Search

Democracy Links

Member's Off-site Blogs

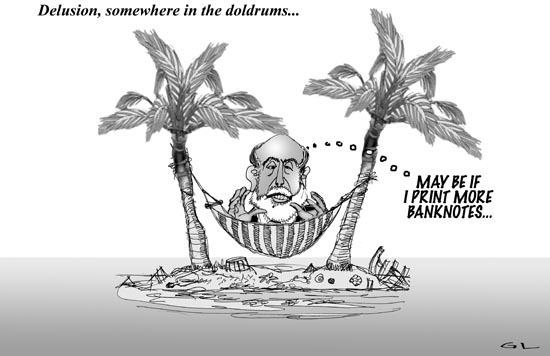

from downside to dark side .....

Ben S. Bernanke, chairman of the Federal Reserve, signaled his readiness on Wednesday to bolster the economy with cheaper money even though inflation is picking up speed....

On Wall Street, investors and analysts expressed relief that the Fed was indeed ready to lower rates again. It has already reduced the Federal funds rate to 3 percent from 5.25 percent since September, and investors had already been betting that Fed officials would lower it to 2.5 percent at its next meeting on March 18.

“We think Bernanke is (finally) right on” in placing top priority on fighting a recession, wrote Bernard Baumohl, managing director of the Economic Outlook Group in Princeton, N.J.

But some experts were sharply critical.

“They’re doing the same stupid things they did in the 1970s,” said Allan H. Meltzer, a professor of economics at Carnegie Mellon University and the leading historian of Fed policy. “They were always saying that we’re not going to let inflation get out of hand, that we’re going to tackle it once the economy starts growing, but they never did it.”

Even some economists who have warned about a recession for more than a year now expressed worry that the Fed’s policy of lower interest rates, combined with slowing growth and credit market problems, could undermine foreign confidence in the dollar, driving up both interest rates and inflation.

“I’m still of the view that the downside risks to the economy are more important than the inflation risks, but at some point the ability of the Fed to cut rates will be limited by the willingness of the rest of the world to finance the current account deficit,” said Nouriel Roubini, president of Roubini Global Economics in New York, referring to the broadest measure of the nation’s trade and investment balance.- By Gus Leonisky at 28 Feb 2008 - 9:49pm

- Gus Leonisky's blog

- Login or register to post comments

Recent comments

3 hours 29 min ago

9 hours 21 min ago

10 hours 19 min ago

10 hours 27 min ago

10 hours 35 min ago

12 hours 58 min ago

14 hours 20 min ago

16 hours 12 min ago

1 day 10 hours ago

1 day 12 hours ago