Search

Recent comments

- struth....

4 hours 42 min ago - earth....

5 hours 22 min ago - sordid....

5 hours 45 min ago - distraction....

6 hours 3 min ago - F word....

7 hours 5 min ago - not losing....

12 hours 17 min ago - herzog BS....

12 hours 40 min ago - freedom to say.....

15 hours 36 min ago - wanton barbarism....

1 day 4 hours ago - little nazi....

1 day 6 hours ago

Democracy Links

Member's Off-site Blogs

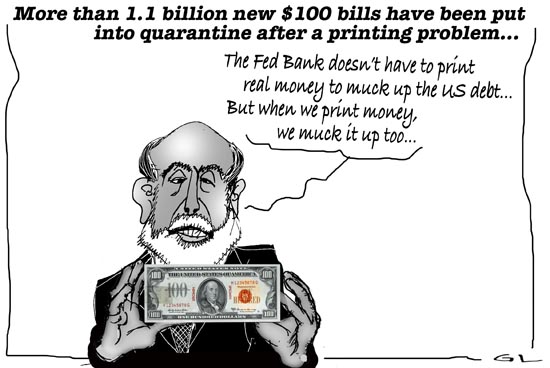

money muck...

More than 1.1 billion new $100 bills have been put into quarantine while officials search for a solution to a printing problem that has rendered some of the bills unusable, an official familiar with the situation said Monday.

Originally scheduled for a February 2011 release date, the bills were the first run of a high-tech note designed to combat counterfeiting by including a 3-D security ribbon.

The Federal Reserve first acknowledged an issue with the bills in October, but did not specify the scope of the problem.

The flaw -- a problem with sporadic creasing of the paper that results in small blank spaces -- only surfaced during a part of the process that requires high pressure printing, the official said.

That made the flaw difficult to detect during the normal inspection process.

http://finance.yahoo.com/news/New-100-bill-flaw-110-billion-cnnm-3132704698.html?x=0

- By Gus Leonisky at 10 Dec 2010 - 5:30pm

- Gus Leonisky's blog

- Login or register to post comments

meanwhile in the mysterious east...

A Taiwanese forensic expert has worked a full week - day and night - piecing together hundreds of banknotes, after a factory owner put them in a shredder.

Justice ministry official Liu Hui-fen, a handwriting expert, said repairing the notes had taken a lot of patience.

The factory owner, named only as Lin, said he accidentally dumped a plastic bag filled with notes into an industrial scrap machine last month.

The Central Bank confirmed the notes were acceptable and would be honoured.

Under Taiwanese law, people can claim replacement notes as long as at least 75% of the original is intact.

http://www.bbc.co.uk/news/world-latin-america-11962349

undervalued protectionism...

The pin that may prick China’s bubble, Duncan said, is a backlash against free trade among voters in the US, where unemployment last month rose to the highest since April. The US House of Representatives in September enacted legislation that would let US companies petition for duties on Chinese imports to compensate for the effect of an undervalued yuan. Protectionist sentiment could gather steam in the next two to three congressional election cycles, Duncan said.

To prop up the flagging US economy, the Federal Reserve last month announced a new round of so-called quantitative easing, $US600 billion ($610 billion) in Treasury purchases through June intended to keep borrowing costs low and deflation at bay. Chinese central bank adviser Xia Bin said the plan amounted to “uncontrolled” money printing.

‘Hugely hypocritical’

“It’s hugely hypocritical for the Chinese to say anything about the US doing quantitative easing because they’re the kings of quantitative easing,” Duncan said in a phone interview this week from Bangkok.

Premier Wen Jiabao’s government has been creating about $US250 billion worth of yuan each year “out of thin air,” Duncan said. To keep its currency from appreciating, the People’s Bank of China has been printing yuan to offset the dollars flowing in from a trade surplus that expanded to $US27.2 billion in October, the most since July.

China’s gross domestic product will by expand by 9.2 per cent this year, according to the median estimate of 17 economists surveyed by Bloomberg News, poised to overtake Japan as the world’s second-largest economy.

Central banks in the US, Japan and the UK have embarked on quantitative easing this year to spur growth, while Europe has responded to a sovereign-debt crisis by setting up a $US1 trillion bailout fund. The dollar has fallen 9 per cent in the past six months, according to Bloomberg Correlation-Weighted Indexes. The pound has declined 1.7 per cent and the yen has risen 0.1 per cent.

http://www.smh.com.au/business/world-business/chinas-biggest-bubble-to-be-pricked-by-trade-spat-economist-20101210-18s7d.html