Search

Recent comments

- a peace deal....

19 hours 12 min ago - peace now!

20 hours 38 min ago - a nasty romance....

20 hours 43 min ago - blackmail?.....

23 hours 14 min ago - ukraine's agony has not started yet....

1 day 16 hours ago - all defeated.....

1 day 16 hours ago - beyond crime.....

1 day 17 hours ago - the end....

1 day 17 hours ago - odessa....

1 day 19 hours ago - weitz....

1 day 20 hours ago

Democracy Links

Member's Off-site Blogs

the legacy .....

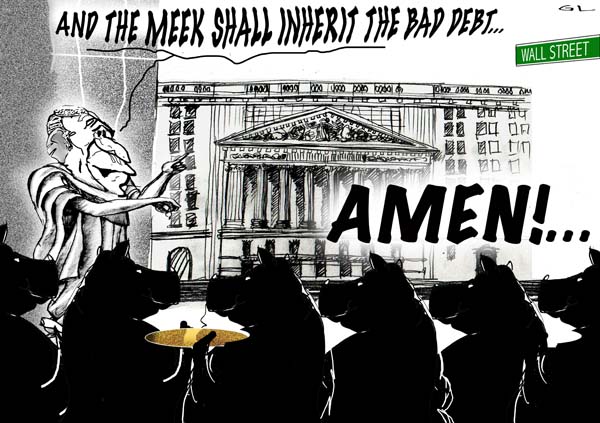

From 1998-2008, Wall Street investment firms, commercial banks, hedge funds, real estate companies and insurance conglomerates made political contributions totalling 1.725 billion dollars and spent another 3.4 billion on lobbyists - a financial juggernaut aimed at undercutting federal regulation.

"Congress and the Executive Branch responded to the legal bribes from the financial sector, rolling back common-sense standards, barring honest regulators from issuing rules to address emerging problems and trashing enforcement efforts," said Robert Weissman of Essential Information and the lead author of the report."The progressive erosion of regulatory restraining walls led to a flood of bad loans, and a tsunami of bad bets based on those bad loans," he said. "Now, there is wreckage across the financial landscape."

http://informationclearinghouse.info/article22146.htm- By Gus Leonisky at 7 Mar 2009 - 3:41pm

- Gus Leonisky's blog

- Login or register to post comments

Monty pythonesque...

The taxpayer is taking a controlling share of 65% in Lloyds Banking Group, up from the previous 43%.

The government has said new lending from Lloyds will jump to £28bn in the next two years, dwarfing similar figures from Northern Rock and RBS.

The taxpayer will also insure toxic loans worth £260bn ($367bn).

The group had to turn to the government for help following its takeover of HBOS, which recently reported an annual loss of nearly £11bn ($15.5bn).

--------------

see toon above...

a generous donation

The following is part of a letter sent on Tuesday by Jake DeSantis, an executive vice president of the American International Group’s financial products unit, to Edward M. Liddy, the chief executive of A.I.G.

After 12 months of hard work dismantling the company — during which A.I.G. reassured us many times we would be rewarded in March 2009 — we in the financial products unit have been betrayed by A.I.G. and are being unfairly persecuted by elected officials. In response to this, I will now leave the company and donate my entire post-tax retention payment to those suffering from the global economic downturn. My intent is to keep none of the money myself.

I take this action after 11 years of dedicated, honorable service to A.I.G. I can no longer effectively perform my duties in this dysfunctional environment, nor am I being paid to do so. Like you, I was asked to work for an annual salary of $1, and I agreed out of a sense of duty to the company and to the public officials who have come to its aid. Having now been let down by both, I can no longer justify spending 10, 12, 14 hours a day away from my family for the benefit of those who have let me down.

---------------------

Gus: we, the taxpayer of Lalaland understand your bent-over position very well. We've been in the same boat for years. We've toiled at the boilers — barely keeping our heads above water while drowning in credit, a credit we took as a duty to patriotic consumerism, a credit pushed by our own leaders so they could make inflated gross budget predictions of perpetual growth.

We've even invested our supers in — on the surface — well-heeled, legitimate financial institution that in return invested it like drunks at a casino — gambling everything 1000 times over with MASSIVE losses. Whatever you did at AIG became as efficient as a blow fly in a glass jar. Compared to the mountain of US$ 2.5 trillion that AIG could owe should the bets all go against it, your work was very valuable but obviously would amount to zippo. It is a super-dysfunctional environment and the culprits (not you obviously) should be in prison — not in the Bahamas smoking Cuban cigars, drinking expensive cocktails and checking their Swiss bank accounts from their laptops, between two plunges in the swimming pool flanked by two stunning Miss Beautifools.

We thank you for your generous donation.

a 'golden hello' .....

Lloyds Banking Group, one of the banks bailed out by the taxpayer, has handed its new chief executive António Horta-Osório a package of up to £13.4m after luring him from his previous employer with a £4.6m "golden hello".

In a move that is likely to reignite public anger about bankers' pay, the Portuguese-born banker, hired from the Spanish bank Santander, has a complex pay deal that comprises a signing-on fee of 6m shares plus a cash payment of £516,000, which could be worth up to £4.6m in total.

The golden hello pays out over three years - some £1.1m of it depends on future performance - and he could also take home £8m a year as a result of a £1.06m salary, potential maximum annual bonus of £2.4m and a long-term incentive plan of 4.2 times his salary (some £4.5m).

To recruit him, the bank has introduced a pension scheme that, unusually, is linked to the share price and could involve more than £800,000 being paid into his pension for the next five to six years.

The golden hello was described as a "disgrace" by thinktank Compass, while Lib Dem peer Lord Oakeshott said taxpayers would be "appalled they have to guarantee him £5,000 each day just for turning up at the office for the next three years".

New Lloyds boss receives 'golden hello' worth £4.6m