - same shit....

8 hours 58 min ago - sadistic arrogance....

11 hours 1 min ago - prayers?...

12 hours 29 min ago - religious war....

1 day 6 hours ago

Democracy Links

Member's Off-site Blogs

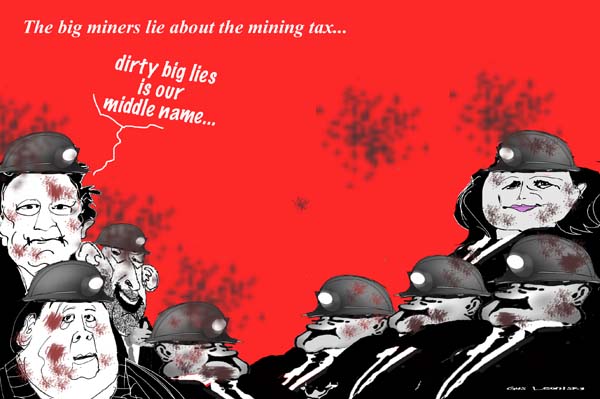

the dirt and mud experts...

Treasury officials have rejected suggestions the Federal Government's mining tax will target smaller miners and let large miners off the hook.

A parliamentary committee is examining the mineral resource rent tax (MRRT) while the Government tries to convince crossbenchers to pass the legislation through the Lower House.

Last week, Fortescue Metals chairman Andrew Forrest released research paid for by his company that shows Rio Tinto and BHP Billiton would not be liable to pay the tax for the next five years but smaller miners would have to pay tens of millions of dollars.

But Treasury general manager of business tax Paul McCullough says the modelling does not reflect the way the tax will work.

"We have tried to make it apply as equally as possible to all of the people that it's designed to affect," Mr McCullough said.

"There is one exception to that. We do have a bias, but it's in favour of small miners.

http://www.abc.net.au/news/2011-11-08/mining-inquiry/3652686

- By Gus Leonisky at 8 Nov 2011 - 2:27pm

- Gus Leonisky's blog

- Login or register to post comments

taxing the big pudding...

Firms with profits under $50 million will be exempt from paying under the tax plan.

The government lacks the vital support of independents to carry its mining tax in the House of Representatives. A parliamentary committee will hold hearings on the legislation tomorrow.

Mr Forrest demanded that the government publish the assumptions that underlie the tax. A resource economist at Melbourne University, Professor John Freebairn, said it seemed unlikely the big multinationals would pay no tax but concurred that the government should release its assumptions.

Read more: http://www.smh.com.au/national/forrest-lashes-out-at-pathetic-swan-as-mining-tax-battle-escalates-20111106-1n21s.html#ixzz1d5LPnfAp

"Small miners don't pay the tax - well, they don't pay it at all on the first $50 million of profit."

Magnetite Network chairman Bill MacKenzie used the inquiry to demand that magnetite miners be excluded from the tax.

The Government wants the tax to apply to coal and iron ore projects but insists that miners and processors of low-quality iron ore, or magnetite, will pay little or no tax.

http://www.abc.net.au/news/2011-11-08/mining-inquiry/3652686

the rotten wood in the forrest...

THE Treasurer, Wayne Swan, and his department have shredded claims by the mining boss Andrew Forrest that the minerals giants will not pay a cent in mining tax, saying Rio Tinto and BHP Billiton will pay at least $2 billion a year on iron ore alone.

With Mr Forrest to appear today before a parliamentary inquiry into the minerals resources rent tax, Mr Swan has sent an angry letter to the head of the Perth accounting firm BDO which modelled the tax for Mr Forrest and fuelled his claims.

The letter, backed by detailed Treasury analysis, describes the modelling as ''utterly unrealistic'' and riddled with errors about how the tax would operate.

Mr Forrest, the chief executive of Fortescue Metals Group, is at war with the government over the tax, saying it was negotiated to suit the big three - BHP, Rio and Xstrata - while smaller miners would be hurt.

Read more: http://www.smh.com.au/national/treasurer-lashes-forrests-tax-claim-20111108-1n5n7.html#ixzz1dB2fEtA5

boom de-boom...

From Ross Gittins, SMH

...

That ain't easy, particularly because most government services - education, hospitals, law and order, roads - are delivered by the states. The cost per person of delivering services varies with how big and decentralised the states are. But another factor is the states' varying capacities to raise revenue. These days, states gaining royalty payments from their big mining industries have considerable ''taxable capacity''.

To bring horizontal fiscal equalisation about, the Commonwealth Grants Commission does many intricate calculations that determine how the $48-billion-a-year proceeds from the feds' goods and services tax are divided between the states. The commission works out the average amount of GST paid per person throughout Australia, then decides whether each state requires more or less than that, per person, to be able to deliver services of equal standard.

This equalisation process was introduced in the early 1930s to mollify the restive West Australians. Until just a few years ago, it meant Victoria and NSW received much less than the national average, while South Australia and Tasmania received a lot more than average and Queensland and WA took a bit more.

In 2004-05, NSW got just 83 per cent of the national average GST paid per person, while Victoria received 84 per cent. WA's share was 104 per cent of the national average and Queensland took 107 per cent, with SA getting 123 per cent and Tasmania 171 per cent.

But the huge increase in the resource states' taxable capacity thanks to booming mining royalties has changed all that. This financial year, NSW's cut has risen to 96 per cent and Victoria's to 90 per cent, whereas Queensland's cut has fallen to 93 per cent and WA's to - get this - 72 per cent.

It works out that, in effect, Queensland's benefit from its mining royalties this year will be reduced by $1.2 billion and WA's by $2.5 billion. Of their combined loss of $3.7 billion, NSW gains $1.3 billion and Victoria $1.8 billion.

Still think you're getting nothing from the boom?

Read more: http://www.smh.com.au/opinion/politics/its-boom-time-for-everyone-20111108-1n5du.html#ixzz1dBAq99mt

Tax? T-A-X?...

The Federal Government has attacked Fortescue Metals Group (FMG) chairman Andrew Forrest in Senate question time over the revelation that his business has never paid any company tax.

FMG head of government relations Julian Tapp told a Parliamentary committee into the mining tax today that the company had not yet paid any company tax, but was due to pay up to $800 million this financial year.

http://www.abc.net.au/news/2011-11-09/fortescue-mining-company-tax/3655270