Search

Recent comments

- cameron hypocrite.....

32 min 8 sec ago - sad to watch....

39 min 4 sec ago - a novel virus.....

4 hours 42 min ago - no grad.....

7 hours 24 min ago - wrong end....

7 hours 40 min ago - jews own USA....

10 hours 49 min ago - nasty japs....

10 hours 56 min ago - middle-east USA....

11 hours 10 min ago - hormuz.....

14 hours 38 min ago - decades of israhell....

20 hours 7 sec ago

Democracy Links

Member's Off-site Blogs

when the music stops .....

There is an ocean of people who are now feeling so depressed that not only have they become resigned to the fact that they are in deep trouble, but they have told everybody else that they are also in deep trouble.

Pessimism has an uncanny knack of being self-fulfilling.No wonder almost every single quoted share in the world has gone down significantly, mostly by half, if not much more.

Even the most solid companies, such as HSBC, which has no real exposure; or BP, which has significant oil reserves; or a company like Dell, which has an enormous amount of cash - the shares of these companies have traded down considerably.That is the barometer of our general pessimism.

The present condition has also been a wake-up call for those who have lost sight of understanding the businesses in which they invest.Before now, there were far too many people out there trying to profit from the shuffling of papers and commodities and derivatives and options and hedging: really sophisticated instruments - but all too clever by half.

It just goes to show that having all these smart theories and ingenious ideas is no substitute for a solid business sense based on the fundamentals of supply and demand, with particular reference to the efficiency of the workforce; all those basic components that people such as Warren Buffett emphasise and are often ridiculed for.

- By Gus Leonisky at 6 Mar 2009 - 6:24am

- Gus Leonisky's blog

- Login or register to post comments

guru keating for chickens...

Keating: fiscal stimulus has reached its limits

By Stephen Long

Former prime minister and treasurer Paul Keating says fiscal stimulus is reaching its limits and even advanced nations are at risk of debt default if they continue to amass huge budget deficits and borrowings to rescue their economies.

"There is a limit to what fiscal policy can do simply because there is a limit to fiscal policy," Mr Keating told a Lowy Institute gathering in Sydney on Thursday.

"Is this sustainable? Who is going to buy the bonds?"

He cited in particular the huge bill the United States was running up in an effort to counter the recession and to bail out its banking system and strategic companies such as the insurer AIG.

"Is America going to default on its debt or be able to issue bonds?" he asked.

Governments across the globe will seek to borrow between $US3 trillion and $US4 trillion on bond markets in the coming year to fund stimulus packages and rescue packages for ailing banks and other financial institutions.

Mr Keating also says Australia's banks are among the strongest in the world because they went through their crisis earlier, in the 1990s, when they "came out of the recession we truly had to have".

------------------------

This man knows the value of lean and hungry versus the fat and wobbly...

He should be rewritting the entire world financial system for all of us — a system that presently is becoming less fair and less sustainable by the minute — as more and more "rescue" package dollars are being swallowed by bad debts. Rewritting new rules is one thing, throwing cash at a pig, it's still a pig — of a system. The pig can eat potato peals as far as I'm concerned. But the proletariat chickens need to be organic free-range to be happy. By this I mean free of debts.

blue ribbon carpet for keating...

Keating is absolutely right, says Hockey

A former Labor prime minister is "absolutely right" in saying the government's cash splashes aren't going to work, opposition treasury spokesman Joe Hockey says.

Mr Hockey's comments come after former prime minister Paul Keating told a gathering at the Lowy Institute in Sydney yesterday that there were limits to what fiscal policy could do because there was "simply a limit to fiscal policy".

Australia and other nations had done the right thing by implementing stimulus packages, Mr Keating reportedly said.

But he has argued the spending had failed to change the levels of confidence in national and international economies, The Australian reports.

"I believe the opportunity for these packages is going to diminish," he said.

---------

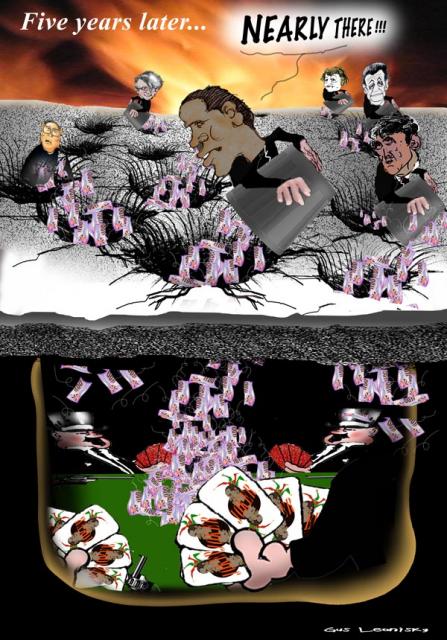

see toon at top...

of therapy and melanoma

When one has cancer, one could be submitted to several therapies that are very fierce. Surgery, radiation therapy and chemotherapy are taxing the body beyond the imagination.

Chemotherapy for example is designed to "poison" the body to a dangerous limit, when the cancerous growths or clusters are killed and the body survives. Hair falls out, your resistance to other diseases diminishes and the therapy makes you feel like shit. One throws up, one is weak and can hardly take any meaningful occupation, apart from worrying sick about the whole process that can kill you should the dose be tiny-weeny too strong. Chemotherapy is harsh but works, to my knowledge, in half of cases — although some sceptics will argue it only works for about 2 to 4 per cent of the cases.

Radiation therapy is used when the cancer in a critical area can be pinpointed thus a radiation beam is concentrated on the specific area at the depth required. It's likely to kill off a bit of healthy tissues but the process works in about half of cases and sceptics will also argue my estimated survival rate based on studying friends, neighbours and acquaintances who had their life "extended by 10 or 20 years" by the treatment is erroneous.

Surgery is performed when the cancer is large or localised, often in conjunction with chemotherapy applied after surgery to make sure all traces of cancer are gone...

All these therapies work to a point at prolonging patient life and this can be contentious, since we're prolonging the patient life" we've got no idea "how long the patient would have lived", except by applying case studies of other non-treated patients... Quite a statistical nightmare.

Chinese medicine can sometimes work with herbal/natural chemotherapy but the results can be iffy or non-quantified...

In no circumstances one should allow the cancer to be "let" grow even larger... unless one is terminal and hopeless.

Sure when one has terminal cancer "one is happy" to be on morphine. In fact, one is not happy but one has to stop feeling the horrible pain. I had some great friends who lived in the haze of daily morphine for up to ten years...

The world financial system is cancerous. Riddled with cancer... Sometimes a transplant can help too. For example Kerry Packer survived for another five years with a live donated kidney and his quality of life improved dramatically except his heart gave up. He used to smoke like the Port Kembla stack, but only drank milk...

Back to our thread

So what do we do? We feed the system giving it more reasons to be more cancerous. More cash to make it greedier. And morphine to soothe it for the populace as if it was terminal, but we don't accept it is terminal... (In fact, some studies suggest it's best to starve the patient before applying chemotherapy.)

This is where Mr Keating comes in.

Mr Keating has often been poopoo-ed by Mr Costello, the "world-best" treasurer who allowed the largest bribes to Saddam — in a sanction era before the war on Iraq by his own government — to be called kickbacks and then made them tax deductible... Mr Costello, the loving partner of that financial con-artist, Mr Greenspan. Mr Costello who implemented modest surpluses in the government coffers, while you and I carried the can of humongous personal credit to barely survive as he tightened the noose... Mr Costello who encouraged the Australian greedy housing bubble for his boss, Howard — a housing bubble that now sees about half of its value gone. Mr Costello, presently polishing the back bench with his gleaming trousers and now giving or not giving his two bob worth on the value of dead fish, either to undermine his own party or sell a few more "self-biography" or become alternative PM — take your pick...

But Keating as usual has the pulse on the patient.

To quote Peter Hartcher:

--------------------

When Barack Obama announced his champion to rescue the world from economic ruin, it was the first time most Americans had ever heard the name Tim Geithner.

The initial impression was good. The stockmarket surged and the pundits swooned. "Exactly a decade ago, he was Uncle Sam's golden-boy emissary sent into the stormy centre of what was then the world's worst financial crisis [the Asian crisis]," reported The New York Post.

The paper gushed: "Just 36 at the time, he'd been raised in Asia and knew the culture so intimately he scored successes and won confidences that other diplomats couldn't match. Geithner earned widespread plaudits for pulling together quarrelling Asian finance ministers into a $US200 billion rescue of their economies."

"A fantastic choice," said a Bank of Tokyo-Mitsubishi analyst, Chris Rupkey, as the Dow rose by nearly 6 per cent. Even one of Obama's political rivals, the hard-bitten Republican senator Richard Shelby, agreed Geithner was "up to the challenge".

If anyone in the US media had thought to ask a former Australian prime minister for his assessment, they would have heard a different view. And they would not have been so surprised at Geithner's performance since.

In a speech to a closed gathering at the Lowy Institute in Sydney on Thursday, Paul Keating gave a starkly different account of Geithner's record in handling the Asian crisis: "Tim Geithner was the Treasury line officer who wrote the IMF [International Monetary Fund] program for Indonesia in 1997-98, which was to apply current account solutions to a capital account crisis."

In other words, Geithner fundamentally misdiagnosed the problem. And his misdiagnosis led to a dreadfully wrong prescription.

-------------------------

And Peter Hartcher is right (I disagree with half his views). Paul Keating is spot on.

One of the major problem then and now is that the IMF can be and is politicised in the same way its twin the "World Bank" can be...

Actually this morning, hearing RN's Geraldine Doogue (a good woman, very energetic...) interview a few "people" (experts) on the financial crisis I heard myself say loudly: "That's a lot of crap!" at every turn of phrase used by these jingoistic cliché users (most with a Yankee accent) who had no idea about what they were talking about. I call this: "housewives economics" with no clue about the size and shape of the iceberg below, or of the traitorous waters full of rips, rocks and strong currents...

Keating does have a clue. Mr "recession-we-had-to-have" Keating is not afraid of giving the bitter pill when it is needed — even to his own detriment. At the time, most world governments could pull the levers of interest rates as their majesty's pleasure, but since that accelerator/brake pedal was taken away and placed into the hands of, would you believe, "bankers"... !!!

What would they know????

Instrumentation like these in the hands of the banks end up hiding the true malaise of the system. For 10 years the true inflation was about 8 per cent or more, while the governments of Bush, Blair and Howard were tooting a low of 3 per cent, spruiking this with fake financial snouts. This gave the clown-regulators of interest rates, the fantasy of setting them as low as 5 per cent, now at freezing point would you believe... So...? The economy is going to freeze some more thus while feeling warm peeing in the waters it's swimming in!!!

In my books it was not going to take long before this differential of illusion was going to hit hard, but, on top of that, the true financial system below the waterline is as clear as freshly made strong coffee... Smells terrific but one cannot see through. And do we need transparency in the system!!!?? We do!!!!... We're high on caffeine and we're buzzing busy like a fly in a jar, half full of crap.

For example the US government has sunk about US$160 billion into the rescue of AIG... Most of that money has since vanished into paying off the derivative branches of AIG where money filtering is as clear as thick mud. No one sees anything. That's why there are a few senators on both sides of the political spectrum in the US asking pertinent questions. "Where is the money going?" The patient's response of course is "we can't reveal this because of client confidentiality..."

Bullshit!!! Can we allow the taxpayers money to be siphoned off fast into private pockets, without anything, not even a kiss on the cheek? ...Or on our butts?...

Keating, unlike the Australian Liberal (similarly conservative to G.O.P. in the US), knows the way the system works. The Liberal give the impression they are lively surface feeders, but they are opportunistic bottom feeders who care less about what they eat and more about how much munch they can do during the good times.

Before the "Asian" crisis, one did not have to look far to see opportunistic moneys coming to rob the life out of healthy but steady Asian markets. And as Keating said, the solution to the then "created crisis" was the wrong one, leaving more havoc behind than solving the problem. It took some astute footwork, including a few despots, to restore the system. Some countries never recovered and may I say I smell a political rat there...

One cannot disassociate Politics and Finance. These are two art form (they are not sciences, oh no...) that rule our day-to-day comforts. And the IMF and the World Bank are financial arms of strong political currents. For example when that horrible man, that other Paul, Paul Wolfowitz, responsible for the war on Iraq, was head of the World Bank, he would not lend money to perfectly legitimate projects that would have staved off hunger, because the governments, he would have had to lend to, had communist tendencies... That's politicisation of purpose. And in the rescue of the Asian crisis there was a political purpose: bring to heel the nicely independent system of Asia...

The Chinese saw through this very clearly and set up a massive slush fund for themselves...

Peter Hartcher quotes Keating:

China, in particular, drew hard conclusions from the IMF's mishandling of the Asian crisis. It decided that it would never allow itself to be dependent on the IMF, or the US, or the West generally, for its international solvency. Instead, it would build the biggest war chest the world had ever seen.

Keating continued: "This has all been noted inside the State Council of China and by the Politburo. And it's one of the reasons, perhaps the principal reason, why convertibility of the renminbi [yuan] remains off the agenda for China, and it's why through a series of exchange-rate interventions each day that they've built these massive reserves.

"These reserves are so large at $US2 trillion as to equal $US2000 for every Chinese person, and when your consider that the average income of Chinese people is $US4000 to $US5000, it's 50 per cent of their annual income. It's a huge thing for a developing country to not spend its wealth on its own development."

---------------

Thus the doctor who screwed up the Asian crisis rescue back in the 1990s was called back to fix the present cancerous problem. No wonder that Keating is calling him, Geithner, a "gigantic fool".

Keating knows finance AND politics. He is a financial artist of the finest kind. He should be called in to perform chemotherapy on the system. Sure, it would be far more painful than what's going on at the moment, like being on a morphine drip, with money lining around the shitty coop, but in the end the financial system would become far healthier. And I think Keating would include global warming in his equations...

He would have to... Global warming is likely to lead to massive melanoma of the system, thus we need to "slip, slap, slop..." while surgically carefully removing the new melanomas as they occur and spend 10 minutes in the morning sun for vitamin D. Fast.

Newton, Darwin, Keating... we need you. The planet needs you

Have a nice day.

ps: Hartcher ends up with:

"In sum, Tim Geithner is a gigantic fool, the IMF the gun that can't shoot straight, Alan Greenspan a bungler. The big US banks were run by the greedy and the hopeless, the Australian banks by counterhopping clerks. It's a world of many villains. And only one hero."

A bit glib if you must but one has to study Isaac Newton as a financial Mint whiz to know that P J Keating is right. If what Keating says was rot, the financial market would be rosy. It is not.

Have a great mardi-gras...

see toon at top...

junk humanity...

From the NYT

WASHINGTON — The economic crisis that started with junk mortgages in the United States is causing havoc for poorer countries around the world, not only stifling their growth but choking off their access to credit as well, the World Bank said on Sunday.

In a bleaker assessment than those of most private forecasters, the World Bank also predicted that the global economy would shrink in 2009 for the first time since World War II. The bank did not provide a specific estimate, but bank officials said its economists would be publishing one in the next several weeks.

Until now, even extremely pessimistic forecasters have predicted that the global economy would eke out a tiny expansion but had warned that even a growth rate of 5 percent in China would be a disastrous slowdown, given the enormous pressure there to create jobs for its rural population.

The World Bank also warned that global trade would shrink for the first time since 1982, and that the decline would be the biggest since the 1930s.

see toon at top and read more at the NYT...

--------------------

But note what I posted above. I quote:

One of the major problem then and now is that the IMF can be and is politicised in the same way its twin the "World Bank" can be...

...

One cannot disassociate Politics and Finance. These are two art forms (they are not sciences, oh no...) that rule our day-to-day comforts. And the IMF and the World Bank are financial arms of strong political currents. For example when that horrible man, that other Paul, Paul Wolfowitz, responsible for the war on Iraq, was head of the World Bank, he would not lend money to perfectly legitimate projects that would have staved off hunger, because the governments, he would have had to lend to, had communist tendencies... That's politicisation of purpose. And in the rescue of the Asian crisis there was a political purpose: bring to heel the nicely independent system of Asia...

......

Is this present crisis designed to bring political turmoil around the world by some nasty piece of ruthless clever "free-marketeers"? Because let me tell you, my friend, when there is confusion and destabilisation, there is "war" and wars are profiteers' dream. For example, most of the console gaming these days is about war and destruction of "enemies" that are assessed as such for us by the game-makers who make these "enemies" usually ugly, sneaky and "evilish". But "we have good on our side" to win... We, of course, only used sneaky thumb reaction speed and our craziness of movement to do this, and our minds become totally polluted with garbage heroics. This is the future for our kids...

So, was this present crisis "designed" to bring political turmoil in China for example? As China is on its way to become the numero uno world power in 2015, some boffins devised a clever way to rob one-self in order to suck the massive insurance pay-outs, including Chinese savings? And stuff up the cocky Russians at the same time? See the Ruskies are new to the game of "capitalism" — a game in which most lose their pants, some win big bux. And the game jackpot is where the entire public "society" pays for the massive private gains, not only now but for years to come? So far the Russians have come to this poker table reluctantly, gingerly and quite suspiciously of being robbed... And they were robbed blind too. First by the "oligarch" (some supported by the CIA and MI6) and now, like us most, by the "derivativists"... But these ones, this species of looters, are harder to pick than the mafiosi oligarchi... The amount of "toxic" derivative debt is potentially huge. If for example this unregualted but "legitimate" market goes only ten per cent against the "average" bet, it will swallow nearly half of the world's finances... into very few private hands. And we will have to fork out big unless we refuse to pay. This time may have to come and according to the venerable Paul Keating, this time has come. Enough...

But in the end the derivativist's game is not to cook the goose, just ruffle the feathers to collect the golden eggs...

Far fetched I know, but the deviousness of humans never cease to not surprise me if you see what I mean.

cooking the goose nonetheless

The world's best efforts at combating climate change are likely to offer no more than a 50-50 chance of keeping temperature rises below the threshold of disaster, according to research from the UK Met Office.

The key aim of holding the expected increase to 2C, beyond which damage to the natural world and to human society is likely to be catastrophic, is far from assured, the research suggests, even if all countries engage forthwith in a radical and enormous crash programme to slash greenhouse gas emissions – something which itself is by no means guaranteed.

The chilling forecast from the supercomputer climate model of the Met Office's Hadley Centre for Climate Prediction and Research will provide a sobering wake-up call for governments around the world, who will begin formally negotiating three weeks today the new international treaty on tackling global warming, which is due to be signed in Copenhagen in December.

------------------

See toon around this site and the blog above...

meanwhile, the massive world financial problem is going to be saved by an understaffed "skeleton crew":

March 9, 2009Geithner, With Few Aides, Faces Challenges

By EDMUND L. ANDREWS and STEPHEN LABATONWASHINGTON — Rarely have so few people had so little time to prop up so many pillars of the economy as those in the Treasury Department under Timothy F. Geithner.

In the six weeks since Mr. Geithner took over as Treasury secretary, he and a skeleton crew of unofficial senior advisers have been racing to make decisions that will shape the future of the banking, insurance, housing and automobile industries.

But even as he maintains a frenetic pace — unveiling plans, testifying before Congress and negotiating new bailouts with the likes of Citigroup, General Motors and the American International Group — there are signs that events are getting ahead of him.

Administration officials say they are postponing their plan to produce a detailed road map for overhauling the nation’s financial regulatory system by April, in time for the Group of 20 meeting in London. Though officials say they will still develop basic principles in time for the meeting, the plan will not include much detail.

Treasury officials are also still scrambling to decide details of their plan to buy up as much as $1 trillion in toxic assets from the nation’s banks, one month after being widely criticized for presenting a plan that lacked any specifics on how it would work.

Analysts say it is far too early to know if Mr. Geithner and his team will be effective. But some worry that political and financial constraints have made them reluctant to grapple with the full magnitude of the crisis.

Many financial experts estimate that the nation’s banks are holding as much as $2 trillion in troubled assets, most of it tied to mortgages. By contrast, the Treasury has less than $300 billion left in the financial rescue plan that Congress reluctantly approved last year.