Search

Recent comments

- tanked think-tank.....

20 min 25 sec ago - (PAUSE)....

47 min 6 sec ago - repeat....

1 hour 39 min ago - losing....

2 hours 6 min ago - was Pepe sold a pup?....

2 hours 42 min ago - a peace deal....

22 hours 30 min ago - peace now!

23 hours 55 min ago - a nasty romance....

1 day 1 min ago - blackmail?.....

1 day 2 hours ago - ukraine's agony has not started yet....

1 day 20 hours ago

Democracy Links

Member's Off-site Blogs

all in la famiglia .....

A fund, usually used by wealthy individuals and institutions, which is allowed to use aggressive strategies that are unavailable to mutual funds, including selling short, leverage, program trading, swaps, arbitrage, and derivatives.

Hedge funds are exempt from many of the rules and regulations governing other mutual funds, which allow them to accomplish aggressive investing goals. They are restricted by law to no more than 100 investors per fund, and as a result most hedge funds set extremely high minimum investment amounts, ranging anywhere from $250,000 to over $1 million. As with traditional mutual funds, investors in hedge funds pay a management fee; however, hedge funds also collect a percentage of the profits (usually 20%).http://www.investorwords.com/2296/hedge_fund.html

----------------------------------------

Who's Controlling and Looting the Pension Funds?

17 Aug 2007

https://www.larouchepac.com/news/2007/08/17/whos-controlling-and-looting-pension-funds.htmlAugust 17, 2007 (LPAC)--While wealthy investors and banks are stampeding their loans and funds out of hedge funds, the nation's pension funds are also stampeding--deeper into hedge fund investments!

The funds stand every chance of having their assets looted as so-called "smart money" and bank leverage deserts the hedge funds and many go under.The San Diego County Employees Retirement Association, for example, has upped its investments in 12 hedge funds during August to $1.4 billion, or 18% of the total $8.4 billion which it manages.

San Diego County has invested a combined $255 million in AQR Capital Management and D.E. Shaw and Co., both huge hedge funds which have suffered huge losses in the mortgage meltdown panic. On Aug. 15, the pension fund decided not to consider withdrawing its investments in D.E. Shaw and AQR, saying that they were "both still up for the year"!In Massachusetts, the state's Public Employees Retirement Administration Commission (PERAC) on Aug. 16 gave the go-ahead to state employees' pension funds to put more than 10% of their assets into hedge funds, without even notifying PERAC. This was because the state teachers' retirement fund asked to be ableto go plunging in the dried-up hedge fund liquidity pool.

-------------------------------Plans are moving apace to purposely set up a "toxic bank" full of poisonous assets to further bail out those banks that had greedily and recklessly accumulated them.

Call it Shitibank. And give it the naming rights to the new baseball stadium for the New York Mets, taking the moniker away from toxic Citibank.

No joke. As Ground Zero reminds us of 9/11, ShitiField would serve as a monument to the global financial meltdown caused by New Yorkers. ShitiField would remind us to burst any future Wall Street bubbles before they blow up in our faces.And, once the toxic bank is up and running, we proles can move our non-existent pension money to it. But don't count on driving a new Nissan to the new bank: Even if you could afford to buy one, Nissan can't afford to keep its factories open to manufacture one.

What's really going to happen this week sounds just as far-fetched, but it's not: Many investors on Wall Street don't want the market to recover. They want it to hit bottom so they can start buying shares and companies again.http://blogs.villagevoice.com/pressclips/archives/hedge_funds/

---------------------------------

Back in November...

----------

AIG: The Looting Continues (Banana Republic Watch)

The Wall Street Journal reports, as was rumored on Friday, that AIG appears on the verge of approving a considerably enlarged and sweetened rescue package from the government.We were less than happy with the idea when it first surfaced (see our rant "The Black Hole Gets Bigger: AIG Back for Yet Another Bailout").

Let us review the basics:1. AIG came desperate to the US government for a rescue, and a whopper at that.

The Federal government has no oversight responsibility for AIG, which oh by the way, just happens to have very large overseas operations (in other words, one could take the position that AIG's problems, for a whole host of reasons, are really not the Federal government's problem). However, having seen the disruption that the collapse of Lehman caused, and knowing that AIG was a substantial and unhedged writer of credit default swaps, the powers that be were worried that a bankruptcy could be cataclysmic.2. The initial deal was punitive by design. Some key elements of the Fed's loan.

- An $85 billion, two year facility with interest at Libor + 850 basis points (and note the 850 basis point was the commitment fee, payable on the whole amount; the Libor addition kicked on on funds drawn down)

- The loan was secured by all of AIG's assets and those of its primary non-regulated subsidiaries- The government received 79.9% of AIG and had a veto right on payment of common and preferred stock.

- The loan was to be repaid by asset sales

Now this could and should have been treated as a nationalization in all but name.The very top management was replaced (and realistically, only limited housecleaning would be possible given the specialized nature of many of their businesses).

The only reason the government did not take 100% of the equity was for the same reason they only took 79.9% of Freddie and Fannie in their conservatorship: going above that level would force the Federal government to consolidate their balance sheets.But instead, stunningly, the accounting fiction, that AIG is an independent operation with rights, as opposed to a ward of the state, is not only being dignified, it is being acted upon.

Look at the list of terms above. The government has the right to seize absolutely everything of value AIG has until it pays off the loans, hold virtually all of the equity, and can veto many key actions (the senior position with respect to the assets gives it more rights than those listed above). Think of AIG as a felon: until it pays its debts to society, it has virtually no rights.Well, that was the theory, but now the deal has been retraded twice. The first time was done with as little notice as possible, but the dispersal of another $37.8 billion was rather hard to hide. Per the Fed's press release:

Under this program, the New York Fed will borrow up to $37.8 billion in investment-grade, fixed-income securities from AIG in return for cash collateral. These securities were previously lent by AIG’s insurance company subsidiaries to third parties.

As expected, drawdowns to date under the existing $85 billion New York Fed loan facility have been used, in part, to settle transactions with counterparties returning these third-party securities to AIG.http://www.nakedcapitalism.com/2008/11/aig-looting-continues.html

--------------------------

And back in 2003....

Looting America's mutual funds

Commentary: Wall St. wants freedom of a Baghdad mob

By Paul B. Farrell, CBS.MarketWatch.comLast update: 12:03 a.m. EDT April 15, 2003

LOS ANGELES (CBS.MW) - What's happening in Baghdad happens every day on the Wall Street. Looting. Mob rule. Baghdad and Wall Street, so different, yet so dangerously similar.We're reminded of this because Barron's -- Wall Street's Minister of Information -- is now disseminating information recommending the mass looting of the U.S. mutual funds.

Over the weekend, we were shocked to read of mobs looting the Iraq National Museum and destroying the heritage of the nation, more than 170,000 items of antiquity. In one day, 7,000 years of history disappears.

You can understand looting the electronics stores, the food warehouses, and the government offices. But the National Museum? U.S. soldiers guarded the Oil Ministry; five more could have protected the entire museum. Instead, the continuity of one of the world's oldest cultures was lost amid mistaken values.

Fund managers as looters.

http://www.marketwatch.com/News/Story/Story.aspx?guid={02A93BD9-5F8D-4136-A0A7-389BDF440784}&siteid=mktw--------------

Gus: etc.... WE KNEW IT WAS COMING.... GOVERNMENTS KNEW IT WAS COMING BUT DID THEY DO ANYTHING??? Dumbya was still thinking of useless war... to go and pinch someone else's oil...

- By Gus Leonisky at 3 Mar 2009 - 10:13pm

- Gus Leonisky's blog

- Login or register to post comments

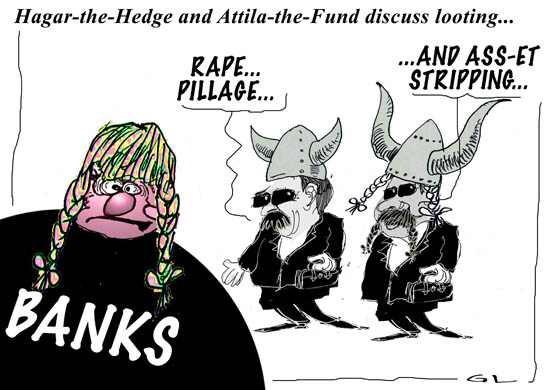

haghedge and attifund cannot raid the bank yet...

THE corporate regulator has widened a split between Australia's banks and the rest of the finance sector after extending its ban on the short selling of financial stocks.

The ban's detractors called on the Australian Securities and Investments Commission, headed by Tony D'Aloisio, to clarify what it has learnt since it imposed the ban six months ago, why it has decided to keep it, and what needs to happen for it to be lifted.

The regulator extended the ban yesterday to the end of May. It was first imposed in September. A ban on short selling companies with no links to the finance industry has already been lifted.

ASIC said it was pursuing a "cautious approach" amid "potential damage from aggressive or predatory practices" in volatile markets. It had conducted "extensive research and analysis" before making its decision.

But the chief executive of the Investment and Financial Services Association, Richard Gilbert, drew attention to the vagueness of ASIC's statement.

"What the finance industry needs is some clear guidelines about what conditions [ASIC] would need in order to lift the ban," Mr Gilbert said.

Australia is one of a number of smaller markets - including Italy and the Netherlands - to retain a ban on short selling. The practice involves investors borrowing shares, selling them, and hoping to buy them back at a lower price and pocket the difference.

----------------------

Short selling: one way to rob a bank's shareholders, create mayhem, aggravate a financial crisis and get away with it, legally so far... except for a ban on the process till due notice.

see toon at top.

blue-chips shock...

Slump Humbling Blue-Chip Stocks, Once Dow’s Pride

By JACK HEALYThe banking giant Citigroup commanded a stock price of $55 just two years ago. But at one point Thursday, as markets hurtled to their lowest close in 12 years, the shares were worth less than an item at the Dollar Store.

After months of breathtaking declines, this is what Wall Street has come to: Blue-chip companies, once considered safe investments and cornerstones of the economy, are akin to penny stocks.

The bear market is tightening its grip, despite efforts by the government to support the economy and some of its biggest companies. Fears about the depth and breadth of the recession drove the Dow Jones industrial average down another 4 percent on Thursday, bringing its losses so far this year to 25 percent — just shy of the 33 percent decline recorded for all of 2008.

“It borders on unbelievable,” said Glenn W. Tyranski, senior vice president for financial compliance at NYSE Regulation. “You’re seeing companies that are just really suffering across the board.”

The number of companies trading at $10 or less on the Standard & Poor’s 500-stock index has increased tenfold since the market reached a peak in October 2007. And with no end in sight to the downward spiral, the New York Stock Exchange has temporarily suspended its $1 minimum share-price requirements to prevent a wave of delistings.

------------------

What has gone wrong? Probably some derivative bets went against the bank and... pow! catastrophe... investors are bleeding to death...

dear phillip

Spread of ancient art is a good thing

Phillip Adams | April 11, 2009

Article from: The Australian

....

I’m talking about the art regarded as looted – the paintings stolen or bought under duress from Nazi Germany’s Jewish families, and the mountains of ancient art souvenired by triumphant army generals, a venerable tradition honoured, if that’s the word, as late as the Six-Day War. General Moshe Dayan’s “private” collection, gathered in the heat of battle, now resides in an Israeli museum.

...

Yet the greatest threats aren’t the foreigners but the locals. No sooner was a dead pharaoh plonked in his pyramid than the tomb was looted. Often by his successor.

...

There are times when the collectors and the museums are the saviours, protecting the past like zoos breeding endangered species. At an early meeting of the Australia Council I proposed a plan that would limit looting and help poor countries with rich pasts while cutting Sotheby’s and Christie’s out of the picture.

---------------------

Gus Leonisky:

Dear Phillip

Most people know where you coming from. You are a collector of antiquity. And that's commendable to your chosen ideals, which you try to justify in your column (see above link)... Please don't. We all try to justify one way or another the purpose of our personal indulgence. I do this every day, on many fronts. We all do it privately, but it's often loaded with self-serving double dipping... Doing it publicly seems hypocritical...

Yes, on this subject of antique collectibles there is always a fine line between looting and acquiring. I remember this affable dealer once in Yourp (Europe) who had more than two tonnes of roman coinage in two large antique cast-iron tubs. He also had a massive collection of prehistoric arrow heads and axes... I had no idea where all this came from... No questions asked.

But no, collecting is not like zoos where we 'protect" endangered species with breeding programmes. Sure, on one side we protect a few individuals of a species and encourage them to breed while on the other side we are hell-bent on destroying their specific precious homes (habitats). They would not be in the zoos' breeding programs had we not interfered with their space. Some zoos and some species are able to be successful in such ventures, but success is rare as territory and species always go hand in hand.

We are killing nature in the name of progress.

We are robbing tombs in the name of knowledge.

Zoos are pathetic places for species to live and breed in, even with our utmost caring and replicating of a landscape, to a point. Gees..., there is this series on ABC2 at present called "Zoo" coming from the UK. There are fantastic carers, vets and other human creatures fussing about stuff, including nutrition. But a concrete floor in a windowless grubby shed divided with fences designed to arrest Sherman tanks is not a place for a female elephant to give birth in. Would you breed in an environment like this? I would not. I'd shoot myself. But the animals are not provided with the means to do so. They live in prison and with forlorn demeanor they appear to know that... A "zoo" like the Western Plain Zoo, in New South Wales, Australia, is closer to the mark by giving some species more acreage to move about, but the hunt and the purpose of being is still muddled by human "systems" of interference. In the English Zoo, species like elephants are aired for a few hours daily and their horizon expands to the boundary of the concrete jungle of the monkeys. No wonder some chimps at a zoo in Sweden collect stones, before the visitors pour in, to throw angrily at the suited great apes who pay money to gawk at them. Would you not?

Because in the long and short term, it is only because of our vicarious pleasure and our guilt at our expansionist destruction that we have zoos. Same with collecting, the best place for the items is to be left alone underground as you say but then why leave it to the pharaoh successor to loot the place when we can do it "legally"?

Yes, who owns the treasures of the planet? A question that has always been at the centre of war, at the tall fence building and wanton destruction...

see toon at top.

bygone looting...

The US state of California has returned three Renaissance paintings that were confiscated from Jewish art dealers in Nazi Germany during the 1930s.

The 16th-Century paintings were returned to the heirs of their former owners, Jakob and Rosa Oppenheimer, who died during the Holocaust.

After World War II, the paintings ended up in the collection of US newspaper tycoon, William Randolph Hearst.

They have been on display at a California museum for over 30 years

---------

read comment above: "dear Phillip"