Search

Democracy Links

Member's Off-site Blogs

phooee .....

Home borrowers will be given a one-page fact sheet outlining their monthly mortgage repayments and how they can shop around for a better loan, under new banking reforms unveiled today.

Exit fees, which can run into the thousands, will also be banned from July 1, 2011 and the Australian Competition and Consumer Commission will be given the power to investigate price collusion among banks.

The federal government has also pledged to spend another $4 billion on residential mortgaged-back securities to help smaller lenders, taking to $20 billion its investment in non-bank players since the onset of the global financial crisis.

In another development, former Reserve Bank governor Bernie Fraser will conduct a study into how technology can be harnessed to make it easier for consumers to move between deposit accounts and mortgages.

In a bid to boost competition in the lending market, credit unions and building societies will for the first time be allowed to issue covered bonds.

That's it?

Well, if we ever needed evidence of just how much our politicians are under the thumb of the big end of town, this would surely have to be it.

Wayne Swan's breathless announcement that 'exit fees' for mortgage-holders are to be outlawed would, on the face of it, seem like a positive step. However, as long as the majority of the banks offer mortgage interest rates with only a few points in difference, there is simply no incentive for consumers to shop-about & consider changing banks.... You could grow old just going through the necessary identification process!!.

Of course, the banks will doubtless be trembling in their vaults, now that the fearsome ACCC to be given new powers to investigate any anti-competitive conduct on their part. Apart from wondering why the ACCC never had that power in the first place, you'd have to wonder how much these powers are really worth, given the track record of the competitive 'watchdog' in nailing the supermarket duopoly or the oil cartel .... zip.

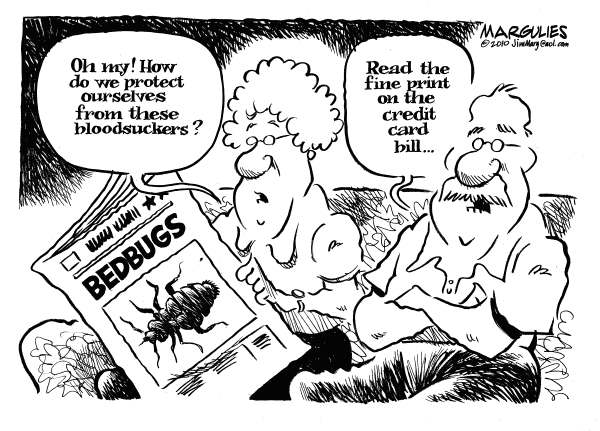

In the meantime, nothing to stop the banks from continuing their gouging practices on home-mortgage interest rates; nothing to stop the banks from continuing their practice of refusing to increase deposit rates in-line with increases in their charge-out rates; & nothing whatsoever said about the usurious interest rates on credit cards, nor the deceitful practices used to entice the needy, desperate or plain stupid consumers into using the damned things.

Just another window-dressing exercise from our political pygmies.

- By John Richardson at 12 Dec 2010 - 5:23pm

- John Richardson's blog

- Login or register to post comments

Recent comments

5 hours 27 min ago

6 hours 25 min ago

6 hours 33 min ago

6 hours 41 min ago

9 hours 5 min ago

10 hours 26 min ago

12 hours 18 min ago

1 day 6 hours ago

1 day 8 hours ago

1 day 9 hours ago