Search

Recent comments

- crummy....

10 hours 35 min ago - RC into A....

12 hours 28 min ago - destabilising....

13 hours 31 min ago - lowe blow....

14 hours 3 min ago - names....

14 hours 40 min ago - sad sy....

15 hours 6 min ago - terrible pollies....

15 hours 15 min ago - illegal....

16 hours 27 min ago - sinister....

18 hours 49 min ago - war council.....

1 day 4 hours ago

Democracy Links

Member's Off-site Blogs

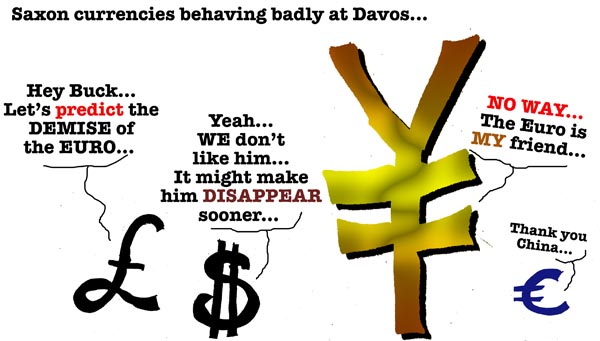

currency wars...

There is some anger at the "Saxon" economists in Davos, from the "Europeans"... The Saxons are defined as the English and the American economists who have been credited with the gloom and doom of 2007-09 (they basically caught the clap and gave it to the rest of the world) and who predicted a greater doom for 2010, which did not eventuate (they had a 50/50 chance). They are now "predicting" the demise of the Euro... which they hope will happen. But China and the Europeans are not going to let it happen...

Meanwhile the big US private banks are fuelling massive currency wars... With every trade, positive or negative, they collect a percentage... The more trade, the more volatility, the more volatility, the more they make money... Governments can only watch as unrealistic discrepencies are fuelled by the huge US unregulated deficit — which has sunk the highly regulated economies of Europe, with US subprime crap. What the "central banking" of Europe might have to do is print more money, like the Yanks... The problem is in the allocation of it... Should the countries who have not been so truthfull about their finances and have been caught with their pants down — dealing secretly for "illegal" loans from the US banks — get more of the "lazy" money, than those who have been very prudent?

Where's Newton when we need him to sort out the mess...?

- By Gus Leonisky at 28 Jan 2011 - 8:43pm

- Gus Leonisky's blog

- Login or register to post comments

economic wars...

World leaders have warned that rising food prices could lead to social unrest and even "economic war".

Indonesian President Susilo Bambang Yudhoyono said that with the world population rising, "the race for scarce resources" could lead to conflict.

And French President Nicolas Sarkozy called for regulation to rein in speculation and volatility in prices.

But business leaders at the World Economic Forum rejected calls for curbs on commodity speculation.

http://www.bbc.co.uk/news/business-12301261

remember when...

Aussie dollar to hit 47 US cents: bank

25/11/2008 11:54:01 AM

The Australian dollar will hit an all-time low of 47 US cents by the middle of next year,

a major French bank says.

Meanwhile, several economists are expecting official interest rates to fall to the lowest

levels in almost half a century as Australia faces the biggest global economic turmoil

since the end of World War II.

BNP Paribas says the domestic currency will plunge, from its present level of 65 US

cents, by the June quarter of 2009, as the economies of Australia's major trading

partners softened.

"The slowdown in the economies of Australia's main trading partners, particularly in

Asia, implies that export demand will soften," the bank said in a global outlook report

for December 2008.

"Nonetheless, net exports are likely to receive some benefit from the plunge in the

Australian dollar exchange rate."

The Australian dollar fell to an all-time low of 47.78 US cents in April 2001 in the wake

of the tech wreck.

A tumble to 47 US cents would represent a 52 per cent dive since mid July when the

Australian dollar reached a 25-year high of 98.49 US cents.

The Australian dollar fell to a five and a half year low of 60.12 US cents in late October.

http://news.theage.com.au/business/aussie-dollar-to-hit-47-us-cents-bank-20081125-6gsq.html

of beads and shells barter...

HONG KONG — Inflation is starting to slow China’s mighty export machine, as buyers from Western multinational companies balk at higher prices and have cut back their planned spring shipments across the Pacific.

Markups of 20 to 50 percent on products like leather shoes and polo shirts have sent Western buyers scrambling for alternate suppliers. But from Vietnam to India, few low-wage developing countries can match China’s manufacturing might — and no country offers refuge from high global commodity prices.

Already, the slowdown in American orders has forced some container shipping lines to cancel up to a quarter of their planned sailings to the United States this spring from Hong Kong and other Chinese ports.

The trend, if it continues, could eventually ease trade tensions by beginning to limit America’s huge trade deficit with China. Those tensions were an undercurrent during Chinese President Hu Jintao’s recent Washington meetings with President Obama.

Manufacturers and distributors across a range of industries say the likely result of the export slowdown is higher prices for American shoppers in the coming months, and possibly brief shortages of some products if Western retailers delay purchases too long while haggling over prices.

China exports more than $4 of goods to the United States for each $1 it imports from America, creating a trade surplus of about $275 billion. The higher Chinese prices will tend to show up mainly in products like inexpensive clothing and other commodity goods in which labor and raw materials represent a bigger part of the final value — rather than in sophisticated electronics like Apple iPads, in which Chinese assembly is only a small fraction of the cost.

http://www.nytimes.com/2011/01/31/business/global/31trade.html?_r=1&hp

war of the bux...

Washington appears to be trying to recruit Brazil in its undeclared currency war against China after the United States Treasury Secretary commiserated the South Americans on the high value of their currency.

On his first official visit to Brazil, Timothy Geithner said that the country's manufacturing base - and exports - had been harmed by upward pressure on its currency, the real.

A strong currency means a country can be flooded with imports – particularly from China, which is accused of artificially keeping its currency, the yuan, undervalued and therefore its exports ultra-competitive.

Although Geithner did not mention China by name, a report by the US Treasury recently said the yuan remains "substantially undervalued".

Brazil has been the target of overseas investors, who see it as offering better returns than other emerging economies. Geithner said pointedly: "These flows have been magnified by the policies of other emerging economies that are trying to sustain undervalued currencies, with tightly controlled exchange-rate regimes."

Read more: http://www.thefirstpost.co.uk/74812,business,united-states-tries-to-recruit-brazil-in-currency-war-on-china#ixzz1DSf36msW

see toon at top...

half-pregnant...

Joining the euro would have been a "huge, huge error", Nick Clegg admitted today.

The Deputy Prime Minister, previously a strong advocate of single currency membership, said that, in "hindsight", Britain had had a lucky escape.

However, he insisted no-one could have predicted the problems which have emerged, and blamed the Germans and French for wrecking the project.

The Liberal Democrat leader was asked about his views on the euro in a round of broadcast interviews at the party's conference in Birmingham.

"I think, clearly, with the benefit of hindsight, you can say it would have been a huge, huge error," Mr Clegg replied.

"I don't think anyone could have predicted at the time the euro was created that the rules which were supposed to be in place to ensure that everybody looked after their own financial affairs properly would be so spectacularly ignored and broken.

"I think history will judge the then French and German governments very, very unkindly who, some years ago, basically signalled that the rules could be relaxed because that then sent a signal out to everybody else - oh well, we don't need to keep our house in order.

"Now I think we are dealing with the consequences."

http://www.independent.co.uk/news/uk/politics/error-to-join-the-euro-admits-clegg-2357747.html

-------------------------

Gus: the UK has always been half-pregnant in regard to the Euro... The UK has been playing the USA's little game of destroying Yourp, while being within. For the UK not to have joined the Euro has created at least half of Yourp's problems and the other half has been created by US banks selling shit at premium prices. Even the Greek tragedy is due to some US banks that made illegal under the table deal with the previous right wing government, with easy money. The Greek problem that should have been tackled about 20 years ago was encouraged to snowball — not by Yourp (they had "no idea")— but by the USA... Hopefully the Chinese will step in and buy a lot of Armani suits and a few Greek islands on which to build new Acropolis using local builders. It could be in their interests to make sure the Greek debt is wiped clean and then start to use Yourp as a leverage against the US......

and the aussie peso...

Some economists warn the yen's more than 10 per cent retreat since January is already forcing China's hand on its own controversial policy of yuan capping in a way that could cause consternation in Washington in an election year.

Far from seeing a sharply rising yuan emerge from China's policy of greater exchange rate flexibility - core U.S. and multilateral demands - the yuan has actually weakened this year as China's economy and inflation rates slow, its trade account worsens and fears of a "hard landing" there persist.

Even though the tightly-controlled yuan has gained more than 10 per cent against world currencies over the past five years, it's one of the few major emerging market currencies to remain lower against the US dollar so far in 2012. Bouncing back smartly from a dire 2011, Russia's rouble, India's rupee, Mexico's peso and South Africa's rand are all up 5-10 per cent.

Read more: http://www.smh.com.au/business/markets/turning-point-in-currency-wars-20120322-1vl9k.html#ixzz1ppOnAJBc

playing clay pot...

A senior Liberal senator is warning a free trade deal with China could "turn into a disaster" for Australia if appropriate safeguards are not put in place.

In an exclusive interview with the ABC, Bill Heffernan raised the prospect of China cutting its tariffs, but then manipulating its currency to come out ahead.

"How do you really have a trade agreement with a country that won't put their currency on the market? I mean we should learn from our free trade agreement with the US," Senator Heffernan said.

"When we signed that agreement we were at 65 cents, when we enacted it the following February we were at 67 cents to the US.

"We did away with 5 per cent and 15 per cent tariffs and within a few years we found ourselves at a huge trade disadvantage because we had a 45 per cent currency tariff against us because we went parity with the US and above parity at one stage."

read more: http://www.abc.net.au/news/2014-11-11/liberal-senator-raises-concerns-over-china-free-trade-deal/5880740

--------------------------

I don't like senator Heffernan at most time, but he is correct here... Andrew Robb is about to Andrew Robb Australia with this iffy "agreement"... It is well-known that should you be a pot made of clay you don't go chummy-chummy with a much bigger pot made of iron... You keep your distance... Otherwise any encounter will go clunk-a-clunk with clay pot in pieces...

I actually believe that Julia Gillard saw this problem and was working on a Chinese currency-Aussie Dollar fixed parity, like the US has with China, but with the Aussie Dollar and the US dollar being free to rise and fall against each others, it is a difficult situation.