Search

Democracy Links

Member's Off-site Blogs

drunken sailors .....

from Crikey

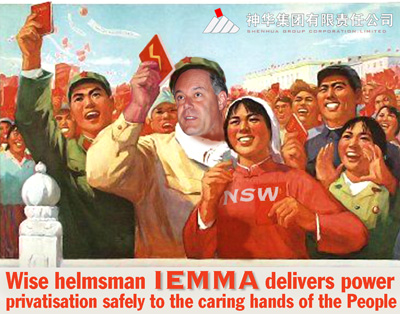

Iemma's power privatisation to favour Chinese state giant

Alex Mitchell writes:

NSW MPs should be brushing up on their Mandarin, re-reading Chairman Mao’s Little Red Book and digging out their worker-peasant Red Guard uniforms in advance of next month’s vote to sell commanding sectors of the state’s electricity industry.

Tickets should go on sale for seats in state parliament’s public gallery to watch the historic spectacle of MPs tramping through the lobbies to flog the power utilities to the giant Shenhua Group Corporation Ltd, one of the richest and most powerful state-owned companies in China.

Ferociously anti-communist Liberal blue bloods, Nats, Fred Nile’s Christian Democrats, the two Shooters Party MPs and independents will be asked to join Labor MPs to support the transfer of the power industry to Shenhua despite two-thirds of the public being against any sale.

The Iemma Government is doing its best to conceal the fact that Shenhua is the frontrunner to acquire the distribution and retail sectors in partnership with Australian private investors.

It is already having enough trouble convincing its own MPs, the party’s rank and file and the trade unions to support the sell-off without revealing that control of the publicly-owned electricity industry is heading overseas to the People’s Republic of China.

Senior Shenhua executives visited Sydney late last year as the guests of Energy, Mineral Resources, State Development and Primary Industries Minister Ian Macdonald who, incidentally, led the left faction’s charge against power privatization when it was attempted by former premier Bob Carr and then treasurer Michael Egan in 1998 and roundly defeated.

Shenhua is China’s biggest coal mining company and the world’s second largest coal company after America’s Peabody Energy group based in St Louis.

According to a glossy KPMG prospectus on China’s booming energy industry, Shenhua is “a state-owned enterprise under the supervision of China’s State Council”. ("Going for gold: China as a global mining player.") It operates four mining groups and produced more than 150 million tonnes of coal in 2007, almost 16 per cent more than the previous year, and is forecasting a 200 million tonne output by 2010.

“In August 2006, it announced its goal to be the world’s biggest coal miner within five years,” KPMG drooled: The company is also far more than a mining business. It currently operates 11 coal-fired power stations, and runs a series of rail networks totaling 1,300 kilometres.

However, far more important for its continued success is the strong backing it has received – and will continue to receive – from the state. The central government in Beijing is determined to have a model for other domestic mining companies to emulate. This backing has allowed the group to establish the scale and financial muscle to build a vertically integrated, advanced and safe energy business.

KPMG’s links with Shenhua have been immensely profitable. “We are proud to to say that KPMG in China and Hong Kong was instrumental in taking China Shenhua Energy Company Limited to the Hong Kong Stock Exchange in June 2005. At US$3.3 billion, it was one of the largest listings of the year.”

KPMG’s undisclosed fees and commissions for the listing of 21 per cent of the company's shares would have been colossal. Late last year, Shenhua president Ling Wen said the group was studying acquisition targets in Australia, Indonesia and Mongolia, telling reporters: “It's very important to use not only organic growth but also mergers and acquisitions to make our enterprise larger, better and more profitable. We have huge room to make some acquisitions."

Without identifying specific items on his shopping list, Ling said the company was considering coal mining, electricity generation, railways and ports. The share price of China Shenhua, one of the top 200 companies in Asia, more than doubled last year, outpacing the 43 per cent advance in the benchmark Hang Seng Index, while its war chest for overseas expansion was estimated to be a breath-taking $90.8 billion.

Will the Foreign Investment Review Board withhold permission for the sale of the NSW power industry to China?

No chance. Mandarin-speaking Prime Minister Kevin Rudd and Treasurer Wayne Swan will be supportive of any sale to any quarter that will give the embattled Iemma Government a financial lifeline.Not to be missed will be the sight of leading Liberal hardliners David Clarke, Charlie Lynn, Chris Hartcher and Greg Smith, all members of the parliamentary “God squad”, joining comrades from the ALP to vote for the power sell-off to the godless, atheistic, satanic, baby-devouring, sabre-toothed communists in Beijing.

- By John Richardson at 28 Feb 2008 - 10:08pm

- John Richardson's blog

- Login or register to post comments

Recent comments

3 hours 29 min ago

9 hours 20 min ago

10 hours 18 min ago

10 hours 26 min ago

10 hours 34 min ago

12 hours 58 min ago

14 hours 19 min ago

16 hours 11 min ago

1 day 10 hours ago

1 day 12 hours ago