Search

Democracy Links

Member's Off-site Blogs

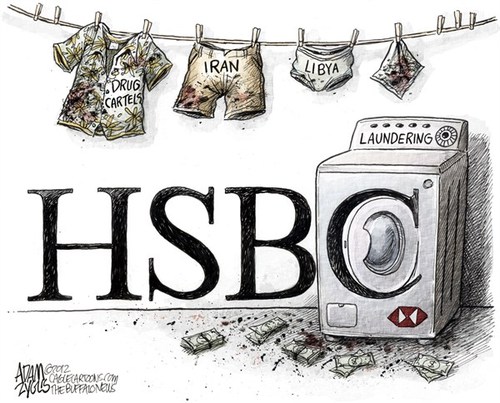

from the laundry .....

Remembering how HSBC helped launder hundreds of millions of dollars for drug cartels and terrorists and the DOJ let them get away with it.

A year ago, Matt Taibbi reported in the Rolling Stone how the US Justice Department allowed executives of British-based bank HSBC to walk after it helped launder hundreds of millions of dollars from international drug cartels and terrorist organizations for at least half a decade.

Looking back on that great piece, you wonder if much has changed.

From Rolling Stone:

...[T]he storied British colonial banking power helped wash hundreds of millions of dollars for drug mobs, including Mexico's Sinaloa drug cartel suspected in tens of thousands of murders in just the past 10 years--people so totally evil, jokes former New York Attorney General Eliot Spitzer, that "they make the guys on Wall Street look good."

The bank also moved money for organizations linked to Al Qaeda and Hezbollah, and for Russian gangsters; helped countries like Iran, Sudan and North Korea evade sanctions; and, in between helping murderers and terrorists and rogue states, aided countless common tax cheats in hiding cash.

The Justice Department said it decided not to bring criminal charges against HSBC for fear that the bank would lose its license in the US and destabilized the entire banking system. Throughout his investigation, Taibbi highlighted some of HSBC's most shady dealings.

One in particular involved Saudi Arabia's Al Rajhi bank, described by the CIA in 2003 as "a conduit for extremist finance." HSBC continued dealing with Al Rajhi to some extent despite a federal cease-and-desist order in 2003 to severe ties. The government officially relinquished HSBC from the order in 2006, and the multinational bank proceeded to flood Al Rajhi with nearly 1 billion US dollars in subsequent years. The Saudi bank explained away the cash as being necessary for "tourists traveling for their vacations."

HSBC and its subsidary banks also aided confidants of Syrian dictator Bashar al-Assad to avoid American jurisdictional oversight by consolidating their accounts in the Cayman Islands, and enabled $19 billion in transactions involving Iran to flow through the American financial system by "stripping" references to the Islamic Republic in wire transactions to and from the United States.

From Rolling Stone:

What's the upside for a bank like HSBC to do business with banned individuals, crooks and so on? The answer is simple: "If you have clients who are interested in 'specialty services'--that's the euphemism for the bad stuff--you can charge 'em whatever you want," says former Senate inestigator [Jack] Blum. "The margin on laundered money for years has been roughly 20 percent."

Taibbi also wrote that HSBC offshore operations in Mexico enabled virtually anybody to walk into an HSBC Mexico branch in the Cayman Islands and open a US-dollar account. It was later revealed that some of these accounts were used to buy aircraft for Mexican drug cartels, and years after the discovery, the banking firm still had 20,000 such accounts worth some $670 million open. The government came at the financial powerhouse twice more, in 2010 and 2012, with similarly weak cease-and-desist orders that for all intents and purposes were ignored. Then, HSBC twisted the government's arm into making a settlement that worked out overwhelmingly in its favor.

Taibbi summed up the score between HSBC and the feds:

At HSBC, the bank did more than avert its eyes to a few shady transactions. It repeatedly defied government orders as it made a conscious, years-long effort to completely stop discriminating between illegitimate and legitimate money. And when it somehow talked the US government into crafting a settlement over these offenses with the lunatic aim of preserving the bank's license, it succeeded, finally, in making crime mainstream.

In addition to investigating HSBC's hand in money laundering, Taibbi examined how the Department of Justice "essentially let Swiss banking giant UBS off the hook for its part in what is likely the biggest financial scam of all time." Read and remember the whole brilliant, meticulous, and sordid tale here.

How 'Gangster Bankers' at HSBC Turned Out to Be 'Too Big to Jail'

- By John Richardson at 7 Feb 2014 - 7:20pm

- John Richardson's blog

- Login or register to post comments

Recent comments

20 min 15 sec ago

10 hours 19 sec ago

12 hours 56 min ago

15 hours 15 min ago

1 day 55 min ago

1 day 1 hour ago

1 day 8 hours ago

1 day 12 hours ago

1 day 14 hours ago

1 day 14 hours ago