Search

Recent comments

- UK-israhell.....

42 min 59 sec ago - albania.....

50 min 54 sec ago - israhell crap.....

1 hour 8 min ago - waste of cash....

3 hours 47 min ago - marles' bluster....

4 hours 8 min ago - fascism français....

4 hours 12 min ago - russian subs in swedish waters....

4 hours 51 min ago - more polling....

4 hours 20 min ago - they know....

9 hours 8 min ago - past readings....

10 hours 7 min ago

Democracy Links

Member's Off-site Blogs

the natural order .....

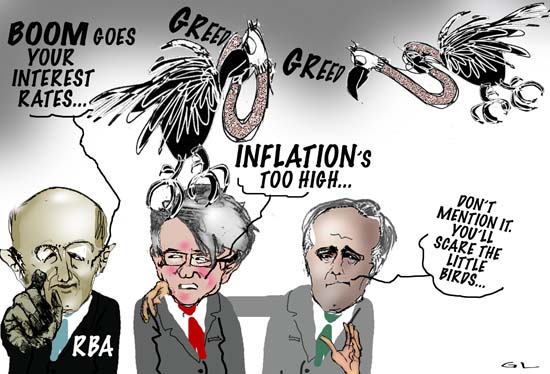

The Federal Opposition says Prime Minister Kevin Rudd is creating problems for the economy by talking up the challenge of inflation.

The official interest rate is expected to be lifted to its highest level in 12 years today and the Government warns it may be some time before homeowners get any relief.

Coalition treasury spokesman Malcolm Turnbull says the Prime Minister and Treasurer Wayne Swan are making the problem even worse. 'Their language they are using is so immoderate, so unmeasured, it's actually creating economic problems for us,' he said. 'Only this morning I received a news alert from the Financial Times, Europe's leading financial newspaper, headlining about Australian inflation fears, based on Mr Rudd's comments of last night.'

However, Mr Swan says Labor inherited high inflation from the previous Government.

PM 'Talking Up' Inflation: Turnbull

meanwhile …..

The Reserve Bank of Australia (RBA) has raised its official cash rate 0.25 per cent to 7 per cent, in a move which will increase the pressure on struggling families.

Interest rates are now at their highest level since 1996 after 11 consecutive increases. In a break with tradition the RBA announced the decision on the same day as its board meeting, instead of waiting 24 hours as has previously been the case.

Economists had tipped a rate rise as a response to Australia's inflation problem, which Prime Minister Kevin Rudd last week proclaimed was the country's 'public enemy number one'.

Opposition treasury spokesman Malcolm Turnbull says the Government should stop blaming the Howard government for the latest interest rate rise and instead do more to manage inflation.- By Gus Leonisky at 5 Feb 2008 - 11:16pm

- Gus Leonisky's blog

- Login or register to post comments

blowing in the wind...

Bob Ellis, ABC Unleashed

The Reserve Bank put up interest rates last week, for the eleventh time in eight years, in order once more to 'fight inflation'. They felt that in adding thus to the cost of living they were fighting inflation, not fuelling it.

Let's look closely at the results of their cunning ploy, and see if they were wrong.

Let's look at a small businessman paying off a building with two floors. One floor he uses himself, as his office and his dwelling, the other he rents to a fruiterer.

The Reserve Bank puts up interest rates by 0.25 per cent. Its client, the NAB, then puts up its interest rates by 0.30 per cent. Our small businessman, let's call him Joe, who was paying off $320,000 at $40,000 a year is now paying $80 more each month than he used to.

To recoup his loss he puts up the fruiterer's rent by $20 a week. The fruiterer, aghast, puts up the price of a mango by 30c. His regular customer, a working housewife, noting how much more a mango costs now, asks her union to get her a higher wage as a part-time teacher. The union does so, and everyone's wage rises. To pay these new costs, many companies put prices up.

This, in sum, is what we call inflation. And noting inflation is once again occurring, the Reserve Bank, moronically, puts interest rates up, not down.

They seem to think that interest rates are not a cost, but a sort of paralysing hypodermic in the bloodstream of the economy. But they are a cost, an added cost, that in turn spurs, and fuels, other costs.

----------------------

Gus: The idea behind raising interest rates is to slow spending. But For what I know, there are few luxuries that people spend things on, except big-TV screens and the like of necessities like obsolescence-riddled fridges. In regard to the fruiterer, his costs are already stretched beyond belief — even with all the members of his family working in the shop and another job somewhere else. To recoup his rent increase, not only he's got to sell the mangoes at a higher price but more mangoes as well... Beyond that, the big merchants of TV sets and goods for which "one buys now, pay in 2010 with no interest" have already factored in their profit margin a certain risk factor that allow them some flexibility in the pricing, since they don't pay much for the goods made in China. They can put them on the market here with a mark up that the market is prepared to bear. Sure, there is competition, but in real terms not much... When a store like a certain hardware chain advertise that "on advertised items blah blah they'll beat it by ten per cent", one has to realise that many lines of goods are exclusive to this hardware chain and nowhere else can you find the same products, except under a different branding or packaging...

Yes, the government has to find another culprit or another lever to fight inflation, without penalising the toilers... May be the obscene profits made by some companies... Possibly make the banks pay by enforcing a restraint on them for screwing up on buying subprime stuff, and lambaste the market for inflating the value of things beyond a fair illusion... Without inflation, the market would be flat or not enticing enough. with annual inflation running at 3 per cent, annual profit margins have to increase by 20 per cent in order to keep the fuel of the greed differential working. net gain 17 per cent...

With an annual inflation at 2 per cent, the profit margin can increase to 15 per cent and the shareholders might be happy... The greed differential net gain is only 13 per cent... Behind the close doors of big business, as long as workers' pay-packet only increase by 2 per cent, that's an extra one per cent in their inflated bonus package...

In fact, with an inflation rate of 2 per cent, increase in profits margins should only be 10 per cent annually. But there is all the rigmarole of buying the competition, market share increase and all kinds of factors that would make a competitive pig in mud happy... including rolling in the money market. Good luck.