Search

Recent comments

- a peace deal....

19 hours 44 min ago - peace now!

21 hours 10 min ago - a nasty romance....

21 hours 15 min ago - blackmail?.....

23 hours 46 min ago - ukraine's agony has not started yet....

1 day 17 hours ago - all defeated.....

1 day 17 hours ago - beyond crime.....

1 day 18 hours ago - the end....

1 day 18 hours ago - odessa....

1 day 19 hours ago - weitz....

1 day 21 hours ago

Democracy Links

Member's Off-site Blogs

no hope, no change .....

as the murray-darling collapses …..

The Federal Opposition says the Government needs to provide evidence that its new industrial relations laws will make people's jobs safer.

Workplace relations spokesman Michael Keenan says many businesses are seeking answers, particularly in the context of the international credit crisis.

Mr Keenan says the Government refuses to model the changes and show how they will affect the labour market.

"What we'd like to see is some information about what effect the Government thinks it will have on the employment market," he said.

Concern About Job Safety Under New IR Laws

look at them …..

Education Minister Julia Gillard says the former Coalition government must take part of the blame for the collapse of ABC Learning, while the four big banks say they have been exposed.

The embattled child care provider went into administration earlier today, owing more than $1 billion, and the Government is now in discussions with ABC's creditors, banks and receivers McGrath Nicol.

Westpac's exposure amounts to $200 million, ANZ's to $182 million and National Australia Bank's exposure is $140 million.

Gillard Blames Coalition, Banks Exposed As ABC Learning Dives

look at me …..

The Federal Opposition says the Government is to blame for October job losses, and says Labor must focus on maintaining jobs creation.

But Workplace Relations Minister Julia Gillard says the latest job figures are "very solid" in the climate of the global economic meltdown.

Their comments follow the release of figures which showed the unemployment rate remaining steady at 4.3 per cent for October, despite economists expecting a slight rise.

The official figures show 34,300 people gained employment during October, while expectations were that 10,000 had lost their jobs.

Creating Jobs Should Be Major Focus: Turnbull

look at them …..

Federal Opposition Leader Malcolm Turnbull says he shares Finance Minister Lindsay Tanner's optimism that the worst of the global financial crisis is over.

Mr Tanner says he believes the international financial market is beginning to turn around.

Mr Turnbull says he supports that view, but says Mr Tanner's comments seem to be at odds with those of Prime Minister Kevin Rudd.

"I'm happy to share optimism and confidence. It think really the person that Mr Tanner is differing from is Mr Rudd," he said.

Rudd, Tanner At Odds On Crisis: Turnbull

look at us …..

The Federal Government has defended the timing of its mid-year Budget update.

The update released today showed growth this year is expected to slow to 2 per cent.

The unemployment rate is likely to increase to 5.75 per cent by mid 2010.

The Opposition says the Government tried to conceal the bad news by releasing it on the same day as the US presidential election.

Deputy Opposition Leader Julie Bishop says the timing was deliberate.

"This is a cynical political exercise by the Treasurer," he said.

Treasurer Wayne Swan has told ABC1's 7.30 Report the timing was appropriate.

"We are bringing forward this mid-year economic and fiscal outlook at exactly the time it should be brought forward," he said.- By Gus Leonisky at 8 Nov 2008 - 7:17am

- Gus Leonisky's blog

- Login or register to post comments

loose turnbull in a crystalware shop

Bull in the china shop

Fred Argy

In Parliament, Kevin Rudd accused Malcolm Turnbull of undermining public confidence in vital Budget bills, in key financial institutions and in the Government's senior advisers. He thus failed "the first test of a responsible political leader" and shown "excessive arrogance, recklessness and lack of control" at a time of global crisis.

On the other hand, Mr. Turnbull accused the Rudd Government of "consistently putting its short term political strategy ahead of responsible economic management" by:

(a) Talking up inflation and talking down the economy;

(b) Refusing to release its latest economic forecasts - the "evidence" on which its fiscal policy was based;

(c) Engaging in a "slippery performance" about the RBA's degree of support for a cap in the bank deposit guarantee; and

(d) The government's failure to satisfactorily deal with the issue of an "unlimited guarantee" on bank cash deposits - and thus causing cash management moneys to flow out to those guaranteed institutions.

I now want to consider each of the four cases above and then reassess the chances of bipartisanship.

In essence, Rudd chose to adopt the Reserve Bank's line of attack on inflationary pressures. As the events developed, the RBA may have exaggerated the inflationary problem, so Turnbull's attack on the Budget Bill proved to be of little consequence. But it was a legitimate area of concern, at least in the early months of Rudd's term of office.

-----------------------

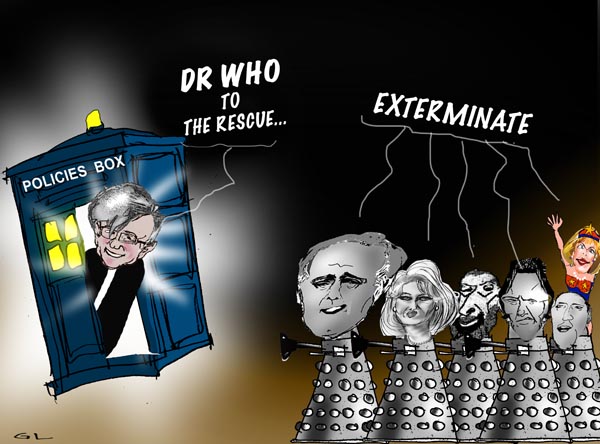

see toon at top... Like the Daleks, the Liberal party seems to know only one simplistic thing: exterminate.

a dalek in a fragile universe...

In a statement to Parliament today, Mr Rudd said the Government would be irresponsible not to spend on infrastructure to prop up growth if global economic conditions continued to deteriorate.

"If Australian economic growth slows further because of a further deepening of the global crisis then it follows that Australian Government revenues will reduce further," he said.

"Under those circumstances it would be responsible to draw further from the surplus and if necessary to use a temporary deficit to begin investing in our future infrastructure needs, including hospitals, schools, tafes, universities, ports, roads, urban rail and high speed broadband," he said.

"Such action would support growth would support families and jobs and would be undertaken in the national interest."

But Mr Turnbull seized on the statement as a sign of economic weakness.

"The key to managing difficult times is discipline and the willingness, the guts, to take tough decisions," he said.

"All through this year the Prime Minister has made no hard decisions.

"The Prime Minister has mismanaged our response to the global financial crisis. The Prime Minister wants a leave pass for economic laziness."

-------------------------

Gus: it appears that Mr Turnbull has not heard that the US boffins have now spent 5 trillion dollars in total trying to rescue their US economy, this on top of their already huge deficit... And under Gus prediction there could be another 5 trillion to go...

So far Kev Rudd has done the best that can be done for Australia's economy and this firm statement comes from multimillionaire geezers who, unlike Malcolm, have not become amateur politicians — especially one trying to politically profit from a very delicate situation brought out by his former boss, John Howard and his merry friend, Bushit the Minus.

Of all things before the last federal elections, I was already warning my neo-conservative friends (yes I have some), in a very gentle way, that the way the economy had been managed by their mates was going to blow up like never before. And I argued Australia would be slightly less affected not because of a better management but because there were still some prudential and social laws that our Johnnee had not had time to put his hands on — but was slowly working towards dismantling when "the time would have been right" should he'd been elected some more. The Yankeenisation of Aussieland was on its way like never ever...

At least Work Choices is now moribund. let's hope the opposition led by Malcolm does not try to keep it alive secretly. A Dalek in a fragile universe? We don't need that, Malcolm.

One of the cry on BigBux Street — long ago shouted on this site — is that Greenspan was somewhat criminal letting the interest rates in the US so low for so long, allowing for an overinflated value of the market to the tune of up to 200 per cent. Greenspan only did this caper to allow the survival of George W Bush and his neo-conservatives who also ruled in Australia... Under the neo-conservative management of Howard and Bush, many financial sins were committed, including the rape of the social system that blew up huge differences between the rich and the middle and poorer classes — classes that were treated like dirt but given the illusion of care — now in debt up-to the ears.

Malcolm should say nothing with brilliance... and be less of an obstructionist... see toon at top.