Search

Democracy Links

Member's Off-site Blogs

let's play pretend .....

When elementary school kids want to escape the confines of their circumstances they pretend to be pirates, princesses, and Jedi knights.

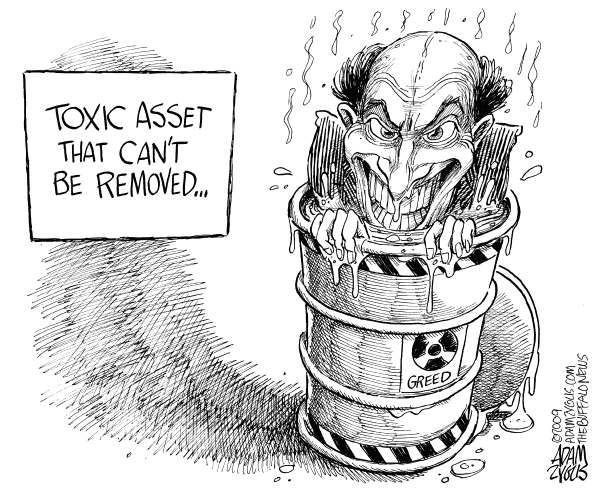

Now, with the relaxation of "mark to market" valuation rules announced yesterday by the accounting trade's self-regulatory body, our bankrupt financial institutions can escape their own reality by pretending to be solvent.The unravelling of our fairytale economy over the last few months has not yet convinced us that the time has come to put away childish things. The applause that greeted the news yesterday on Wall Street is a clear sign that we still have some growing up to do.

The imaginative conceit that lies behind the accounting change is that the toxic assets polluting bank balance sheets are not really toxic at all. They are in fact highly valuable assets that for some irrational reason no one wants to buy.Using the "mark to market" accounting method, mortgage-backed securities were valued relative to the latest prices fetched by the sale of similar assets on the open market. Currently, those bonds are being sold at deep discounts to their original value.

By "marking" their unsold bonds down to those prices, the insolvency of our financial institutions had been laid bare. The new accounting changes will allow the nervous owners to assign more "appropriate" (i.e. higher) values.Problem solved.

http://www.lewrockwell.com/schiff/schiff13.html- By John Richardson at 5 Apr 2009 - 8:41pm

- John Richardson's blog

- Login or register to post comments

Recent comments

28 min 50 sec ago

20 hours 16 min ago

21 hours 41 min ago

21 hours 47 min ago

1 day 18 min ago

1 day 17 hours ago

1 day 18 hours ago

1 day 18 hours ago

1 day 19 hours ago

1 day 20 hours ago