Search

Democracy Links

Member's Off-site Blogs

John Richardson's blog

too late she cried .....

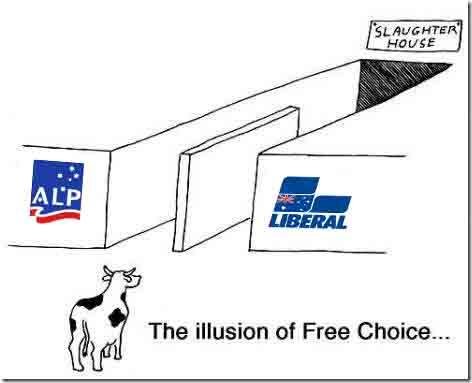

It is now looking pretty clear that some sections of the Parliamentary Labor Party Left are distancing themselves from the Bill and Tony comedy duo. I wouldn’t be surprised if this tactic is part of the right’s attempt to win back disaffected supporters and voters. Let the left have a little leeway, not too much, but enough to attract support for a new Labor that will be in fact just like old Labor – neo-liberal economically and reactionary socially.

- By John Richardson at 13 Oct 2014 - 7:12am

- Login or register to post comments

- Read more

the uncle joe show .....

- By John Richardson at 12 Oct 2014 - 9:48pm

- Login or register to post comments

the world of 'blinky bill' .....

Only the Australian Labor Party could kid itself into believing that the world is its oyster, simply because unity has broken-out within its parliamentary caucus.

- By John Richardson at 11 Oct 2014 - 1:01pm

- 1 comment

- Read more

thanks uncle joe .....

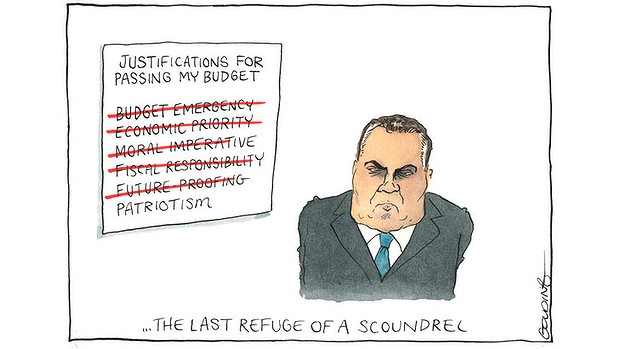

David Crowe refers to the failure of Joe Hockey to follow through with Labor’s proposed repeal of section 25-90 of the Income Tax Assessment Act 1997. (‘Libs must fix credibility gap on tax dodge’ The Australian Friday October 10, Commentary p 14.)

- By John Richardson at 11 Oct 2014 - 12:52pm

- 1 comment

- Read more

fakin' it .....

from Crikey …..

In 1940, when the Communist Party of Australia was banned by the Menzies government, police raiding militants often compensated for their ignorance of socialism by simply confiscating all books with red covers. The legendary Sydney waterfront activist Stan Moran supposedly even convinced constables that a portrait of Karl Marx merely depicted a jolly old Santa.

- By John Richardson at 9 Oct 2014 - 9:54pm

- 1 comment

- Read more

we agree .....

I wish I could get a list of G20 delegates and send them copies of the documents Chevron✓ and the Australian Tax Office have filed for Chevron's appeal against an ATO claim for back taxes and penalties.

- By John Richardson at 9 Oct 2014 - 8:36pm

- Login or register to post comments

- Read more

all the king's men .....

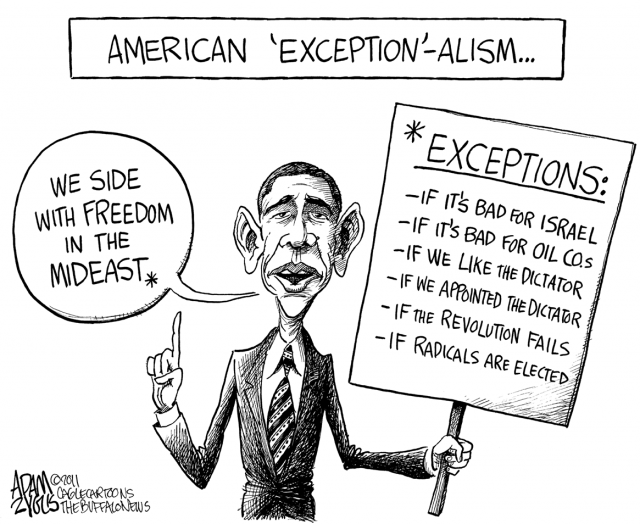

If the United States is not an empire, the word has lost all meaning.

No sparrow falls in the forest that does not provoke a national security assessment and response.

- By John Richardson at 8 Oct 2014 - 11:08pm

- 1 comment

- Read more

breaking eggs .....

Dear John,

Let me say at the outset how much I respect your persistent calls for the Australian Labor Party to embrace significant internal change & reform.

Having said that, I would like you to be aware that, as a non-member but occasional supporter of the Labor Party in the past, no amount of organisation reform would persuade me to support your party again.

- By John Richardson at 8 Oct 2014 - 8:11pm

- Login or register to post comments

- Read more

keeping score .....

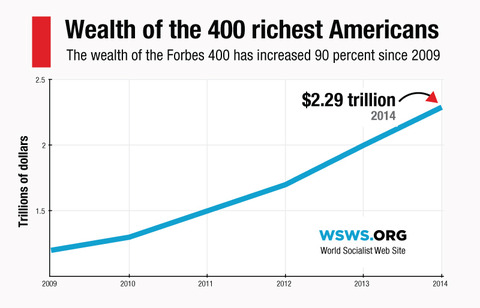

The wealthiest 400 people in the United States had their combined net worth grow thirteen percent to $2.29 trillion this year, amidst a surging stock market and record corporate profits.

The figures come from the Forbes 400 list of the wealthiest Americans, compiled every year since 1982 by the American business magazine of the same name.

- By John Richardson at 7 Oct 2014 - 10:02pm

- 1 comment

- Read more

behind a different veil .....

In Britain, the mainstream media is in overdrive, trying to sell the latest war to the population. Prime Minister David Cameron and his sidekicks Theresa May and Philip Hammond are attempting to convince everyone that bombing Iraq and Syria is all about making Britain safe. To frighten the living daylights out of everyone, they talk of murderous jihadists and terrorists and how ‘British values' are under threat.

- By John Richardson at 6 Oct 2014 - 3:29pm

- Login or register to post comments

- Read more

the hand that feeds ....

- By John Richardson at 6 Oct 2014 - 3:22pm

- Login or register to post comments

- Read more

headshots .....

Even before the embarrassing backdown there were problems. For starters, it's not a burqa

A burqa is that particularly Afghan garment, usually blue, with the mesh covering the eyes.

- By John Richardson at 4 Oct 2014 - 12:26am

- Login or register to post comments

- Read more

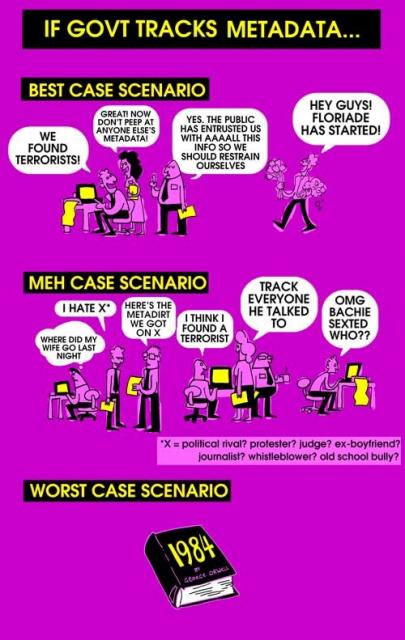

we are made nails for the hammer of government .....

One of the greatest conceits of the modern journalist may be the notion that she, or he, has a better idea of what is in the Australian national security interest or the public interest than the government of the day, the politicians of the day, or even the permanent public administration, including the military and security establishment.

- By John Richardson at 1 Oct 2014 - 3:53pm

- 1 comment

- Read more

the great game .....

Almost a third of Australia's largest companies are paying less than 10¢ in the dollar in corporate tax, according to a report that exposes a gaping hole in government revenues over the past decade.

As Australia prepares to host world leaders at the G20 summit in Brisbane in November, where a global assault on tax avoidance will be a key topic of discussion, the report found 84 per cent of Australia's top 200 stockmarket-listed companies pay less than the 30 per cent company tax rate.

- By John Richardson at 29 Sep 2014 - 9:49am

- 1 comment

- Read more

Recent comments

9 min 11 sec ago

5 hours 13 min ago

7 hours 10 sec ago

7 hours 50 min ago

8 hours 17 min ago

9 hours 22 min ago

9 hours 43 min ago

9 hours 55 min ago

11 hours 8 min ago

11 hours 16 min ago