Search

Democracy Links

Member's Off-site Blogs

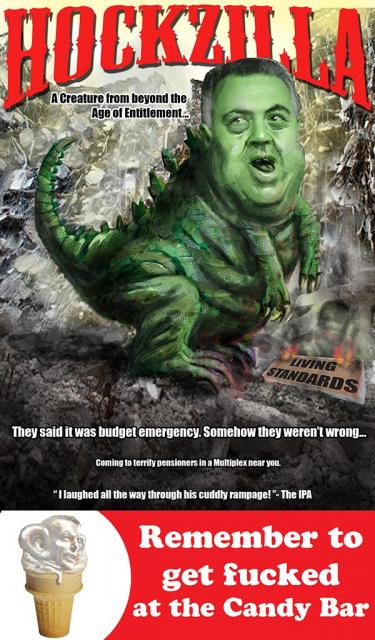

hockzilla ....

from Crikey ….

It's hard to recall a pre-budget process in which a government's messages have been more confused than this one.

The weeks before a budget, particularly difficult budgets, are for expectations management and trying out some ideas to see what sort of outcry they cause. Ideally, they should also reinforce the government's core messages about the economy and what it stands for.

But at the moment we have a government that is all over the place. It repeatedly boasts of cutting taxes for big corporations via the removal of the carbon price and the mining tax. The Prime Minister declares that his paid parental leave scheme, which is extravagantly generous to high-income earners, is his "signature policy". Last week, he looked like a child while clambering around a fake F-35, having announced Australia would spend over $24 billion on the fruit of one of the worst military procurement processes in United States history.

At the same time, Treasurer Joe Hockey has been lamenting the budget blues, complaining that we need to lift the pension age, need to end bulk-billing, that all must contribute to the task of repairing the budget. Now there's talk of a "debt levy" on personal income taxpayers - which includes most small businesses. Tonight, PM Tony Abbott will seek to sound Kennedyesque in asking Australians to think of their country ahead of themselves. The party of individualism, the party of getting government out of the way so that people can make the most of their opportunities, will be asking Australians to make a collective contribution to the taxman for the national good.

The problem with a debt levy is that it would have to be awfully big to make a sizeable difference to the budget deficit. Julia Gillard's temporary Queensland flood levy - which she managed to successfully sell to voters, despite criticism from the opposition - only raised around $1.8 billion.

There's not much point in incurring the political pain of breaking your promise about "no surprises" and no raised taxes for a lousy $2 billion. A similar levy aimed at higher-income earners would have to be four or five times higher to make a serious difference to the budget.

Then it would make about as much money as Hockey wasted this financial year on a handout to the Reserve Bank that it didn't need and didn't ask for.

The other confusion in the government's message is between the short term and the long term.

There's no short-term budget crisis. Australia retains the triple triple-A credit rating former treasurer Wayne Swan secured, and the Australian dollar continues to enjoy the confidence of investors across the globe - so much so that Hockey has whinged to the Reserve Bank about it. Our budget problems are long term: a significant downward shift in the proportion of tax revenue to GDP, an ageing population, rising healthcare, aged care and pension costs, plus sundry other issues like a GST that is no longer a high-growth tax for state coffers.

If, as media reports suggest, Hockey is seriously looking at curbing family benefit payments ("politics of envy" Hockey called that when Labor did it, but presumably he sees it differently now), that is the sort of long-term saving that is worthwhile, although the cost of the total family benefit payment system isn't large enough to fix the budget on its own. If a Medicare co-payment does actually reduce GP visits without redirecting patients to emergency wards, or worsening health outcomes - though health economists doubt it - that will help curb long-term growth in primary care costs. The same goes for curbing the remarkable cost of superannuation tax concessions - although Hockey has already given up billions of dollars in revenue there.

But a temporary levy to pull in a few billion in 2014-15 is likely only to harm consumer and business confidence - as business groups are already predicting - without making a worthwhile difference to the budget. Instead, it would exacerbate what the Reserve Bank has been saying about fiscal policy - such as this from February:

"With governments at both the federal and state levels planning to undertake fiscal consolidation over the next few years, the outlook for growth in public demand remains very weak relative to its historical average. Consistent with budget projections, the contribution to GDP growth from public demand over the forecast period is expected to be around half of its long-term average."

And if the government, aided by cuts in the states, especially the conservative-run states, crunches domestic demand, it will be up to the Reserve Bank to save its bacon, and possibly its 2016 election prospects with interest rate cuts it doesn't want to make. But before then, a poorly executed budget strategy will probably cause the dollar to be sold off, and a bout of nervousness emerge about the competence of the government in Canberra.

And the bigger challenge is for the government to gets its message clear and straight, to stop the mixed signals in which big corporations get tax cuts and billions in Defence largesse while the rest of us pay more. The Rudd and Gillard governments repeatedly demonstrated the problems of being unable to communicate effectively on economic policy. At the moment the Abbott government looks no better.

- By John Richardson at 28 Apr 2014 - 4:52pm

- John Richardson's blog

- Login or register to post comments

Recent comments

2 days 14 hours ago

2 days 16 hours ago

2 days 16 hours ago

2 days 16 hours ago

2 days 17 hours ago

2 days 17 hours ago

2 days 17 hours ago

3 days 1 hour ago

3 days 1 hour ago

3 days 3 hours ago