Search

Democracy Links

Member's Off-site Blogs

an entitlement called privilege .....

America is the most unequal country in the developed world. We also pay the lowest taxes among all developed nations. Is there a connection?

Runaway inequality and declining taxes are linked together through a set of economic policies called the "Better Business Climate" model which came to America around 1980. (By then Margaret Thatcher had already put her version to work in England.)

After the turbulent 1970s, which featured oil boycotts, high unemployment and even higher inflation rates, the policy establishment was hungry for a new simple plan that promised renewed prosperity. The Better Business Climate model had two key components: cutting taxes on corporations and the super-rich, and reducing regulations, especially on Wall Street.

This potent combination was to encourage the rich to invest, which in turn would lead to more jobs and increasing incomes for all. A massive boom would then ensue to make all boats rise. But as we painfully learned, tax cuts and the unleashing of Wall Street led to luxurious yachts for the few and leaky rowboats for the rest of us.

Mind-altering tax cuts

The massive tax cuts which followed changed the way we perceive government and how we think about taxes. Since everyone hates to pay taxes, a model that claimed tax cuts would actually be good for the economy was enormously seductive.

However, it is easy to forget that before the Better Business Climate model slashed taxes, there was a national consensus that the super-rich and corporations should carry a disproportionate share of the tax burden. It was generally understood that if the wealthy had too much money they might be tempted to gamble it on Wall Street, creating bubbles that would take down the economy as happened during the 1929 stockmarket crash which led to the Great Depression.

Money from the wealthy would be used to fight WWII, the Cold War and build the American Dream. Through high taxes on the largest corporations and on the wealthiest Americans, we could pay for a new national highway system, provide nearly free public higher education, build affordable housing, support full employment and pay for the largest military establishment in the history of the world.

The Great Depression and world war cast a sobering shadow over how we viewed economic stability and high taxes. Never again would we allow mass unemployment to take hold.

Never again would we allow obscene and illegal financial speculation (or so we thought).

This tax-the-rich national mindset was so pervasive that both Democratic and Republican administrations from Roosevelt to Nixon supported enormously high taxes on the wealthy.

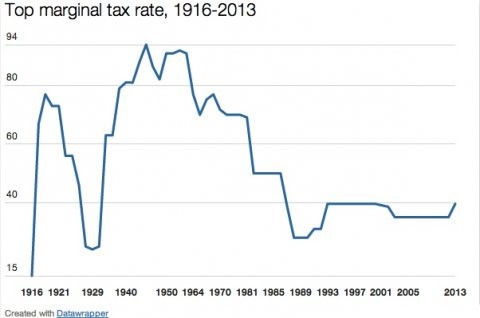

For example, during WWII all income over $2.6 million in today's dollars was taxed at a 94% rate. Think about that for a moment. Basically this rate served as a cap on elite compensation. After bankers hit $2.6 million, they received only 6 cents on the next dollar.

In 1956, during the conservative Eisenhower administration, the tax rate was still 91% of all income over $3.4 million. In 1976, 70 cents of every dollar of income over $807,000 went to federal income taxes.

In sum, here was a national consensus that such tax rates were both necessary and proper. For more than a quarter century, we shared an inner sense of justice: To promote the interests of everyone, there should be some limit on what the wealthy could earn.

The current notion that the rich should be able to manipulate the tax codes to pay lower tax rates than the rest of us would have been revolting to previous generations. Not just revolting, but downright stupid. We once understood quite clearly that runaway inequality would surely lead to calamity.

Yet, today, the top tax rate is down to 39.6 percent on income over $440,000. The chart below shows the dramatic decline in these rates.

Top marginal tax rate, 1916-2013.

The downward spiral of tax cuts and government services

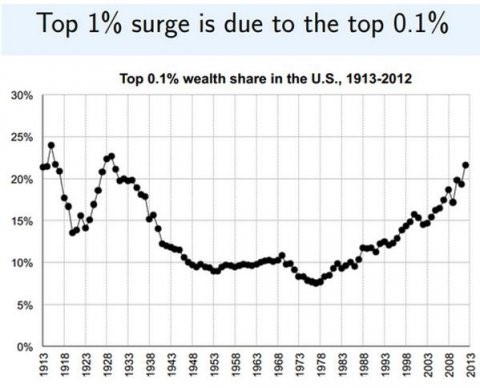

During the period of high tax rates, America reached its peak of fairness, as Thomas Piketty demonstrates in his excellent charts on our distribution of wealth and income. Yes, there were still plenty of rich people and they still lived damn well. But nearly all of us experienced a rising standard-of-living year after year.

But as soon as tax rates on the super-rich and corporations declined, inequality took off again.

Top 0.1 percent wealth share in the U.S., 1913-2012.

Runaway inequality and runaway democracy

Every nation has a long and sordid history of money buying political favor. But rising inequality sets in motion a downward spiral that is so corrupt that democracy itself is in danger.

All of us have an intuitive grasp of how elites translate their increasing wealth into political power, which in turn leads to more tax breaks, more money for the few, and even more political power.

As the tax cuts associated with the Better Business Climate model set in, both political parties scrambled to raise money from those most enriched by the new economic policies.

We now even refer to the "money primaries" in which newly declared political candidates scramble for financial support from the super-rich before the first vote is case. It is done so blatantly that we not accept it as normal politics.

But the consequences are not just that one politician wins over another. The rest of us pay dearly as we experience a decline in public services. And we don't even see how why it's happening.

Zero sum taxation

Buying political favor for the few inevitably leads to more hardship for the many. As the corporate contribution to federal taxes dropped from 32% in 1952 to only 9% in 2013, individual taxpayers had to make up the difference and to be sure, the super rich did all they could to avoid that burden. That left the broad section of American working people stuck with most of the tab.

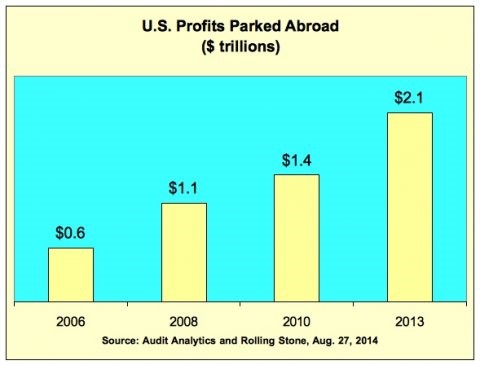

More subversively, corporations and the wealthy discovered new ways to move money offshore in order to avoid taxes. What would have been impossible to even openly discuss in the 1960s is now common practice. Large corporations simply keep their global profits in foreign subsidiaries. (They often can do so just by switching accounts in Wall Street banks without the money ever leaving the country.) As the chart below shows, this practice is growing rapidly.

Audit Analytics and Rolling Stone, Aug. 27, 2014

Contrary to the hype of the Better Business Climate model, they less the rich pay, the more tax pressure builds on the rest of us. This, in turn, increases the pressure to reduce public services, especially for those at the bottom of the income ladder. But it hits all of us as public employment and services deteriorate.

As we feel like we are getting less and less for our tax dollars, anti-government sentiment increases.

As we experience declining services, the pressure mounts for more tax cuts, which further erodes government services.

As we see our wages stagnate and our benefits deteriorate, we turn against public sector workers who seem to have it better.

Corporations then swoop in with privatization plans for public services which often cost us more and give us fewer services.

The net result is ever more money for those at the top and poorer services for the rest of us.

The black hole of runaway tax dollars

Perhaps the biggest tax crime against American working people takes the form of individual wealth parked abroad. It is now considered normal practice to take money made in the USA and hide it offshore from the IRS. The numbers, compiled by the Tax Justice Network are staggering:

A significant fraction of global private financial wealth—by our estimates, at least $21 trillion to $32 trillion as of 2010—has been invested virtually tax-free through the world's expanding black hole of more than 80 offshore secrecy jurisdictions. We believe the range to be conservative.

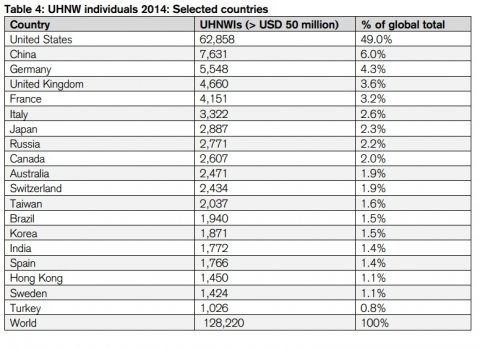

We don't know precisely how much of this offshore wealth stems from American elites. But we can assume that most of it comes from the U.S. As the chart below shows, we have nearly half the world's "ultra-high net worth" individuals (UHNW)—people with more than $50 million in wealth.

UHNW Individuals 2014: Selected Countries.

How much tax money are we losing?

U.S. Public Interest Research Group (PIRG) reports that we're losing about $184 billion a year due corporate and individual offshore tax evasion. That's a big number, more than enough to eliminate tuition at every public university, college and community college in the country.

"Pirate Banking" brought to you by bailed-out Wall Street

The Better Business Climate model not only reduced taxes on corporations and the super-rich, but also deregulated Wall Street. By abandoning the prudent New Deal controls that prevented Wall Street from excessive gambling and outright criminal activity, the Better Business Climate advocates unleashed a new generation of financial manipulation followed by crashes and bailouts galore.

With massive financial deregulation came the rapid expansion of "wealth management" for high net worth individuals. The name of the new game was moving money into offshore facilities. Here's how the Tax Justice Network puts it:

Of the top 10 players in global private banking, all 10 received substantial injections of government loans and capital during the 2008-2012 period. In effect, ordinary taxpayers have been subsidizing the world's largest banks to keep them afloat, even as they help their wealthiest clients slash taxes.

Many of these market leaders in global pirate banking who are in the practice of hiding and managing offshore assets for the world's elites have also been identified as market leaders in many other forms of dubious activity, from the irresponsible mortgage lending and high-risk securitization that produced the 2008 financial crisis, to the latest outrageous scandals involving LIBOR rate rigging and money laundering for the Mexican cartel.

No taxation without representation: revolutionary potential?

We're in a whale of a tax mess. Runaway inequality will lead to even more runaway taxation. Meanwhile government will be starved for funds as the tax burden shifts from corporations and the wealthy onto the rest of us. Government services will decline while the rich evade their taxes and use their money to insulate themselves from the public services they don't need.

Normally, we would expect to rectify the situation through electoral means. However, the wealth and power of financial elites thoroughly dominate the political process. Even the Democratic Party fears eliminating outrageous tax loopholes ("carried interest") for billionaire hedge fund and private equity managers that cost the treasury billions of dollars each year.

The combination of deteriorating government services, tax avoidance by the rich, and unresponsive elected officials form a combustible mix. Nothing short of a massive movement that builds a new political organization will be needed to right these many wrongs. But it will have to be more than another Occupy Wall Street. We will need to do the painstaking work of spreading the word, and then organizing the 99 percent into a new political force to be reckoned with. It took 30 years to get us here. Expect it to take that long for us to effectively get our act together.

How America's Wealthy Stole the American Dream and Cashed It at an Offshore Bank

- By John Richardson at 21 Jan 2015 - 8:00am

- John Richardson's blog

- Login or register to post comments

Recent comments

1 hour 43 min ago

1 hour 53 min ago

3 hours 29 min ago

4 hours 22 min ago

5 hours 23 min ago

5 hours 50 min ago

6 hours 42 min ago

7 hours 9 min ago

7 hours 46 min ago

1 day 3 hours ago