Search

Recent comments

- intensity....

2 hours 17 min ago - adaptation....

2 hours 57 min ago - bloody op.....

13 hours 50 min ago - avoiding biffo....

19 hours 41 min ago - leak....

21 hours 46 min ago - trump's women....

1 day 2 hours ago - CIA control....

1 day 2 hours ago - attritioning....

1 day 2 hours ago - hypocrite....

1 day 3 hours ago - not mentioned....

1 day 13 hours ago

Democracy Links

Member's Off-site Blogs

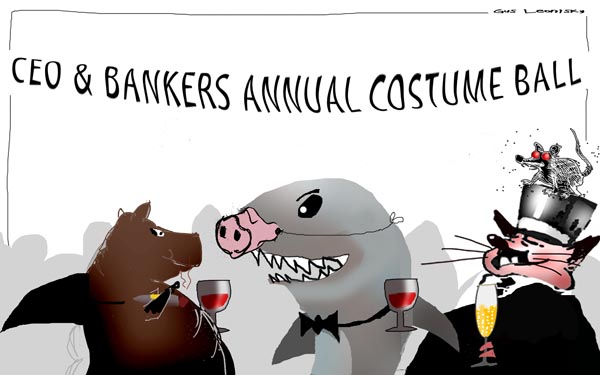

a charity event to protect endangered bonuses, stock options and accrued perks...

"I love your costume..." "Thank you..."

- By Gus Leonisky at 29 Oct 2011 - 9:14am

- Gus Leonisky's blog

- Login or register to post comments

flying pigs and a bipolar opposition...

The Qantas chairman, Leigh Clifford, said the voting showed shareholders overwhelmingly supported management, and described the outcome of the meeting as a ''bit of a watershed''. ''There was a lot of talk about how the board was going to be rolled … but that was not the case,'' he said.

Although Qantas was keen for changes to the foreign ownership cap on the airline, Mr Clifford said there was no appetite on either side of politics for such reform to the Qantas Sale Act.

He also poured cold water on rumours that private equity firms were circling Qantas, saying it would be difficult for them to raise the funds due to the precarious state of the markets.

As the Opposition Leader, Tony Abbott, was encouraging the Prime Minister, Julia Gillard, to ''get active'' to end the dispute, the former Coalition industrial relations minister Peter Reith told Sky News such federal intervention was ''old thinking'' and ''an idea that we have effectively abandoned for very good reason''.

Stephen Matthews, from the Australian Shareholders' Association, said that over the past five years Qantas CEOs, including Mr Joyce and his predecessor, Geoff Dixon, had received $55 million and the non-executive directors $13 million.

Read more: http://www.smh.com.au/business/verbal-blows-fail-to-ground-pay-rise-for-qantas-chiefs-20111028-1mo9r.html#ixzz1c7atIXia

the trickle-down effect is not trickling down...

AMONG the often inchoate complaints of those who have been ''occupying'' public spaces in almost 1000 cities around the world over the past couple of months - including Melbourne and Sydney - one common theme appears. It is the resentment at the share of income and wealth controlled by, and the degree of political influence exercised by, the richest citizens of each nation.

In the US, where the ''Occupy'' protests first appeared on Wall Street, these concerns are quite well founded.

According to data published in the Paris School of Economics' World Top Incomes Database, the share of total household income accruing to the top 10 per cent of the income distribution in the US rose from 34.6 per cent in 1980 to 48.2 per cent in 2008 - an increase of 13.6 percentage points.

Put simply, the top 10 per cent of Americans control almost half the country's household wealth.

Read more: http://www.smh.com.au/business/why-some-incomes-are-just-gross-20111028-1mo9g.html#ixzz1c7bkvCP3

of banks and jefferson...

I believe that banking institutions are more dangerous to our liberties than standing armies. If the

American people ever allow private banks to control the issue of their currency, first by inflation,

then by deflation, the banks and corporations that will grow up around the banks will deprive the

people of all property until their children wake-up homeless on the continent their fathers

conquered.

Thomas Jefferson (Letter to the Secretary of the Treasury Albert Gallatin, 1802)

--------------------------

Disputed "issuing power" and "If the American people ever allow private banks..."The disputed section used to read like this:

Since the part " If the American people ever allow private ... conquered." has a separate origin and is more obviously bogus, I moved it to Misattributed. The quotes appeared separately more often than together until the last few years.

The 1895 and 1896 appearances of the "issuing power" quote had an additional sentence: "Let the banks exist, but let them bank on treasury notes" in "Bimetallism and Currency", and "Let banks exist but let them bank upon coin or treasury notes" in Life Work of Thomas L. Nugent. This also appears to be a paraphrase from the 11 Sept 1813 letter: "Let banks continue if they please, but let them discount for cash alone or for treasury notes." After 1896, however, that sentence disappeared. KHirsch 22:32, 10 February 2009 (UTC)

http://en.wikiquote.org/wiki/Talk:Thomas_Jefferson

No matter what was truly said by him, there is a near certainty that Jefferson was weary of banking — especially central banking... He was quite a complex character in his views, including that of slavery. But this is history, our past, then a broth in the making, with it's moires of contradictions and progress...

Thomas Jefferson (April 13, 1743 – July 4, 1826) was the principal author of the United States Declaration of Independence (1776) and the Statute of Virginia for Religious Freedom (1777), the third President of the United States (1801–1809) and founder of the University of Virginia (1819).[1] He was an influential Founding Father and an exponent of Jeffersonian democracy.

At the beginning of the American Revolution, Jefferson served in the Continental Congress, representing Virginia. He then served as the wartime Governor of Virginia (1779–1781), barely escaping capture by the British in 1781. Just after the war ended, from mid-1784 Jefferson served as a diplomat, stationed in Paris, initially as a commissioner to help negotiate commercial treaties. In May 1785, he became the United States Minister to France. He was the first United States Secretary of State (1790–1793). During the administration of President George Washington, Jefferson advised against a national bank and the Jay Treaty. Upon leaving office, with his close friend James Madison he organized the Democratic-Republican Party to oppose Treasury Secretary Alexander Hamilton's policies, especially his desire to create a national bank. He and Madison secretly wrote the Kentucky and Virginia Resolutions, which attempted to nullify the Alien and Sedition Acts and formed the basis of States' rights.

Elected president in what he called the Revolution of 1800, he oversaw a peaceful transition in power, purchased the vast Louisiana Territory from France (1803), and sent the Lewis and Clark Expedition (1804–1806) to explore the new west. He decided to allow slavery in the acquired territory, which laid the foundation for the crisis of the Union a half century later.[2]Aaron Burr, and escalating trouble with Britain. Jefferson always distrusted Britain as a threat to American values. With Britain at war with Napoleon, he tried aggressive economic warfare, however his embargo laws stopped American trade, hurt the economy, and provoked a furious reaction in the Northeast. His second term was beset with troubles at home, such as the failed treason trial of his former Vice President

Jefferson was part of the Virginia planter elite and, as a tobacco planter, owned hundreds of slaves throughout his lifetime. Like many of his contemporaries, he viewed Africans as being racially inferior. He remained a widower for the rest of his life after his wife of eleven years, Martha Wayles Skelton Jefferson, died in childbirth. Their marriage produced six children. Most historians believe that after his wife's death, Jefferson had an intimate relationship for nearly four decades with Martha's half-sister, his mixed-race slave Sally Hemings; and he also fathered her six children.[3] He freed the four surviving Hemings children when they came of age.

A leader in The Enlightenment, Jefferson was a polymath who spoke five languages and was deeply interested in science and political philosophy. While not an orator he was an indefatigable letter writer and was acquainted with many influential people in America and Europe. His views on slavery were complex, and changed over the course of his life.[4] He was a leading American opponent of the international slave trade, and presided over its abolition in 1807. Jefferson has often been rated by historians as one of the greatest U.S. presidents, though in recent decades scholars have tended to be more negative.[5]

----------------------

a bottom exploding dream...

We are slowly — and painfully — being forced to realize that we are no longer the America of our imaginations. Our greatness was not enshrined. Being a world leader is less about destiny than focused determination, and it is there that we have faltered.

We sold ourselves a pipe dream that everyone could get rich and no one would get hurt — a pipe dream that exploded like a pipe bomb when the already-rich grabbed for all the gold; when they used their fortunes to influence government and gain favors and protection; when everyone else was left to scrounge around their ankles in hopes that a few coins would fall.

We have not taken care of the least among us. We have allowed a revolting level of income inequality to develop. We have watched as millions of our fellow countrymen have fallen into poverty. And we have done a poor job of educating our children and now threaten to leave them a country that is a shell of its former self. We should be ashamed.

Poor policies and poor choices have led to exceedingly poor outcomes. Our societal chickens have come home to roost.

This was underscored in a report released on Thursday by the Bertelsmann Stiftung foundation of Germany entitled “Social Justice in the OECD — How Do the Member States Compare?” It analyzed some metrics of basic fairness and equality among Organization for Economic Co-operation and Development countries and ranked America among the ones at the bottom.

http://www.nytimes.com/2011/10/29/opinion/blow-americas-exploding-pipe-dream.html?_r=1&hp=&pagewanted=print

U.S.: 21.6 percent of children affected by poverty

Besonders besorgniserregend ist dabei das Phänomen der Kinderarmut: Im Schnitt leben rund 12,3 Prozent der Kinder unterhalb der Armutsgrenze. Particular concern is the phenomenon of child poverty: on average about 12.3 percent of children live below the poverty line. Daher mangelt es vielerorts bereits an den Grundvoraussetzungen von sozialer Gerechtigkeit und Teilhabe. Therefore, it lacks many places on the basic requirements of social justice and participation. Das Gefälle innerhalb der OECD ist alarmierend: Während etwa in Dänemark nur 3,7 Prozent der Kinder von Armut betroffen sind, liegt die Quote in den USA bei erschreckenden 21,6 Prozent (Rang 28). The differences within the OECD is alarming: While in Denmark only 3.7 percent of children affected by poverty, the rate in the United States at alarming 21.6 percent (rank 28). Nur die Türkei, Chile und Mexiko schneiden schlechter ab als die größte Volkswirtschaft der Welt. Only Turkey, Chile and Mexico cut worse than the largest economy in the world.

www.bertelsmann-stiftung.de/

winning the loss...

He says a loss is no longer called a loss but a ''negative return''.

Similarly, ''negative growth'' is a recession by another name, says Satyajit Das, author of Extreme Money: The Masters of the Universe and the Cult of Risk. Das likes to quote US cowboy and commentator Will Rogers, who once said you can't say civilisation doesn't advance when in every war they kill you in a new way.

"Financial markets find more ways of losing money every time," Das says.

One way to keep your head, and your savings, while everyone around you is losing theirs is to cut through the jargon, hype and obfuscation to reveal what lies beneath. The following is just a small sample of the current argot.

Read more: http://www.smh.com.au/money/the-abcs-of-gfc-jargon-20111025-1mgsb.html#ixzz1cFmHhgfb

see toon at top...

the price of big fish...

From Jessica Irvine

...

Alan Joyce, the CEO of Qantas, which has a near-monopoly over air travel in Australia, has hit the headlines with his $5 million pay packet. But he is far from the highest paid CEO in Australia.

Top of the list for 2010 was the outgoing Commonwealth Bank boss Ralph Norris, on $16.2 million. ANZ's Mike Smith also makes the top 10, as does Westpac's Gail Kelly on $9.6 million and Macquarie Group's Nick Moore (an unfortunate name) on $9.6 million. In fact, of the 10 largest companies in Australia, eight also have CEOs in the top 10 of highest paid executives.

Economic theory says workers are paid according to the value of their marginal product. But what are the bank CEOs adding?

It is hard to escape the conclusion that many of their salaries derive not from the value added by the CEOs but the monopolistic power those companies exert over the prices paid by the Australian consumer.

Australian CEOs say they must be remunerated so as not to be tempted away by jobs as international CEOs. But running a company is a tougher gig in the big, deeper pools of larger economies. Better to be a big fish in a small pond.

CEOs also say they need to be compensated for the risks involved in running these very large companies. But what risk? Running a big bank in Australia is about as risky as running a large bureaucracy, and we don't pay public servants anything like these guys get. The membership of the top 10 companies in Australia is remarkably stable. These are not companies that fall over. In fact, the big four banks have an all but explicit guarantee they will not be allowed to fail.

Sitting in a CEO chair at the top of the ASX food chain is a great gig. These companies are simply not at risk of going under and their CEOs simply don't deserve what they get.

Read more: http://www.smh.com.au/opinion/politics/top-bosses-riches-are-undeserved-20111101-1mttj.html#ixzz1cWdUNcej

big bux for bank

Westpac has announced profits of $6.99 billion, the highest full-year net profit recorded by an Australian bank and an increase of 10 per cent on last year.

Cash earnings, the bank's preferred measure, rose by 7 per cent to $6.3 billion.

But the result was driven by lower costs and a drop in bad debts by 32 per cent to $463 million, says chief financial officer Phil Coffey.

And revenues were flat.

"In a time when credit growth is low, if you can keep your margins flat and get the benefit of your impairment reduction, then that's what can drive your earnings growth," Mr Coffey said.

City Index chief market analyst Peter Esho says the bank also benefitted from a tax adjustment.

"Westpac also had a tax benefit with the effective tax rate down to 17 per cent this year compared to the 20 per cent booked last year," he said.

http://www.abc.net.au/news/2011-11-02/westpac-profits/3614554

admitted that they are paid too much...

British bankers have admitted that they are paid too much, a report into moral standards in the City of London will reveal tomorrow.

A survey of 500 workers in City financial institutions, carried out for the Christian think-tank St Paul's Institute, found that "a substantial number" believed they were overpaid compared with other professions – particularly frontline workers including teachers and, most of all, nurses.

The results will fuel continuing bitterness towards the industry over its culpability for the financial crisis and its apparent failure to rein in huge salaries and bonuses . Last night The Sunday Times reported the publicly owned Royal Bank of Scotland is planning to pay its investment bankers about £500m in bonuses.

The Archbishop of York, Dr John Sentamu, yesterday joined the attack on bankers' pay, claiming excesses in the financial sector had helped to create huge inequalities in wealth, "demonstrating how scandalously unfair our society is".

The Independent on Sunday revealed last week that St Paul's had suppressed the report following the resignation of Canon Chancellor Giles Fraser, amid fears that it would inflame tensions over the Occupy London protest outside the the cathedral.

http://www.independent.co.uk/news/business/news/we-are-paid-too-much-bankers-confess-in-st-pauls-survey-6258032.html#

If my memory is correct St Paul's real name was Saul and he was riding a horse on the way to Damascus... We all know what this means from now on... A sort of enlightenment in which god pressed his buttons by making him blind until he saw the light... For him, a Roman, it was to stop annoying the christians... But there is ambiguity in the record, if this was referring to the same man or if two stories got tangled up to make one tale... Who knows... Scholars don't all agree on this... Anyway...

I was nearly going to mix him with another saint who gave half of his coat to a poor man who was freezing to death... That was St Martin... Mind you Martin could have given his whole coat... but we wont bicker if the man died from frost bite in twice the time he would have had with no half-coat...... The fact is that bankers are awakening to their greedy ways, so what are they going to do about it... Well, you know... A holiday in the Bahamas would be nice...

history revisionism according to big bux...

Wall Street has its own version: Its Big Lie is that banks and investment houses are merely victims of the crash. You see, the entire boom and bust was caused by misguided government policies. It was not irresponsible lending or derivative or excess leverage or misguided compensation packages, but rather long-standing housing policies that were at fault.

Indeed, the arguments these folks make fail to withstand even casual scrutiny. But that has not stopped people who should know better from repeating them.

The Big Lie made a surprise appearance Tuesday when New York Mayor Michael Bloomberg, responding to a question about Occupy Wall Street, stunned observers by exonerating Wall Street: “It was not the banks that created the mortgage crisis. It was, plain and simple, Congress who forced everybody to go and give mortgages to people who were on the cusp.”

What made his comments so stunning is that he built Bloomberg Data Services on the notion that data are what matter most to investors. The terminals are found on nearly 400,000 trading desks around the world, at a cost of $1,500 a month. (Do the math — that’s over half a billion dollars a month.)

http://www.washingtonpost.com/business/what-caused-the-financial-crisis-the-big-lie-goes-viral/2011/10/31/gIQAXlSOqM_story.html?hpid=z3

----------------------

Meanwhile, in the pipes of free-flowing cash of the world...

Adam Smith Institute claims Tobin tax would lead to greater volatility and more unemployment

LAST UPDATED AT 09:58 ON Fri 4 Nov 2011ACTOR Bill Nighy has managed very well in taking his campaign for the Robin Hood tax to Cannes on behalf of Oxfam. He has successfully batted off any number of City pundits and TV hosts throwing awkward questions at him, and with Nicolas Sarkozy, Angela Merkel and the Archbishop of Canterbury backing a financial transactions tax, he has the wind behind him.

But how will he answer the new evidence from the leading free market think-tank, the Adam Smith Institute, that London will be "hung out to dry" if the tax is implemented?

http://www.theweek.co.uk/city/robin-hood-tax/42061/nighys-tobin-tax-disaster-london-says-think-tank

Yes the Adam Smith institute — the voice of free markets — lets us know that "markets are the method of getting what we all desire, that cleaner, greener, richer, world."... Of course no point disputing this but free markets tend to hurt people if not properly regulated.

Why? because there are too many merchants of snake oil out there and too many of us are prepared to believe in snake oil. One could say that it's our own fault then to be taken for a ride... But I will argue that the methods used to make us believe in snake oil are very powerful and designed to capture as many people as possible. Religion works on the same principle... This free market junk leads to ugliness such as advertising pollution everywhere: on the streets, on the roads, on buildings. Lucky, some countries have very strict rules about this practice, thus regulation of advertising (true or false) is a first regulation of market...

On the old market place, stall holders used to pay a rent fee according to the size (and position) of their stall. In finance, the size of the stall can be equated to the amount of transactions a stall-holder makes. Furthermore, even before entering a town, stall holders had to pay an entry fee. On top of that, these days if the chickens you sell are off and make people sick, you will be fined and your business shut down.

Too many Wall Street operators disguised their crook chooks in packages with pink bows and sold them as premium products. That is charlatanism of the worse kind... Even some of their own got sick... In Australia where the banking system is highly regulated, the impact of the WFC was limited but felt enough for the government to garantee all savings and fork out a program of policies designed to stop people from starving.

Regulation works and is necessary. It's easy to talk of "free market" but in the end, considering all freedom, I would be free to come and rob a bank freely while avoiding the bullets from the armed guard, the same way as a bank can rob me — and does freely by claiming that "we've simplified the way we do your account. Instead of charging you a tiny weeny percentage on your extra transactions, we'll install a flat monthly fee on your account. Keep smiling.

see toon at top

the monopoly of money...

Three Swiss experts on complex network analysis have recently examined the architecture of international ownership, analyzing a large database of transnational corporations. They concluded that a large portion of control resides with a relatively small core of financial institutions, with about 147 tightly knit companies controlling about 40 percent of the total wealth in the network.

Their analysis draws heavily on network topology, a methodology that biologists use to good effect. An article in the British magazine New Scientist describes the research as evidence of a global financial oligarchy.

The technical details of economic network analysis are daunting, but the metaphors evoke a “Star Trek” episode: the network is described as a bow-tie shaped “super entity” of concentrated corporate ownership. One cannot help but worry about threats to the safety of the starship Enterprise.

In recent years, research on industrial organization has focused more on corporate strategy than on social consequences. A recent article in the socialist journal Monthly Review, by John Bellamy Foster, Robert W. McChesney and R. Jamil Janna, criticizes both mainstream and left-wing economists for their lack of attention to monopoly power.

http://economix.blogs.nytimes.com/2011/11/07/who-rules-the-global-economy/?hp

bonus for failure...

The Finance Sector Union (FSU) has attacked bonus payments made to Commonwealth Bank senior executives despite their failure to meet certain performance targets.

Executives failed to meet targets for customer satisfaction, but the bank's board exercised its discretion to award $8.5 million in bonuses linked to the measure, the union says.

CBA chairman David Turner told shareholders at the bank's annual general meeting in Brisbane yesterday that the bonuses were paid because the satisfaction result was an anomaly.

But FSU national secretary Leon Carter says it is a "double standard", as the bank's lower-paid workers are not excused from meeting their performance targets.

"If they don't make that target, they are put on performance counselling and often they're told to leave the bank," Mr Carter said.

http://www.abc.net.au/news/2011-11-09/cba-executive-pay/3655152

these boots are made for walking...

At first blush, it seems to make policy sense, too. The rich fabric of America’s civic life, from Boy Scouts to community orchestras to soup kitchens, is the envy of the world. Its diversity reflects in part how much it depends on private givers with diverse interests and motives, and not just on the government. Their giving is encouraged by the charitable deduction, enacted in 1917, just four years after the income tax itself. The deduction lets people feel they are beating the system even as they practice virtue.

But there’s a question of fairness that complicates the issue. Overwhelmingly, the deduction benefits the wealthy — and the rest of the country has to make up the gap.

Say a grateful California billionaire gives $10 million to a Los Angeles hospital where his wife received good care. If he is paying income tax at the highest rate (not a sure thing, as we know from the presidential campaign), he can reduce his income tax bill by 35 percent of the worth of the donation. He pays $3.5 million less in federal taxes than he otherwise would have had to pay.

For the very wealthy, as the nonpartisan Tax Policy Center (TPC) explained in a recent paper, the deal is often even sweeter. If our billionaire makes his donation in stock that he acquired years ago for $5 million but that is now worth $10 million, he not only gets his $3.5 million deduction; he may avoid the capital gains tax he would have had to pay if he sold the stock and put the proceeds in his bank account.

For someone who earns less, the deduction is worth less. If you’re paying at a 15 percent rate, the deduction for that same $10 million would be worth just $1.5 million. And 70 percent of Americans don’t itemize at all. Many of them are generous, but they get no subsidy for their charity.

A Congressional Budget Office study last year found that taxpayers reporting less than $50,000 in income accounted for 19 percent of charitable donations but received only 5 percent of the tax subsidy for donations. Essentially, average Americans are helping to pay for our billionaire’s generosity, though of course they have no say in where his charity goes. And they’re paying a lot: The total charitable deduction will amount to $230 billion between 2010 and 2014, according to the Joint Committee on Taxation, not including taxes lost on capital gains. That revenue has to be made up in some other way.

The tax incentive for giving could be made less costly to the government and more progressive. In his first term, President Obama proposed limiting the maximum value of the deduction to 28 percent, so the billionaire would reduce his taxes by $2.8 million, not $3.5 million. That would have raised a fair amount of revenue while triggering “a relatively modest decline in charitable giving,” according to an analysis by the Center on Philanthropy at Indiana University — a drop of 1.3 percent the second year the change was in effect. The nonprofit lobbyists rose up against that idea, too, and it went nowhere in Congress.

...

You need to keep all of them in mind as you decide how much you want to pay to help renovate that hospital wing with the billionaire’s name above the door.

http://www.washingtonpost.com/opinions/fred-hiatt-paying-for-charitable-giving/2012/12/02/9e8ca322-3b27-11e2-8a97-363b0f9a0ab3_print.html

http://www.mediaite.com/online/inspirational-photo-of-the-day-nypd-cop-gives-boots-to-homeless-man/

Charity goes back a long way, but tax deductible charity goes back only one hundred years....

St Martin... Born at Sabaria (today Steinamanger in German, or Szombathely in Hungarian), Pannonia (Hungary), about 316; died at Candes, Touraine, most probably in 397. In his early years, when his father, a military tribune, was transferred to Pavia in Italy, Martin accompanied him thither, and when he reached adolescence was, in accordance with the recruiting laws enrolled in the Roman army. Touched by grace at an early age, he was from the first attracted towards Christianity, which had been in favour in the camps since the conversion of Emperor Constantine. His regiment was soon sent to Amiens in Gaul, and this town became the scene of the celebratedlegend of the cloak. At the gates of the city, one very cold day, Martin met a shivering and half-naked beggar. Moved with compassion, he divided his coat into two parts and gave one to the poor man. The part kept by himself became the famous relic preserved in the oratory of the Frankish kings under the name of "St. Martin'scloak". Martin, who was still only a catechumen, soon received baptism, and was a little later finally freed from military service at Worms on the Rhine. As soon as he was free, he hastened to set out to Poitiers to enrol himself among the disciples of St. Hilary, the wise and pious bishop whose reputation as a theologian was already passing beyond the frontiers of Gaul.

http://www.newadvent.org/cathen/09732b.htm

if you don't know about Constantine, he was a warrior whose interest in christianity was only as a way to conquer (or kill) more people... See toon at top...