Search

Democracy Links

Member's Off-site Blogs

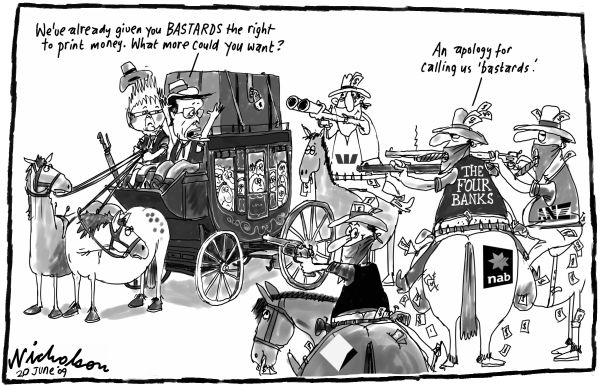

the banksta gang strikes again .....

from Crikey .....

How banks and advisors raided retirees' nest eggs during GFC

Glenn Dyer writes:

Australia's banks, fund managers, investment banks and other "advisors" appear to have staged a massive legal raid on the nest eggs of investors and retirees over the past year, extracting billions of dollars from companies and their small shareholders through a deluge of discounted placements and quasi-rights issues.

Although precise figures are difficult to calculate, it appears that some $7 billion was shifted from super funds, retirement accounts and other investments to this coterie of market operators in the June 30 year.

It is further confirmation of the banking industry's dominance of the Australian economy. Over the past year, amid a bruising credit crisis, the banks applied pressure on companies to raise capital in exchange for debt rollovers. In fact, the amount raised from the market in the year to June was far greater than the amount of new lending by banks to their non-financial customers.

Figures released yesterday by the ASX reveal a record $90 billion was raised in the 2008-09 financial year. That was made up of initial offerings of $1.9 billion (down 83% from the previous year) and secondary share sales of $88.1 billion (up 74%). That compares to the previous record of $77.9 billion raised in 2006-7, which was largely comprised of new floats.

While some of last year's capital was for expansion -- Santos was a good example with its $3 billion dollar raising -- most was capital companies had to raise at the behest of their banks as part of an overall refinancing. BlueScope's $2.2 billion of new capital and debt rollover was a good example.

In the process banks have earned billions in profits through hard-nosed deals on refinancing fees, and investment banks scooped their share by helping raise the money. Some of the investment banks charged fees of 2%-5%, similar to the fees charged by the banks for refinancing the loans. The more risky the company, the higher the fee.

According to some estimates, up to 8% of the $88 billion raised -- or over $7 billion -- went in fees to banks and investment banks.

In addition, fund management outfits and other big investors like AXA and AMP were able to sell some or all of their discounted shares into the market to make trading profits, while making more fees from the customers whose funds they were managing.

This is after many had also earned fees from lending shares to traders shorting the shares of the companies, such as Fairfax Media, GPT, Mirvac, who needed to raise money.

The $88 billion raised in new secondary issues dwarfs the growth in lending by the banks in the past year. According to APRA figures lending to non-financial companies rose from $479.3 billion in June of 2008 to $496 billion in April of this year, a rise of around $17 billion (It peaked at $503 billion in December).

- By John Richardson at 8 Jul 2009 - 8:30am

- John Richardson's blog

- Login or register to post comments

Recent comments

36 min 22 sec ago

1 hour 58 min ago

3 hours 49 min ago

22 hours 3 min ago

23 hours 56 min ago

1 day 1 hour ago

1 day 1 hour ago

1 day 2 hours ago

1 day 2 hours ago

1 day 2 hours ago