Search

Recent comments

- china

2 hours 24 min ago - google bias...

19 hours 7 min ago - other games....

19 hours 10 min ago - נקמה (revenge)....

20 hours 10 min ago - "the west won!"....

22 hours 14 min ago - wagenknecht......

22 hours 55 min ago - the game of war....

1 day 1 hour ago - three packages....

1 day 2 hours ago - russian oil.....

1 day 2 hours ago - crime against peace....

1 day 10 hours ago

Democracy Links

Member's Off-site Blogs

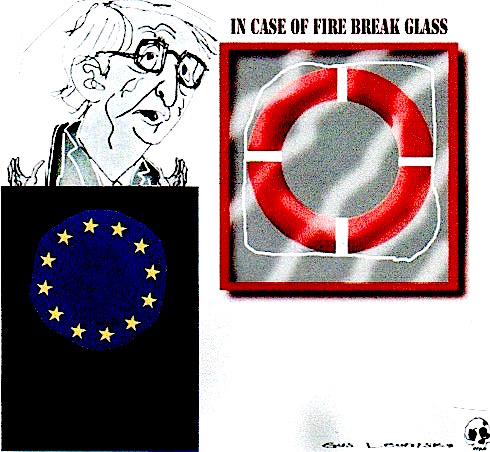

defending the eurozone and the euro against turbulence

Eight years ago, just five people worked for the company's predecessor, which was located a few streets away. Today, though, it has 180 employees on the payroll and they deal with hundreds of billions of euros. They hail from 43 countries and speak two dozen languages.

In contrast to other business models of other startups, though, this place is not focused on identifying and attacking new markets. On the contrary, their mandate is defense. They are tasked with defending the eurozone and the euro against turbulence. And soon, even more people are set to join the staff. After all, this startup is adding to its portfolio of expertise.

The startup operates under the acronym ESM, which stands for European Stability Mechanism: But it is more commonly referred to as the euro rescue fund.

The finance ministers of the 19 eurozone member states, who make up the ESM's board of governors, have been discussing for months how the organization should be further developed. They have big plans.

The board of governors would like to see the ESM become a European version of the International Monetary Fund (IMF). To achieve this, the ESM would have to be given new powers to better monitor euro countries' fiscal policies. The organization would also be expected to play a bigger role in bank bailouts -- not exactly an unimportant responsibility should a new financial crisis arise. And last but not least, the ESM would be empowered to better assist governments that find themselves in a tight spot. The board of governors hopes such reforms would bolster the rescue fund such that it could even handle a situation such as that developing in Italy, where the government is pursuing a heedless fiscal policy that has for the first time pushed a large European country to the brink of bankruptcy.

Strict Conditions

The fact that the ESM has come to play such a central role in European fiscal policy has to do with its own success. The organization and its predecessor, the European Financial Stability Facility (EFSF), have helped five eurozone member states grapple with the consequences of the financial crisis. Tens of billions of euros were loaned to Greece, Ireland, Portugal, Cyprus and Spain -- either because investors no longer wanted to provide these countries with follow-up loans, or because they simply lacked the money to save their own banks.

Read more:

http://www.spiegel.de/international/europe/eurozone-esm-bailout-fund-on-...

- By Gus Leonisky at 14 Oct 2018 - 10:13am

- Gus Leonisky's blog

- Login or register to post comments

it's only money...

Beijing is the largest holder of US debt. As of July, China had $1.17 trillion invested in debt minted by the US Treasury.

China has made the sale at a time when yuan has depreciated 10 percent against the dollar amid an escalating trade war with the US. “For any other normal corporate borrower the decision might have been to stand on the sidelines and wait for the market to stabilize a bit, but China is a little bit of a different animal,” a banker who worked on the deal told Reuters.

“I don’t think people had concerns about China specifically, but it’s just a broader macro noise,” the person said.

In the recent tat-for-tat trade punches, China stopped buying oil from the US. China’s crude oil imports from America reached an average of 334,880 barrels per day through August, making Beijing the second-largest buyer of US oil after Canada.

So far, Washington has imposed tariffs on $200 billion of Chinese goods and Beijing retaliated with tariffs on $60 billion of US imports.

Read more:

https://www.rt.com/business/441146-us-treasury-bonds-china-sale/

China also stopped buying SOY BEANS from the USA. This has placed the US soy bean growers in a pickle... See PBS NewsHour...

Russian companies are eager to increase exports of soybeans and other agricultural products to China amid the China-US trade war. However, Russia's soybean exports are unlikely to replace those from the US, at least in the short term.

It is time for China and Russia to increase cooperation in agricultural investment and trade, Maxim Basov, CEO of Russia major agricultural company Rusagro Group, told the Global Times in a recent interview.

"The focus now is shifting from the domestic market to the international market," Basov said, noting that the ongoing trade war between China and the US opens opportunities for Russia to sell more agricultural products to China and become a new partner.

For now, only 1 percent of China's food imports come from Russia, which is still very low, Basov noted.

Business representatives and Russian federal government officials expressed high interest in expanding food trade with China during the fourth Eastern Economic Forum (EEF), which ran from Tuesday to Thursday in Vladivostok, a city in the Russian Far East. Some of those participants said they expect more investment from China in Russia's agricultural sector.

"We're now ready to invest in more agricultural projects… China will be an important investor in those projects," Nikolay Kharitonov, a member of the State Duma, the lower house of Russian parliament, who is also in charge of Far East affairs, told the Global Times during the EEF.

Greater acreage and improved yields will see Russia produce 3.7 million tons of soybeans in the 2018-19 marketing year, up 8.2 percent from the previous year, according to a post on industry website agricensus in April. Russian soybean exports are forecast to reach 625,000 tons for the 2017-18 period, reflecting a good pace of shipments to China, the post said.

Many Chinese companies have also shown an interest in investing more in the agriculture sector in Russia, with soybeans becoming a major focus.

Read more:

http://www.globaltimes.cn/content/1119561.shtml

it's only money (2)...

https://off-guardian.org/2018/10/14/watch-the-spiders-web-britains-second-empire/

Read from top.

planning the euro without the poms...

The agreement between the EU's 27 finance ministers, without the UK, is planned to give authorities a more effective toolbox in the event of a major shock to the European economy.

'What is worth waiting for. After almost 16 hours of negotiations in the Eurogroup, we have a result — a good one. The Euro reform is taking decisive steps forward. Thanks to everyone who helped', the German Finance Minister Olaf Scholz wrote on his Twitter account.

The Eurogroup welcomed that all 19 member states had submitted Draft Budgetary Plans (DBPs) for 2019, the joint statement said.

Read more:

https://sputniknews.com/europe/201812041070368255-eurozone-reform-agreem...

The body is merely moribund and they're dancing on the grave.

Read from top.

on his way out...

United Airlines Flight 951 is ready for departure and Jean-Claude Juncker is one of the last to board the plane, greeting the journalists accompanying him on his trip to Washington. "Everything's OK. It's just my damned knee," he says, before disappearing into the front of the Boeing 777. The European Commission president is wearing a blue shirt and jeans with a braided belt, and limping slightly. During the flight, three blue file folders lie on the armrest of his seat. When Juncker returns from the lavatory during the flight, he blows kisses to the reporters.

A few days earlier, Juncker had stumbled across the blue carpet at the NATO summit, with Dutch Prime Minister Mark Rutte and others having to grab him under the arms and drag him to the gala dinner. Right-wing politicians mocked the allegedly drunk commission head while in Germany, parliamentarians from the right-wing populist Alternative for Germany (AfD) immediately posted the video on social media. His spokesman said that Juncker had suffered a "painful attack of sciatica." He rejected any aspersions that alcohol might have been involved.

Now 64, Jean-Claude Juncker hails from an era when people tended to look the other way when politicians were ill, complained of pain or had a little too much to drink. For a long time, only insiders knew how severe U.S. President John F. Kennedy's back pain truly was. Former German Chancellor Willy Brandt's drinking habits, on the other hand, were a topic of conversation in the West German capital of Bonn during the 1970s, though his fondness for a tipple never seemed to bother the public.

These days, though, politicians are expected to be completely transparent, their authority coming in part from looking fit and fresh on television. German Interior Minister Horst Seehofer is known to get quite indignant when journalists ask him about his occasional shortness of breath.

A Favorite Target of the Far Right

Even though Juncker's term in office is coming to an end, it's unlikely that the populists are going to spare their favorite enemy in the run-up to late-May European Parliament elections. Opponents of the EU vilify the head of the commission as a symbol of a moribund and ailing political bloc. As such, whatever might be ailing Jean-Claude Juncker is no longer a private matter -- it's a political one.

The right wing, for example, mocks Juncker for having allegedly turned Europe a "laughing stock," as if they actually care about the EU's welfare. At the end of last year, when the dispute with Brussels over the draft Italian budget was simmering, Matteo Salvini, the head of the right-wing populist Lega party, said: "I only talk to sober people."

Just about every Brussels journalist seems to have an anecdote to share among colleagues about Juncker drinking too much or allegedly smelling of alcohol. But doubts as to whether the commission president is up to the task of fulfilling his duties are hardly ever brought up in public.

Ultimately, a story about Juncker is thus is also one about the way journalism is practiced in the European capital. In Brussels, friends of the European cause tend to stick together -- not only when it comes to beating back attacks from the right, from populists and nationalists like Marine Le Pen in France or Heinz-Christian Strache in Vienna -- but also when justified criticism is leveled at leaders in Brussels.

Read more:

http://www.spiegel.de/international/europe/the-final-days-of-eu-commissi...

Read from top...