Search

Democracy Links

Member's Off-site Blogs

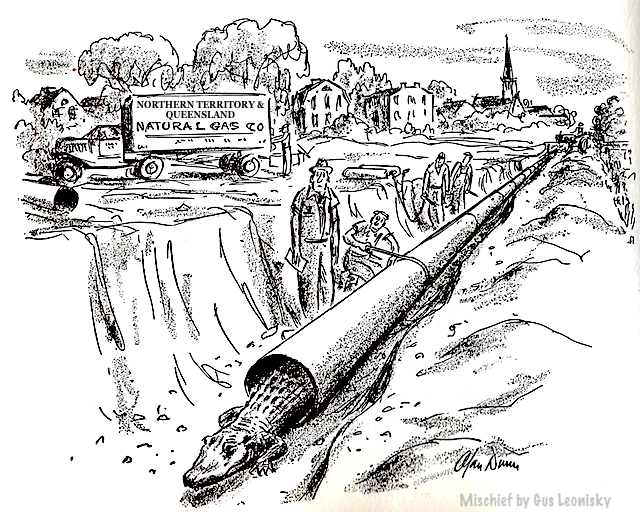

gas pipeline with no gas.....

The Australian public has bought a big-long gas pipeline from foreign tax cheats – but there’s no gas. It’s a white elephant! Jemena and sleepy regulators AEMC are the culprits. Energy consumers and taxpayers the victims. Michael West reports.

Energy bosses cover for tax cheat, public gets elephantine billThe can’t say they weren’t warned this would be a shocker. They were warned by energy analyst Bruce Robertson and environment lawyer David Barnden more than five years ago. And so it is that the public has paid for a billion dollar gas pipeline which has no gas running through it. They built it anyway.

Our story begins in the foyer of an office block in Sydney’s CBD in 2019 when yours truly – a journalist – was blocked from attending a public meeting of a regulator, the mob which sets the rules for the energy market, the AEMC (Australian Energy Market Commission). The proposed Northern Gas Pipeline was to open up three Northern Territory & Queensland basins for gas fracking.

John Pierce, then chairman of the befuddled AEMC, gave the excuse that yours truly had not filled out a pre-registration form to attend the meeting; a meeting incidentally which had plenty of empty seats.

Fast forward five years and the 622km pipeline between Tennant Creek and Mount Isa has been built, but the Northern Gas Pipeline ceased to operate in September 2022 due to lack of gas volume.

The NGP again stopped transporting gas in early February and two week ago the pipeline operator Jemena informed NGP customers it expected gas flows would not resume until at least June.

The irony is that the NT is the beneficiary of the pipeline but southerners are paying for it as the NT is subsidised by the Federal Government. A further irony is that the Tax Office has since pinged the operator, Chinese and Singapore owned Jemena, for tax evasion.

This at a time when the Albanese government is under fire from Liberal Party media outlets for subsidising the renewable energy transition, the Future Made in Australia policy.

Tax Office passes Go, collects $50m cash, saves a further $170mThe AEMC had been well warned. Bruce Robertson wrote a report on Jemena’s Northern Gas Pipeline in May 2016.

The Northern Gas Pipeline report warned:

“In 2015 Jemena’s shareholders restructured their investment in the company. They converted their Trust loans into $3.2 billion of shares and an $800m convertible note (see note 22b of the 2015 Jemena accounts). The $800m of convertible instruments is classified in the accounts as debt. It is arguable whether these securities have debt or equity characteristics.

“A common way of tax avoidance is for a parent company to charge high non-commercial interest rates on debt. This has the effect of reducing the profit before tax of a corporation and transferring that wealth to the parent company or intermediaries that may be located in lower tax jurisdictions. Jemena’s convertible notes are a debt instrument according to their accounts. The rate charged on these notes is not commercial. At 10.25% it is far above a commercial borrowing rate for a company such as Jemena. APA Group (APA), a similar company operating pipelines, paid an interest rate of 4.97% in 2015. In our opinion this is a method of transferring wealth generated by Jemena to the parent governments (those of Singapore and China) and reduce Australian Income tax costs.”

Environment lawyer David Barnden picked up on the report and wrote a letter pointing out Jemena’s sketchy tax ploy to the Tax Office. Things move slowly in the land of the regulator but the Tax Office did move. They settled an action against Jemena on March 8 this year.

The settlement had three key aspects

- A $50.8m payment to the Australian Tax Office “for past years”.

- Jemena has been forced to change its financial structure to eliminate the convertible notes that caused the tax evasion in the first place.

- But there is no fine, no penalty at all for the $800m convertible note tax rort.

“It’s great to see the Australian Taxation Office finally collecting some tax off these government-owned corporations,” Robertson told MWM. Corporations owned by other governments, not our government that is! Not only has the ATO collected $50.8m in back taxes but it has neutralised the instrument that would have cost it a further $170m out to 2050 based on the size of the settlement. Jemena’s auditor is KPMG.

Another privatisation failFailure of regulators and, in this case the AEMC in particular, has put Australia in a pickle, says Robertson

“Jemena runs vital gas transmission pipelines – services which used to be provided by our government. We have now privatised these monopoly assets (albeit in this case privatised them to a foreign government corporation. The use of the term privatisation is pretty loose as Jemena is really a foreign government corporation.”

Jemena is wholly owned by the State Grid Corporation of China and SP Group. Essentially Jemena is owned by the governments of China and Singapore.

https://michaelwest.com.au/northern-gas-pipeline-with-no-gas/

it's time for being earnest.....

- By Gus Leonisky at 23 Apr 2024 - 8:20am

- Gus Leonisky's blog

- Login or register to post comments

Recent comments

1 hour 31 min ago

1 hour 53 min ago

1 hour 58 min ago

12 hours 27 min ago

15 hours 11 min ago

15 hours 18 min ago

15 hours 55 min ago

17 hours 28 min ago

21 hours 47 min ago

21 hours 54 min ago