Search

Democracy Links

Member's Off-site Blogs

tonocchio exposed .....

from Crikey ….

This week's phoney reasons to attack Labor's economic management

Crikey Canberra correspondent Bernard Keane writes:

CHINA, FISCAL POLICY, INCOME INEQUALITY, INDUSTRIAL RELATIONS, PRODUCTIVITY, SOVEREIGN RISK

One of the ongoing problems for the government's critics in the media and business is the annoyingly strong performance of the Australian economy. When economic growth, employment, inflation and interest rates are all simultaneously at the sort of levels that most other countries, and for that matter Australians of the 1980s and 1990s, would be delighted to have, it's a challenge to find reasons to attack the government.

While the response of some has been the sort of resignation encapsulated in Joe Hockey's urging that we think of how things would be even better if there was a Coalition government, others haven't given up, but have instead tried to find other, more convenient economic issues that reflect a failing of the government. Like ...

· Productivity: the government's Fair Work Act is a burden on productivity because it reduces workplace flexibility, was the argument. Then, inconveniently, labour productivity was shown to have increased over the last year, while an independent review found no evidence of a link between productivity and the legislative framework for IR.

· Sovereign risk: the mining tax, IR laws and the carbon price would send foreign investors fleeing Australia to safer destinations like Zambia and Ghana. Strangely, this failed to prevent the build-up of a record quarter-trillion dollars in committed investment.

· Government debt crowding out the private sector: if sovereign risk wasn't going to do the trick, the budget deficit would drive up the cost of borrowing and send investors fleeing. Never mind the massive investment pipeline that promptly appeared or the lack of correlation between interest rates and the budget surplus under the Howard government. But Australian government bonds subsequently hit record lows as foreign investors and central banks rushed to the safe haven of our super triple A-rated economy. The RBA studies bank funding costs and concludes "the increase in spreads on banks' wholesale funding reflects global investors demanding more compensation for taking on bank credit risk, although the rise for Australian banks has been less marked than it has been for other banks globally". And while we're on our super triple A-rated economy, remember Barnaby Joyce warning we were in danger of defaulting?

· High cost of doing business: the government is making it too expensive to operate in Australia, warn business figures, who (yet again) say investors will flee the country. Quarter-trillion dollar pipeline, etc. Budget figures show the overall tax take from business has fallen as a proportion of gross operating surplus to the lowest level since at least the mid-1990s. And an independent review finds that if there's a problem with wages growth, it's been there since the start of last decade and unrelated to the Fair Work Act.

· Militant unions emboldened by the Fair Work Act are driving up the rate of industrial disputes. After a spike in the September 2011 quarter, the level of disputes promptly slumps in the December quarter. An independent review points out that up to a third of the disputes in 2011 are under state awards that have nothing to do with the Fair Work Act.

Recently there have been a couple more efforts to find a reason to bag the government.

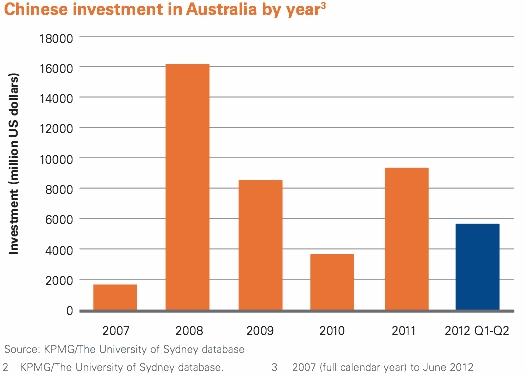

One was a claim by The Australian and business sources -- who refused to be named -- that the government had so mishandled the relationship with China that it was affecting business confidence and Chinese investment was falling. So, how has our economic relationship with China fared under Labor? Well, KPMG recently looked at the level of Chinese investment in Australia.

So, Chinese investment surged under Labor, fell back during the financial crisis and is now rebuilding back to record levels. Indeed, the level of Chinese investment in Australia is so high that the Coalition is dogwhistling about it and suggesting there's not enough scrutiny being applied to it.

How about Australian investment in China? According to DFAT figures, it has gone from $6.9 billion in 2008 to $17 billion in 2011. And in March, The RBA signed a rare bilateral local currency swap agreement with the People's Bank of China for swaps of up to $30 billion.

Another criticism was around the government's record on income inequality. News Limited's George Megalogenis attacked Wayne Swan last week and claimed that inequality had worsened under Swan. Tim Colebatch took Megalogenis apart on Tuesday, pointing out that the very figures that Megalogenis cited in his piece actually contradicted his own claims about growing inequality. Henry Ergas - that's Henry "an inability to express an objective expert opinion upon which reliance can be placed" Ergas - pursued the attack on Wednesday, ignoring Colebatch's demolition of Megalogenis and insisting any fall in inequality since 2007 was "statistically insignificant".

Rest assured you won't see The Oz showing too much interest in income inequality any other time. But the search for reasons to attack the government sometimes take its critics into unfamiliar territory.

- By John Richardson at 10 Aug 2012 - 4:31pm

- John Richardson's blog

- Login or register to post comments

Recent comments

17 min 36 sec ago

27 min 31 sec ago

1 hour 39 min ago

4 hours 1 min ago

13 hours 46 min ago

13 hours 57 min ago

14 hours 9 min ago

15 hours 8 min ago

15 hours 57 min ago

17 hours 20 min ago