Search

Democracy Links

Member's Off-site Blogs

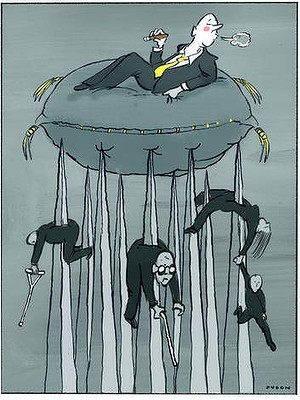

pain all round ....

“Pain all round” will be the rallying cry of the night. Joe Hockey says this first budget - tonight - will hit everyone from high earners to politicians to Australians too poor to pay to see the doctor. All of us will have to “contribute budget repair”.

Except that we won’t.

The latest tax statistics show 75 ultra-high earning Australians paid no tax at all in 2011-12. Zero. Zip.

Each earned more than $1 million from investments or wages. Between them they made $195 million, an average of $2.6 million each.

The fortunate 75 paid no income tax, no Medicare levy and no Medicare surcharge, even though 60 of them had private health insurance.

The reason? They managed to cut their combined taxable incomes to $82. That’s right, $1.10 each.

Cutting taxable income that far doesn’t come cheap.

Forty-five of the uber millionaires claimed a total of $64.4 million for the “cost of managing their tax affairs”. That’s a staggering $1.4 million each. (As a point of comparison an entry-level H&R Block consultation costs $49.)

At face value the figures suggest these super high earners were prepared to spend an unlikely half of their incomes on tax advice. A more likely explanation is that they received far greater incomes than they reported and spent only a portion on tax advice.

It wasn’t wasted.

Ten of the millionaires claimed between them $1.3 million in work-related deductions, for things such as car expenses and clothing. Ten claimed a total of $5 million for donations and gifts, a category that includes political as well as charitable donations.

And they ran loss-making businesses.

The 30 who were in business reported total business income of $121 million offset by expenses of $122 million. Those who ran farms carried over $61.5 million in earlier tax losses and lost an extra $3 million in 2011-12.

When it came to investing they bought up big on shares that paid so-called franking credits on which they could claim tax deductions and stayed away from those that did not. They received $18.7 million in franked dividends in 2011-12, and only $565,000 in dividends that were unfranked.

On Tuesday night these 75 will escape the deficit reduction levy applying to taxable incomes of more than $180,000. Their taxable incomes are closer to nil than $180,000 even though they are well off enough to afford outrageously priced tax advice. And they’ll almost certainly escape the extra charge for bulk-billed visits to the doctor. About the only thing they won’t escape is higher petrol prices, although it should be noted that five of them claim work-related car expenses, so they might be able pass those costs on to the Tax Office.

It isn’t only millionaires. Tax Office figures show there are 1095 Australians earning in excess of $150,000 who pay no tax. Half of them sought tax advice and shelled out an impressive total of $98 million, which works out to $223,000 each. Their biggest lurk is negative gearing. Most lose large sums on properties they rent out in order to destroy their taxable incomes, hoping to make it up later when they sell the properties for a lightly taxed profit.

None of them will pay the deficit reduction levy. None of them will report taxable incomes above the threshold.

But even if they did, Tuesday night’s budget wouldn’t be spreading the pain all round.

The deficit reduction levy is expected to be 2¢ in the dollar. It would apply on top of the existing 45¢ rate, pushing the total up to 47¢ plus the Medicare Levy, which from July will be 2 per cent.

But the levy will be temporary. It will apply for only a few years until the budget is back in shape. By contrast the Medicare co-payment will be permanent. So too will be the twice-yearly increases in petrol excise. So too will be tougher rules of accessing unemployment benefits. So too will be the tougher restrictions on access to the disability support benefit.

Australia’s highest earners, even the bulk of them who actually confess to their incomes, will suffer for only a short time while lower earning Australians suffer year in, year out.

Asked how he would respond to a levy on high earners, Labor treasury spokesman Chris Bowen unaccountably said he was minded to oppose it.

“That's our position, that we don't like this increase in tax, this deficit levy, and therefore we wouldn't be supporting it,” he said.

He should have said it should be permanent.

The most temporary and silly of the all the leaked budget measures (and also the least financially worthwhile) is the freeze on politicians pay. It’ll last for just one year.

Symbolism is important, but if people can see through it it won’t be even symbolic.

What Hockey and Mathias Cormann should have done is to tackle high-end perks. The biggest is superannuation, Labor’s creation. The treasury believes the top 1 per cent of the workforce, a mere 130,000 people, get 6 per cent of all the super tax concessions. They are the people who need them the least.

Late in its term Labor tried to do something about it. It announced a tax of 15 per cent on the previously untaxed earnings of super funds used to support annual income streams in excess of $100,000. It would have hurt a mere 16,000 extremely well off superannuants.

Within months of taking office the Coalition canned it. It headed its press release: “Restoring integrity in the Australian tax system”.

It’s easy to get the impression Tuesday night’s budget will do anything to restore the nation’s finances so long as it doesn’t hurt the really well off. It would be lovely to be proved wrong.

Budget pain? Not for millionaires who pay no tax

- By John Richardson at 13 May 2014 - 5:21pm

- John Richardson's blog

- Login or register to post comments

Recent comments

1 hour 3 min ago

2 hours 2 min ago

9 hours 38 min ago

9 hours 45 min ago

9 hours 54 min ago

10 hours 10 min ago

10 hours 54 min ago

11 hours 37 min ago

11 hours 51 min ago

15 hours 46 min ago