Search

Recent comments

- a peace deal....

9 hours 49 min ago - peace now!

11 hours 15 min ago - a nasty romance....

11 hours 21 min ago - blackmail?.....

13 hours 52 min ago - ukraine's agony has not started yet....

1 day 7 hours ago - all defeated.....

1 day 7 hours ago - beyond crime.....

1 day 8 hours ago - the end....

1 day 8 hours ago - odessa....

1 day 9 hours ago - weitz....

1 day 11 hours ago

Democracy Links

Member's Off-site Blogs

the chinese again...

Australia's currency has risen sharply in recent days.

Key points:

- The Australian dollar passed through 68 US cents today, up 24 per cent from its mid-March low

- The Reserve Bank kept interest rates on hold at a record low 0.25 per cent but they are higher than US, British, EU and Japanese rates

- Australia has posted another current account surplus, based on a large trade surplus as iron ore export prices boom above $US100/tonne

From its lowest level in nearly two decades of 55.1 US cents in mid-March, this morning it was worth 68.13.

That means in less than 10 weeks it has jumped 24 per cent in value against the US dollar — even while the world's economies endure the sharpest global downturn since the Great Depression, Australia's included.

Why?

You may be assuming it's because of the dire political-economic situation in the United States at the moment pushing the greenback lower.

But currency analysts say it has far more to do with the fact that China's economy has been waking from its COVID-19 coma, so its insatiable hunger for Australia's mineral resources (particularly iron ore) has returned.

Read more:

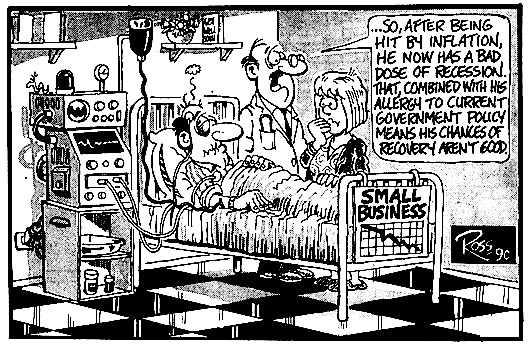

Cartoon at top by Ross, 1990...

- By Gus Leonisky at 2 Jun 2020 - 7:30pm

- Gus Leonisky's blog

- Login or register to post comments

nurses pay freeze to go to arbitration...

Paramedics, nurses and midwives have launched industrial action against the NSW government’s planned 12-month wage freeze.

From Monday night, NSW paramedics were refusing to bill patients, while nurses and midwives started rolling demonstrations outside the state parliament from Tuesday.

Both actions are in protest at the proposed 12-month public pay freeze for the state’s 400,000 public servants, announced by Premier Gladys Berejiklian last week.

The state government wants the freeze to save $3 billion because of the economic damage wrought by COVID-19 restrictions. It says the money will be reinvested in public projects.

Amid a growing outcry at the move, the state government has since offered public servants a one-off $1000 stimulus payment, at a cost of about $200 million. Treasurer Dominic Perrottet said that would leave the government with $2.8 billion to reinvest.

If the offer is rejected and the NSW upper house rejects the government’s proposal – as seems likely – the argument about the pay freeze will go to the industrial relations commission.

Read more:

https://thenewdaily.com.au/finance/work/2020/06/02/paramedics-nsw-pay-fr...

Meanwhile, many small businesses have been replaced by home deliveries under Covid19 situation... Shops are empty...

is worse yet to come?...

GDP figures from the Bureau of Statistics show Australia's economy shrank 0.3 per cent in the March quarter, amid bushfires and the early stages of the coronavirus pandemic.

Key points:

This makes it certain that Australia will suffer its first recession in 29 years, as the full impact of coronavirus-related shutdowns occurred during the current June quarter.

Economists widely define a recession as two consecutive quarters of GDP contraction, which are now certain to occur.

The last time Australia recorded two consecutive negative quarters for GDP was March and June 1991, dubbed by then treasurer Paul Keating as "the recession we had to have".

Even before the full effect of the coronavirus hit, Australia's economy recorded its slowest annual growth in more than a decade, according to the ABS.

"This was the slowest through-the-year growth since September 2009, when Australia was in the midst of the global financial crisis, and captures just the beginning of the expected economic effects of COVID-19," the bureau's chief economist, Bruce Hockman, said.

Read more:

https://www.abc.net.au/news/2020-06-03/australian-economy-gdp-recession-march-quarter-2020/12315140

The latest GDP figures released on Wednesday by the Australian Bureau of Statistics revealed that in the first three months of this year, Australia’s economy shrank for the first time in nine years and removed any lingering doubt that we are in a recession.

The headline news is that Australia’s GDP fell 0.3% in the March quarter – the first fall since March 2011 when Cyclone Yasi and the Queensland floods knocked the economy back a peg.

Because the Treasury and every economist expects the June quarter to be worse, this means Australia will inevitably suffer a misnamed “technical” recession of two consecutive quarters of negative growth.

The reality is, as the treasurer Josh Frydenberg confirmed on Wednesday, we already are in a recession. When the underutilisation rate rises 6.8 percentage points in one month, anyone who thinks we need to look further to work out whether or not we are in a recession must ask themselves what they think a recession actually is.

The figures also revealed GDP per capita fell in the past year – the first time that has happened since the GFC...

....

As bad as that is, we should not forget that things were not good even before the virus. It has now been more than eight years since our spending growth has been above the long-term average. And even before the start of this year it was dropping.

Our panic-buying kept the figures from being even worse than they might have been. Household spending on food grew 5.7% in the March quarter – the biggest ever quarterly growth recorded by some distance...

Read more:

https://www.theguardian.com/business/grogonomics/2020/jun/03/yes-austral...

trying to keep china out?...

In the biggest foreign investment reforms since 1975, foreign investors will face tougher scrutiny before taking a stake in Australian companies and resources.

Treasurer Josh Frydenberg unveiled a proposal to turn Australia’s Foreign Investment Review Board (FIRB) from toothless tiger to apex predator.

The proposal comes at a time of heightened tension between Canberra and Beijing, prompting speculation the new powers are intended to curb China’s influence in Australia’s economy.

But the fears surrounding Chinese investment may be overblown.

James Laurenceson, director of the UTS China-Australia Relations Institute, told The New Daily public attitudes towards foreign investment of any sort have long been sceptical.

“First it was American investment in the 1960s and ‘70s – there was huge pushback against that, then it was Japanese investment in the 1980s,” he said.

“But obviously with China there are additional complications; China is a very different country to us in terms of politics and values in a way that the United States never was.”

Even so, data from the Department of Foreign Affairs and Trade shows China is only a small contributor to Australia’s total foreign investment pool.

Read more:

https://thenewdaily.com.au/finance/finance-news/2020/06/05/china-foreign...

Read from top.

Things to consider are "strategic buys" and "return on investments". China is more likely to invest in infrastructures (ports), farms and mining, while others like the USA might invest in "insurance", "banking" and other fleeting fiddled-footed activities... It's up to us to see how much we benefit from investments... including tax, employment, "free" trade, etc... versus the debt... etc

competitive confrontation...

The hawks that speak loudest about the importance of great power competition don’t have the first clue what the U.S. needs to do to remain competitive against other major powers. This has become impossible to miss in the growing push for pursuing a confrontational China policy.

“Great power competition” has become the slogan that hawks now use to justify never-ending increases to the military budget without paying any attention to the importance of developing the social, intellectual, and economic resources at home that the U.S. would need to stay competitive. That development would require substantial increases in spending on infrastructure, education, and research, but when it comes to those things the China hawks are typically nowhere to be found. The sectors that the U.S. has shortchanged for decades desperately need major investments simply to bring them up to date, but there is no evidence that the new Cold Warriors desire to do any of this. The path that many of these China hawks would have us take is instead one of overextension, exhaustion, and bankruptcy.

Perhaps the loudest of all these hawks has been Arkansas Sen. Tom Cotton. He has typically been the first to advocate punishing China in response to the pandemic, and he has a record of backing the most inflammatory and provocative measures against whichever country is unfortunate enough to be caught in his crosshairs. Last week, Tom Cotton introduced a bill that would bar the granting of visas to Chinese students working in STEM fields. This legislation, the so-called SECURE CAMPUS Act, would have the effect of devastating American research universities by depriving them of a huge number of their prospective students and the tuition payments that come with them.

While Cotton claims to be doing this to safeguard U.S. research from being exploited by the Chinese government, the end result would be to kneecap our own institutions through short-sighted government interference. An effective ban on Chinese nationals studying at U.S. universities in STEM fields would also redound to the Chinese government’s benefit in another way. Instead of drawing talented Chinese science and engineering students to the U.S. where many of them would end up relocating and working, Cotton’s bill would guarantee that they never come to study here. Like so many other hard-line stunts that Cotton has pulled over the last decade, this legislation is clumsy and self-defeating. Even if it never becomes law, this bill represents the sort of blinkered thinking that prevails among so many proponents of a Cold War-like rivalry with Beijing.

We have seen another example of this dead-end hawkishness on the issue of arms control. The Trump administration keeps pretending to want China to join arms control talks. China has no interest in doing this, and the huge disparity between their nuclear arsenal and ours makes it a strange exercise at the best of times. Of course, the administration isn’t really interested in bringing more states into the arms control architecture, but prefers instead to dismantle that architecture and engage in arms races with both Russia and China. The president’s special envoy for arms control, Marshall Billingslea, recently declared that the U.S. would spend both governments into “oblivion.” This makes no sense given the much smaller size of China’s arsenal, and it would represent a huge waste of resources on nuclear weapons in any case. This is a case of wanting to throw huge sums down the drain on weapons that the U.S. doesn’t need. The administration seems determined to focus myopically on hard power as the only measure of great power strength, and meanwhile it is happy to let every other kind of power diminish and disappear.

China hawks are currently ascendant because they can tap into public anger over the pandemic and the Chinese government’s serious abuses, but as ever the remedies they propose are the foreign policy equivalent of snake oil. We see this with Cotton’s anti-China raving and Billingslea’s arms race rhetoric, and we can expect much more of it in the years to come. Like any demagogue, Cotton can both stoke fear and exploit frustration, but he cannot offer a solution that won’t make things worse.

Read more:

https://www.theamericanconservative.com/articles/great-power-competition...

Read from top.

How cooperation sounds? .... That would not suit the American superiority complex....