Search

Recent comments

- waste of cash....

2 hours 27 min ago - marles' bluster....

2 hours 48 min ago - fascism français....

2 hours 52 min ago - russian subs in swedish waters....

3 hours 31 min ago - more polling....

3 hours 19 sec ago - they know....

7 hours 48 min ago - past readings....

8 hours 47 min ago - jihadist bob.....

8 hours 53 min ago - macronicon.....

10 hours 48 min ago - fascist liberals....

10 hours 49 min ago

Democracy Links

Member's Off-site Blogs

billions, more billions, enormous billions...

Billions of dollars in fast-tracked tax cuts and younger worker wage subsidies underline the Federal Government's budget recovery pitch, as Australia's recession sends debt and deficits to record levels.

Key points:- Debt and deficits are set to hit record highs as coronavirus savages the economy

- Businesses will be offered incentives to hire unemployed people aged under 35

- The Government will fast-track $50 billion in tax cuts to attempt to stimulate the economy

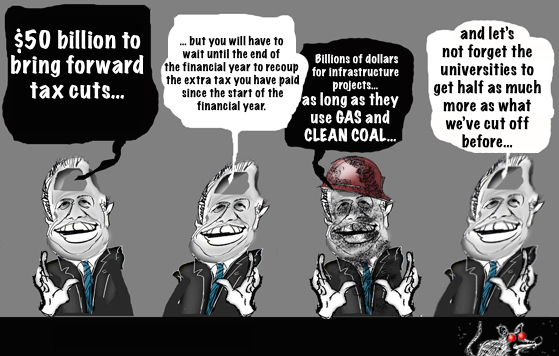

Treasurer Josh Frydenberg's coronavirus-delayed Budget includes $50 billion to bring forward tax cuts and $4 billion in subsidies for businesses to hire unemployed workers aged between 16 and 35.

The focus of the Budget is getting those who lost their jobs to COVID-19 back to work as Australia faces its biggest economic challenge since the Great Depression.

Cash payments worth $500, aimed at stimulating a struggling economy, will go to seniors, carers and disability support recipients, costing $2.6 billion, and an extra 23,000 in-home aged care packages will be offered, costing $1.6 billion.

The economic devastation sparked by coronavirus will see budget deficits continuing for at least another decade.

This financial year, the deficit is forecast to surpass $213 billion.

The 2020 Federal Budget explained:- LIVE UPDATES: For the latest as Josh Frydenberg hands down his Budget read our blog

- Who are the Winners and Losers from the Budget?

- Your cheat sheet to the 2020 Budget

Gone is the Government's pre-virus pledge to get the budget back to surplus and pay off the nation's debt within a decade.

Now, the Government forecasts net debt will peak at $966 billion — the equivalent of 44 per cent of gross domestic product (GDP) — in 2024.

"This is a heavy burden but a necessary one to responsibly deal with the greatest challenge of our time," Mr Frydenberg said.

Unemployment is forecast to be 7.25 per cent this financial year, down from a peak of 8 per cent in December.

Underlying the Government's assumptions is that a coronavirus vaccine won't be in place until late next year at the earliest.

It expects Australians will have to live with social-distancing until a vaccine is fully rolled out.

The Budget expects all domestic borders, except for WA's, will reopen by the end of the year.

It expects WA's to reopen in April, shortly after the state election there.

A return of international students and permanent migration isn't forecast to happen until late next year, with international travel expected to "remain low through the latter part of 2021".

If there is a vaccine before July next year, the Budget expects economic activity could increase by $34 billion.

But if there's no vaccine and further outbreaks occur, forecasted economic activity will be $55 billion lower over the next two years.

The JobKeeper wage subsidy program is still slated to end in March next year, signalling a major end to direct Government economic assistance ramped up during the height of the pandemic.

The Government will also cut placements on its humanitarian program, saving almost a billion dollars in coming years.

The Budget also includes $6.4 billion in funding the Government has allocated but is yet to announce.

Wage subsidies and tax cutsA so-called JobMaker Hiring Credit will be paid for a year to businesses who hire an unemployed worker aged 16 to 35 from the JobSeeker program.

The rate will be $200 a week for people under 30 and $100 a week for people between 30 and 35, and they must work at least 20 hours a week.

It expects Australians will have to live with social-distancing until a vaccine is fully rolled out.

The Budget forecasts that will support 450,000 jobs and is eligible for all businesses except the major banks.

The next round of tax cuts, which are being brought forward two years ahead of schedule, will be retrospective to July, but people will have to wait until the end of the financial year to recoup the extra tax they have paid since the start of the financial year.

Millions of Australians will get a backdated tax cut that will mean they take home at least an extra $1,000 this year.

More than a billion dollars will be spent on new apprenticeships and traineeships for 100,000 people.

The Government will also expand an instant asset write off program, making it eligible for almost all businesses, costing more than $30 billion.

Extra health fundingThe Government says it is committing more than $16 billion in COVID-19 health measures.

Government-subsidised mental health services will double from 10 to 20 and be available to all Australians — previously they were accessible only to Victorians.

The Treasurer said more mental health funding would be announced in the coming weeks.

The Budget also includes an additional $3.9 billion for the National Disability Insurance Scheme.

The Government has failed to include new measures for the residential aged care sector, which has seen the majority of coronavirus deaths in Australia, in this Budget.

It's expected new funding measures will be announced when the aged care royal commission delivers its findings next year.

Billions for research, manufacturing and infrastructureAhead of the Budget, the Government announced billions of dollars for manufacturing and infrastructure projects.

Having faced criticisms for cutting research and development in early years, the Government will now allocate $2 billion in new incentives.

Universities will receive $1 billion in new research funding, and the CSIRO $459 million.

There's also $14 billion to accelerate and fund new infrastructure programs.

A first home buyers deposit scheme will be expanded to include an extra 10,000 buyers.

The Government will also provide $1 billion in finance to support the construction of affordable housing.

Read more:

https://www.abc.net.au/news/2020-10-06/budget-2020-tax-cuts-deficit-coronavirus/12731914

- By Gus Leonisky at 6 Oct 2020 - 7:59pm

- Gus Leonisky's blog

- Login or register to post comments

your luck ends in december...

The Coalition will look to rush billions of dollars in tax cuts through Parliament as early as Wednesday, amid criticism that its big-spending, pandemic-era budget fails to do enough for those most affected.

“The budget will rack up a trillion dollars of debt but still doesn’t do enough to create jobs, fails to build for the future and leaves too many Australians behind,” Labor’s Jim Chalmers and Katy Gallagher said.

Tuesday’s key figures – including a $213.7 billion deficit, gross debt rising to $1.106 trillion next year, and an expected unemployment rate of 8 per cent in December – have startled many, but the government has maintained a big-spending budget was vital to stave off an even bigger economic crash.

Centrepiece policies include a wage subsidy for employers hiring young people currently on JobSeeker, a $1000 one-off tax cut for low-and middle-income earners, a permanent cut for those on incomes above $100,000, and a big spend on mental health.

But critics have already blasted the government for ignoring extra unemployment support for the hundreds of thousands of people who will remain out of work past December, when the coronavirus supplement to JobSeeker is due to end and the payment will revert to its pre-pandemic rate of $40 a day.

‘No plan’ for big issuesDespite a number of measures aimed at restarting the economy, Mr Frydenberg has been criticised for shortcomings in critical areas like social housing and homelessness.

Read more:

https://thenewdaily.com.au/news/2020/10/06/2020-budget-critics-welfare-housing/

And lucky I did not plan to go anywhere...:

Australians weary of restrictions are out of luck, as the country’s new budget predicts social distancing will continue for two years and long-distance travel is to remain off-limits until everyone is able to get a Covid-19 jab.

Widespread adoption of a vaccine for the novel coronavirus will be a prerequisite for Australians being able to travel long distances again, according to the country’s new budget that was unveiled on Tuesday. Until that vaccine is rolled out, they can expect social distancing, intermittent lockdowns and a stagnant economy.

“It is assumed that over the forecast period material localised outbreaks of COVID19 occur but are largely contained. A populationwide Australian COVID19 vaccination program is assumed to be fully in place by late 2021. General social distancing restrictions are assumed to continue until a vaccine is fully available,” reads the part of the document titled “Key assumptions.”

Read more:

https://www.rt.com/news/502720-australia-no-travel-vaccine-budget/

on a wing and a prayer, plus some luck-of-the-devil, budget...

If ever there was a "forgive and forget" Budget, this is it.

That is, the unprecedented nature of the disruption caused by a global pandemic makes most of the Budget's forecasts — things like the deficit and growth forecasts — not much more than a "pin the tail on the donkey" exercise.

It is reasonable and important to question and probe the Budget's underlying assumptions, such as the development of a vaccine by the end of next year.

But the real test of this particular Budget must be in what it potentially delivers to the economy in the next six months in terms of support, and facilitation, for what will be a very difficult period of change that will transform hundreds and thousands of lives and businesses.

In that context, the Budget's two most important measures are the wage subsidy it offers employers who take on young workers, and an investment tax concession so exceptionally generous as to make even the most shell-shocked business — that thinks it has a remote chance of surviving 2020 — contemplate spending some money.

The wage subsidy seeks to short circuit the risk of a generation of young people who have until recently been employed falling into long-term unemployment by urging employers to take them on at what will be the minimum wage, for a minimum of 20 hours a week, with the Government picking up half the tab.

And this is no small ambition. As of the end of August there were already just under 700,000 people under 35 on JobSeeker and Youth Allowance — an increase of 400,000 since December.

Government gambles on confidenceOur salvation, according to Treasurer Josh Frydenberg, will come from business and consumer confidence, and incentives designed to drag every possible bit of investment and spending that might have been lurking out in future years into the present.

The Budget speaks of private-sector led growth, and backs this with measures which flow overwhelmingly to business — from tax concessions to wage and apprentice subsidies.

The backdating of tax cuts to July 1 to give consumers a wad of cash to spend between now and Christmas, as well as two more rounds of $250 one-off payments to those on welfare, have to be seen more as a reassurance to business that there will be people out there ready to consume than a shot in the arm for consumer confidence as such.

Read more:

https://www.abc.net.au/news/2020-10-07/budget-2020-government-gamble-on-confidence-analysis/12732330

Read from top.

braces holding tattered brown trousers budget...

If there is one group who is really, really unhappy with the budget, it is the IPA.

Yup.

Here is today’s release, where it is predicting a $2 trillion debt by 2045:

Modelling by the free market thinktank the Institute of Public Affairs, based on data from the Commonwealth government budget and the Australian Bureau of Statistics, estimates that:

Gross commonwealth government debt will peak at $2.05 trillion in 2045.

Gross commonwealth government debt will not be paid off until the year 2080.

A budget surplus will not return until 2046.

For the purposes of comparison, Australia’s current annual gross domestic Product (GDP) – which measures the value of all goods and services produced – is approximately $1.9 trillion.

The IPA modelled two scenarios. The first scenario is based on the aggressively optimistic economic growth and budget deficit reduction assumptions contained in the commonwealth budget released last night, while the second scenario provides a more realistic scenario of lower GDP growth and a slow path back to a budget surplus.

Cian Hussey, research fellow at the IPA, said:

The devastating lockdown measures have caused a humanitarian tragedy, and the debt Australia has gone into to pay for them will last generations.

Scenario 1

Nominal GDP growth of 5%, as assumed in the budget from 2023-24.

Return to surplus 2038-39 based on deficits falling at a constant rate of nominal GDP as forecast in the budget.

Gross debt peaking at $1.92 trillion in 2037-38.

Surpluses stabilising at 1% of nominal GDP by 2043-44. This is equivalent to the average surplus as a percentage of nominal GDP under Howard and Costello.

Gross debt paid off in 2062-63.

Scenario 2

Long-term nominal GDP growth of 3%.

Return to surplus 2045-46 based on a slower rate of declining deficits.

Gross debt peaking at $2.05 trillion in 2044-45.

Surpluses stabilising at 1% of nominal GDP by 2051-52. This is equivalent to the average surplus as a percentage of nominal GDP under Howard and Costello.

Gross debt paid off in 2079-80.

Scenario 2 is more realistic as it assumes that the Australian economy will grow at a more modest rate post-Covid-19. Research and analysis by the Institute of Public Affairs has demonstrated how the lockdowns have permanently distorted the Australian economy through the disproportionate impact they have had on jobs, young Australians, small businesses and the self-employed.

Consequently, the Australian economy is likely to have a much larger public service, a smaller private sector, and for larger businesses to account for a greater share of employment and output than in the past. This will lead to a less dynamic economy, with slower long-run economic growth.

-----------------

Jacqui Lambie is now giving her view on the budget- she wants more done for social housing.

She tells Afternoon Briefing:

There is plenty of homelessness out there. It is a great way to stimulate the economy. It is a great way to get jobs out there. You talk about having apprentices, they’ve got to be building something along the way. And of course it comes down to TAFEs, they have no money either and they’re depleted. If you want to stimulate an economy where plenty of construction workers out of job, it is the way to do it. Go and wipe that public housing debts for people that need it, for the states that need it.

Read more: https://www.theguardian.com/australia-news/live/2020/oct/07/australian-budget-live-news-coalition-business-coronavirus-tax-frydenberg-morrison-politics-live

The IPA is a rotten ultra-right wing outfit with no grace about how poor people can survive.

the will of making a porcelain toilet bowl was lost in 1977...

“You don’t know what you’ve got ‘til it’s gone…..” Like manufacturing!

By GARY MOORHEAD | On 23 October 2020

As part of the post-COVID recovery, the Morrison Government has announced a “package” to revive manufacturing. But why does manufacturing need to be revived?

Manufacturing in Australia has been in steady decline for decades. It has more than halved as a percentage of GDP over the last twenty-five years to just under six percent.

During these decades, this relative decline of manufacturing was generally regarded as both inevitable and a good thing, especially by neo-liberal commentators (often roosting on perches like the Productivity Commission, Grattan Institute, university economics faculties or the AFR). These commentators were particularly aggravated by, and sniped constantly at, the subsidies that many areas of manufacturing, especially the auto industry, received. Industry support was only ordained when it was of the “smooth the dying pillow” type for “transition” or re-skilling programs in response to closures.

But COVID has forced a rethink.

The urgent need for face masks, hand sanitiser and respirators (and in the near future, vaccines) forced the realisation that most of these manufactured items had been sourced overseas from countries who would certainly place their own needs first – and caused even the most hardened neo-liberals to rethink the issue.

Now that a capacity to manufacture locally is seen as desirable again, can we simply turn the tap back on and start churning out things we need that others may not want to supply? Hand sanitiser was easy for brewers and food manufacturers while face masks became an over-night cottage industry, but respirators and more complex items are not so easy.

Will the Government’s stimulus package for manufacturing be sufficient and have attitudes really changed?

If you google “why manufacturing is important” you will get multiple responses from a variety of seemingly credible sources making assertions for manufacturing such as:

… manufacturing provides high-wage jobs, is a nation’s largest source of commercial innovation, it’s a key to trade deficit reduction, and interestingly, a disproportionately large contributor to environmental sustainability.

It also tends to be highly unionised, which may explain some of the more extreme hostility from the Right.

As part of the stimulus package, the Government said it was necessary to scale up manufacturing.

Commenting on the announcement on the 1 October edition of the ABC’s 7.30 Report, business journalist Alan Kohler said:

“I think largely what we’re doing here and what the Government is trying to do is recover from the loss of the car industry between 2013 and 2017. That was the key event.

It could have been saved and would have cost a lot less than $1.5 billion. But Tony Abbott and Joe Hockey decided not to do it.

The result was, we lost scale. That was the big scale manufacturing in Australia. A lot of manufacturing hung off it.

But now 90% of Australian manufacturers employ fewer than 20 people. So, basically manufacturing in this country has become a cottage industry. And what the Government’s now trying to do is recover scale. The whole focus of this package today is to develop larger scale in some selected areas. I think that’s fine.

It’s what we ought to do, but what we probably should have done was kept the car industry.”

Kohler now sees the loss of the car industry as indicative of a critical decline in capability, but like many business commentators, his current position was not what he had previously thought.

In 2013, speaking on the Drum, Kohler said:

Do we need a car industry? Well, that is the question, and I really don’t know.

Well now it seems he does know. Kohler – and many others – are living examples of Joni Mitchell’s “you don’t know what you’ve lost ’til it’s gone”.

The Drum interview linked above is worth reading for Kohler’s excellent analysis of the travails facing the Australian car industry in its last decade and the role played in adding to these travails by Government policy settings, especially in relation to Free Trade Agreements (FTAs). He also cites research showing productivity in car manufacturing was 15% higher than in the rest of the economy.

Kohler clearly now sees the loss of auto manufacturing as representing a tipping point in our loss of manufacturing capability, especially manufacturing scale.

One element of this lost capability was raised by members of the Medical Technology Association of Australia (MTAA) at a forum held in Parliament House in 2018, less than a year after the car industry had closed. Many MTAA members were trying to build high technology manufacturing businesses in Australia, reliant in part on componentry and technologies sourced from overseas. They told the forum that they found that without the scale provided by the car industry, many overseas suppliers of key componentry found the Australian market just too small to bother servicing.

A key factor in the loss of the car industry was the distortion of facts used by critics of the industry to justify their antagonistic position. Nowhere was this more marked than in claims that on a per capita basis, Australia had the second highest level of subsidy of the car industry in the world. The claims were based on a 2010 OECD Report which was based on a number of other reports, including a Grattan Report that amongst other flaws, lumped ten years funding into two years. (Referenced in the link below).

In fact, Australian per capita support was the lowest of any car manufacturing country ($17.80, compared with $27 in the UK, $90 in Germany, $147 in France and $264 in the USA – all in US $.) The basis for these numbers and assertions are also in the link. Interestingly, once these numbers gained some acceptance, the critics immediately switched to quoting subsidy per unit produced, which made their case look better.

The key point about an automotive manufacturing industry, as was explained to and accepted by Prime Minister Gillard after she unilaterally axed the Green Car Innovation Fund in 2011, is that if a country wants such an industry, it has to pay for it and support it. This “payment” can be through all kinds of direct and indirect subsidies, but it is a fact for every car manufacturing nation.

But supporting manufacturing requires more action from governments than subsidies. Here’s a tip.

We will know this Government is serious about reviving our manufacturing capability when it also comes up with: a genuine long term, national plan for energy transformation that includes a detailed and agreed process for transitioning electricity generation to renewables, with a reservation policy to keep some of our gas for our own needs; a national plan for reviving skills education, rather than a rorts for mates version of VETFEE HELP revisited; realistic funding for universities and research agencies plus an R&D Tax Incentive that doesn’t penalise firms that actually manufacture in Australia; a serious attempt to divert some of the billions of Government procurement to local manufacturers, especially in Defence; and finally, re-regulation (yes, red tape creation) where compliance activity has been so compromised by out-sourcing (as in construction) that legitimate firms are forced into a race to the bottom with shonks. And a plan to return some capability to the public service would also help.

Read more:

https://johnmenadue.com/you-dont-know-what-youve-got-til-its-gone/#more-54701

Read from top.

Please note that I used "the will of making a porcelain toilet bowl was lost in 1977"... and not "the will of making a china toilet bowl was lost in 1977"...