Search

Recent comments

- laughing....

8 min 40 sec ago - meanwhile....

1 hour 37 min ago - a long day....

3 hours 31 min ago - pressure....

4 hours 19 min ago - peer pressure....

19 hours 38 min ago - strike back....

19 hours 43 min ago - israel paid....

20 hours 46 min ago - on earth....

1 day 1 hour ago - distraction....

1 day 2 hours ago - on the brink....

1 day 2 hours ago

Democracy Links

Member's Off-site Blogs

ask the experts...

Stimulus by Fed Is Disappointing, Economists Say

WASHINGTON — The Federal Reserve’s experimental effort to spur a recovery by purchasing vast quantities of federal debt has pumped up the stock market, reduced the cost of American exports and allowed companies to borrow money at lower interest rates.

But most Americans are not feeling the difference, in part because those benefits have been surprisingly small. The latest estimates from economists, in fact, suggest that the pace of recovery from the global financial crisis has flagged since November, when the Fed started buying $600 billion in Treasury securities to push private dollars into investments that create jobs.

As the Fed’s policy-making board prepares to meet Tuesday and Wednesday — after which the Fed chairman, Ben S. Bernanke, will hold a news conference for the first time to explain its decisions to the public — a broad range of economists say that the disappointing results show the limits of the central bank’s ability to lift the nation from its economic malaise.

“It’s good for stopping the fall, but for actually turning things around and driving the recovery, I just don’t think monetary policy has that power,” said Mark Thoma, a professor of economics at the University of Oregon, referring specifically to the bond-buying program.

Mr. Bernanke and his supporters say that the purchases have improved economic conditions, all but erasing fears of deflation, a pattern of falling prices that can delay purchases and stall growth. Inflation, which is beneficial in moderation, has climbed closer to healthy levels since the Fed started buying bonds.

“These actions had the expected effects on markets and are thereby providing significant support to job creation and the economy,” Mr. Bernanke said in a February speech, an argument he has repeated frequently.

But growth remains slow, jobs remain scarce, and with the debt purchases scheduled to end in June, the Fed must now decide what comes next.

http://www.nytimes.com/2011/04/24/business/economy/24fed.html?_r=1&hp=&pagewanted=print

- By Gus Leonisky at 24 Apr 2011 - 5:19pm

- Gus Leonisky's blog

- Login or register to post comments

the debt of trust...

This article was adapted from “The Wizard of Lies: Bernie Madoff and the Death of Trust,” by Diana B. Henriques, a reporter for The New York Times. The book, to be published on Tuesday by Times Books, analyzes Mr. Madoff’s rise and fall.

The paperwork has been completed for a $9 million unsecured loan from his company to Peter Madoff, whose titles at the firm now include senior managing director, chief compliance officer, head of the options department and — since a few years ago — chief compliance officer for the private money management business that Bernie runs on the 17th floor of the distinctive oval office tower known as the Lipstick Building in Midtown Manhattan.

Still, the Madoff firm is casual about titles — Bernie almost seems to make them up as he goes along. Peter’s primary title has always been “Bernie’s brother.” And this latest loan, to finance a real estate investment, reflects this reality.

At most big firms these days, an executive’s request for a $9 million insider loan with a gentle interest rate would be coldly and firmly denied as inappropriate. Despite growing worries in the financial markets, longtime employees of Bernie Madoff’s firm have no trouble borrowing cash when they need it. Bernie rarely says no.

But this loan to Peter — like all the insider loans that have come before and that will follow in succeeding months — is sucking out cash that Bernie Madoff will need when the turmoil bearing down on Wall Street finally hits.

http://www.nytimes.com/2011/04/24/business/24excerpt.html?hp

bernanke swampland...

Fed-watchers may recall that in my last post, I courageously risked my membership in the Ben Bernanke Fan Club by asking the chairman why he had failed to juice the economy enough to avoid sky-high unemployment. The boring answer, I suspect, is that he’s skeptical additional monetary stimulus would help create many jobs, although I don’t expect him to put it quite that starkly at his first-ever press conference on Wednesday afternoon.

But I also promised a follow-up question, and it might even interest normal people who pay no attention to the Fed: Mr. Chairman, if the Fed is done with monetary stimulus, do we need Congress to inject more fiscal stimulus?

If so, why haven’t you pushed for it? And why haven’t you pushed back against the current mania for short-term budget cuts that could slow recovery at the margins?

On the other hand, if you don’t think we need more monetary stimulus or more fiscal stimulus, and you still think unemployment is our biggest problem, are we just screwed? Are the unemployed on their own?

Read more: http://swampland.time.com/2011/04/26/if-the-fed-cant-save-us-then-who-can/#ixzz1KlgQknNY

free money...

The economies that account for 96 per cent of the world economy are today running loose money policies. Most are happily handing out free money. Some are supplying money at rates so low that it's actually cheaper than free.

It's done for good cause. When money is cheap, people are more inclined to invest or spend. So it aids economic recovery. The former chief of the US Federal Reserve, Alan Greenspan, was named as Time magazine's person of the year in 1999 for his ready resort to loose money.

But if there is too much for too long, it ends badly. Exactly a decade later, Time named Greenspan as No. 3 on its list of "25 People to Blame for the Financial Crisis". And I think they let him off lightly.

The evidence of the past three decades should be enough, but you can go back further. In fact, every major financial crisis in the four centuries of capitalism has had its origins in loose money.

How does it work? It's simple commonsense. The basis for value is scarcity. If scarcity is destroyed, so is value. And when money loses its value, it is abused.

Read more: http://www.smh.com.au/opinion/politics/how-funny-money-takes-our-mickey-20110509-1efp0.html#ixzz1Lte7wXZA

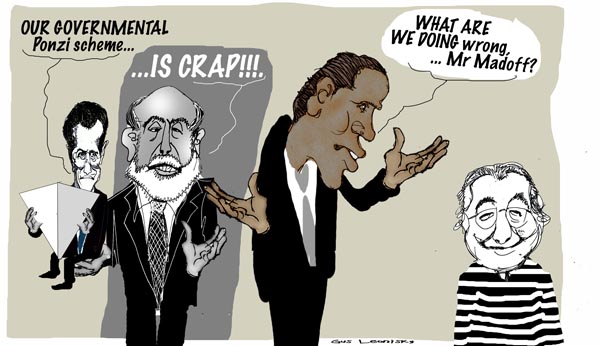

see toon at top...

solve the recession: sell the underwear...

Underwear which once belonged to jailed fraudster Bernard Madoff have been sold for $200 (£120) as part of an auction of items confiscated from his mansion.

The event also saw the sale of furniture and household goods, shoes, golf clubs and art, US media report.

Organised by the US Marshals Service, the $400,000 raised will go towards victims of Madoff's $65bn fraud.

Madoff is serving a 150-year jail sentence after being convicted in 2009.

http://www.bbc.co.uk/news/world-us-canada-13665904

As "our mate" Alan Jones would say, that's about 0.000006 cent per dollar towards the debt...

Glorious... Would look better in a laundry museum... see toon at top...

12 years later.....

The House of Representatives has approved a deal to allow the US to borrow more money, days before the world's biggest economy is due to start defaulting on its debt.

The measure easily passed the chamber by a vote of 314-117, despite some defections on both sides of the aisle.

The Senate must vote on the bill later this week before President Joe Biden can sign it into law.

The government is forecast to hit its borrowing limit on Monday 5 June.

READ MORE:https://www.bbc.com/news/world-us-canada-65771669 READ FROM TOP. HERE COMES THE 40 TRILLION DEBT... THEN THE 54 TRILLION DEBT..... FREE JULIAN ASSANGE NOW.................That has left little margin for error as lawmakers race to avoid the US defaulting on its $31.4tn (£25tn) debt, which underpins the global financial system.

A default would mean the government could not borrow any more money or pay all of its bills. It would also threaten to wreak havoc on the global economy, affecting prices and mortgage rates in other countries.