Search

Recent comments

- was Pepe sold a pup?....

1 min 48 sec ago - a peace deal....

19 hours 49 min ago - peace now!

21 hours 14 min ago - a nasty romance....

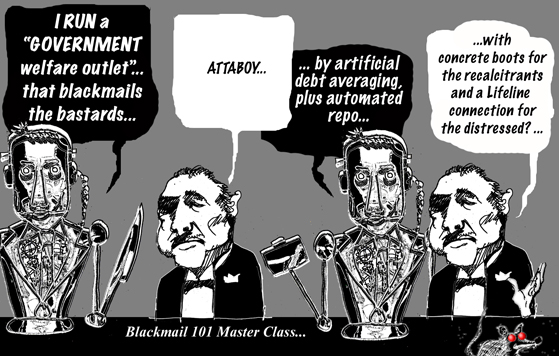

21 hours 20 min ago - blackmail?.....

23 hours 51 min ago - ukraine's agony has not started yet....

1 day 17 hours ago - all defeated.....

1 day 17 hours ago - beyond crime.....

1 day 18 hours ago - the end....

1 day 18 hours ago - odessa....

1 day 19 hours ago

Democracy Links

Member's Off-site Blogs

10 minutes to hell... or concrete boots — the robot decides....

Centrelink management has ordered frontline staff working in branches not to process disputes over the Federal Government's controversial debt claw-back scheme and instead refer welfare recipients to an online portal.

Key points:- Memo orders branch staff not to process debt disputes in person

- Also says staff must "not cancel the activity under any circumstances"

- Employee says customers "anxious, fearful, confused and frustrated"

An internal Centrelink memo obtained by 7.30 said staff "should refer customers online to undertake the intervention" and "must not process activities in relation to the Online Compliance Intervention".

The instructions, available on Centrelink's internal communications system, also told staff in bold text: "Do not cancel the activity under any circumstances."

The memo appears to contradict Human Services Minister Alan Tudge's claim yesterday that people having problems with online and telephone services could go into a Centrelink office and see someone "in 10 minutes".

When pushed on claims that recipients had been turned away at Centrelink offices, Mr Tudge said: "We do have self-terminals in the Centrelink office and there are people there who can help people be able to get online with that process."

read more:

http://www.abc.net.au/news/2017-01-12/centrelink-memo-shows-staff-ordere...

- By Gus Leonisky at 12 Jan 2017 - 4:56pm

- Gus Leonisky's blog

- Login or register to post comments

robots have a better chance to find employment...

However, for every job created by robotic automation, several more will be eliminated entirely. At scale, this disruption will have a devastating impact on our workforce.

Few people understand this tension better than Dr Jing Bing Zhang, one of the world’s leading experts on the commercial applications of robotics technology. As research director for global marketing intelligence firm IDC, Zhang studies how commercial robotics is likely to shape tomorrow’s workforce.

IDC’s FutureScape: Worldwide Robotics 2017 Predictions report, authored by Zhang and his team, reveals the extent of the coming shift that will jeopardize the livelihoods of millions of people.

By 2018, the reports says, almost one-third of robotic deployments will be smarter, more efficient robots capable of collaborating with other robots and working safely alongside humans. By 2019, 30% or more of the world’s leading companies will employ a chief robotics officer, and several governments around the world will have drafted or implemented specific legislation surrounding robots and safety, security and privacy. By 2020, average salaries in the robotics sector will increase by at least 60% – yet more than one-third of the available jobs in robotics will remain vacant due to shortages of skilled workers.

read more:

https://www.theguardian.com/technology/2017/jan/11/robots-jobs-employees...

wrong target...

A leading fetal alcohol syndrome researcher and Queensland Australian of the Year finalist has been caught up in the Centrelink debt recovery scandal, after the system wrongly deemed she owed $7,600.

Medical ethnographer Janet Hammill, 76, has spent decades researching the foetal origins of health and disease, and remains with the University of Queensland, where she works voluntarily and lives off the age pension.

read more:

https://www.theguardian.com/australia-news/2017/jan/16/centrelink-robo-d...

the robot has a sick human heart...

Senator Nick Xenophon will renew a push to decriminalise leaks from the public service after the Centrelink debt recovery scandal.

This week the Department of Human Services sent a memo to its staff, reminding them that the improper leaking of information could result in disciplinary action or constitute a criminal offence.

That memo, which was itself quickly leaked, came after a series of damaging disclosures about the government’s debt recovery system.

Several Centrelink sources have spoken out about problems with the system, which they say are causing low-income and vulnerable Australians to be wrongly issued with debts.

Xenophon said those who had blown the whistle on Centrelink were clearly doing so in the public interest and should not face prosecution.

He has committed to introducing amendments to the Crimes Act to remove provisions that make it an offence for public servants to leak information externally. The offence carries a maximum penalty of two years in prison.

Xenophon told Guardian Australia he would draft amendments and introduce them as soon as possible. “I think it just highlights the need to amend section 70 and 79 of the Crimes Act, which makes it a crime for a public servant to leak information, or for a journalist or third party to receive it,” he said.

“Sections 70 and 79 of the Crimes Act are currently about protecting government from embarrassment, rather than from the public being informed of maladministration or malfeasance in government.”

Xenophon previously pledged to make similar amendments in August, after Australian federal police raids on senator Stephen Conroy’s office over leaks on delays and cost overruns with the national broadband network. He said his office had not been able to draft the amendments before the year’s end.

read more:

https://www.theguardian.com/australia-news/2017/jan/19/nick-xenophon-pus...

See from top

centrelink shitstorm...

We kick off 2017 with the first video of the year – and it’s an Honest Government Ad about the Strayan’s Government latest fail whale.

The Australian Government just released this ad about it’s Centrelink (social security) shitstorm, and it’s surprisingly honest and informative. #NotMyDebt

read more: https://thejuicemedia.com/centrelink-fail-honest-government-advert/

outrageous lack of tracking...

Centrelink is unable to track how many cases of overpayment are caused by government error, according to responses it provided to a senate committee.

The Department of Human Services provided a series of responses to questions posed by the Greens senator Rachel Siewert on welfare overpayments.

Siewert asked how many of the 629,917 customers overpaid last financial year were caused through system or administrative error by Centrelink. DHS responded: “The department does not currently capture the portion of overpayments raised as a result of system or administrative error.”

Siewert described that lack of information as outrageous, saying the department appeared not to be keeping track of its own mistakes. “The government must immediately work to establish how many people accessing the social safety net received an overpayment because of an administrative error,” she said.

“For the government to not collate that information is deeply concerning. It means there is no attempt to collect data and analyse how many vulnerable people are stuck with debts they were not responsible for creating.”

Centrelink has always required those who have been overpaid to pay the money back, including when the overpayment was not their fault. That is a separate issue to complaints about the new debt recovery system, which has been criticised for allegedly wrongly pursuing welfare debts from vulnerable Australians.

read more:

https://www.theguardian.com/australia-news/2017/jan/31/centrelink-unable...

dismally wrong at the expense of struggling Australians...

Labor and the Greens have proposed a wide-ranging Senate inquiry into the Centrelink debt scandal, which would examine how the system went “so dismally wrong at the expense of struggling Australians”.

The Labor senator Doug Cameron and the Greens senator Rachel Siewert gave notice of their proposed inquiry to the Senate on Tuesday afternoon and it is likely to pass a vote on Wednesday, with One Nation and the Nick Xenophon Team previously expressing support.

The proposed terms of reference give the inquiry until May to report on a range of issues, including the impact of the system on vulnerable Australians, the scale of errors being made, the capacity of Centrelink’s phone, online and physical officesto deal with surges of demand, and the adequacy of complaint and review processes.

read more:

https://www.theguardian.com/australia-news/2017/feb/07/centrelink-scanda...

george was bullshitting like a lawyer...

The continuing Centrelink automated debt notice scandal and the future of the national disability insurance scheme (NDIS) were front and centre of the debate during a Q&A that put a human face on issues of disability and welfare.

Audience member Fred Thorpe, whose daughter was the 2014 New South Wales young carer of the year, told the panel, which included the attorney general George Brandis, of her “absolute fear” she would lose her disability pension.

“Can George Brandis explain why politicians’ expenses are extravagant and go unchecked while I am having my disability support pension reviewed, despite a 28-year exemplary career as a school teacher?” asked Thorpe, who receives $22,000 a year and is incapable of working due to ill health.

read more:

https://www.theguardian.com/australia-news/2017/feb/21/qanda-george-bran...

UNLESS:

Rambling and long-winded anecdotes could be an early sign of Alzheimer’s disease, according to research that suggests subtle changes in speech style occur years before the more serious mental decline takes hold.

The scientists behind the work said it may be possible to detect these changes and predict if someone is at risk more than a decade before meeting the threshold for an Alzheimer’s diagnosis.

read more:

https://www.theguardian.com/society/2017/feb/21/long-winded-speech-could...

vile amateur-hour should lead to an unemployed minister...

An agency responsible for Centrelink's controversial debt recovery program did not share any documents about it with another key department for nearly a year — even as the program came under immense scrutiny for its failings.

The minister responsible for the scheme during the height of the criticism was also seemingly uninformed, a freedom of information investigation has revealed.

Social Services Minister Christian Porter did not receive any written briefings, documents or analysis about the program from Centrelink or his department before publicly proclaiming it was working "incredibly well", documents show.

The department issued 170,000 compliance notices between July and December last year, but close to 20 per cent of the recipients did not owe any money.

In a statement, Mr Porter's office said he received "direct verbal briefings" about the program.

"Where he had recourse for supporting documents, those went to the Minister indirectly through the Human Services Minister's Office or through Minister Porter's advisers," the statement said.

read more:

http://www.abc.net.au/news/2017-04-06/documents-show-centrelink-debt-rec...

This is amateur hour. The minister should be sacked.

the robot fucks up...

The Turnbull government’s robo-debt program involves enforcement of “illegal” debts that in some cases are inflated or nonexistent, a former member of the Administrative Appeals Tribunal has said.

The scathing indictment of the program is contained in an academic paper by Prof Terry Carney that also accuses Centrelink of failing to defend the legality of debts in the AAT and suggests the tribunal should set aside debts until the agency has proved the amounts are correct.

The criticism has been echoed by the National Social Security Rights Network and the Welfare Rights Centre, which warned cases of false debts were being routinely challenged and reduced or completely wiped in the tribunal.

Read more:

https://www.theguardian.com/australia-news/2018/apr/04/centrelink-robo-d...

Read from top.

shabbily conceived...

The Department of Human Services has dropped a debt it raised against a Melbourne woman, who is challenging the Coalition’s robodebt program in the federal court.

In February, Victoria Legal Aid and Madeleine Masterton filed a challenge against the “cryptic” process by which Centrelink’s automated debt recovery scheme calculates alleged welfare overpayments.

But the test case faces a new hurdle following a decision by the department to drop its claim on the $4,000 it told Masterton she owed the government in July last year. The move allows the commonwealth to argue it has no case to answer.

It is now unclear whether the court will go on to examine the legality of a program under which the government has demanded about $1.5bn in overpayments from former and current welfare recipients, and which Labor has described as “shabbily conceived”.

Read more:

https://www.theguardian.com/australia-news/2019/may/05/centrelink-drops-...

Read from top.

verging on extortion...

A class action will be launched against the government over the so-called robo-debt scandal, arguing the government’s automated debt system is unlawful.

Opposition government services spokesman Bill Shorten announced the action, which will be brought by Gordon Legal, and comes after sustained pressure on the government over the system.

Peter Gordon, a senior partner at the law firm, said the collection of money based solely on a computer algorithm was unlawful.

“The Commonwealth has used a single, inadequate piece of data, the robo-debt algorithm, and used it to seize money and penalise hundreds of thousands of people,” he said

“We’ll allege that to simply collect money from hundreds of thousands of people by the simplistic application of an imperfect computer algorithm is wrong.

“We think that before the government docked the pensions or took the tax refunds of widows and carers and aged pensioners it needed to have better evidence, it needed to consider each case individually.”

Mr Gordon said he expected up to 160,000 people could fall under the class action, and the action would seek both repayment of falsely claimed debts and compensation for affected people.

He said the system had unlawfully taken tens of millions of dollars from Australians, and he was “comfortably satisfied” the suit met the requirements of a class action.

“Not every case needs to be exactly the same. They only have to be roughly similar,” he said.

Mr Shorten said he believed the robo-debt billing practices were “verging on extortion”.

Read more:

https://thenewdaily.com.au/news/national/2019/09/17/class-action-robo-debt/

read from top..

has robodebt been "deaded"?...

...

This week, the Federal Government effectively dumped the policy as the spectre of a class action loomed, amid rumours of internal legal advice that the whole thing was rather illegal, and signs that the whole project — dreamt up by one of those genius consulting firms so loved by the Coalition — wasn't actually raising anywhere near what it was supposed to.

The distress that people have experienced as a result of getting threatening letters about "debts" that it turned out they didn't actually have has been well documented.

The suggestion is that there may be as many as 700,000 cases now open to review.

Read more:

https://www.abc.net.au/news/2019-11-23/robodebt-scheme-political-disaste...

Read from top.

no apologies for making your life like hell...

Stuart Robert on robodebt: 'This government does not apologise' – politics live

Aged-care package ‘falls well short’ of what is required, Labor says;

Morrison responds to Chinese spy plot allegations;

and Jacqui Lambie ‘not supporting a repeal’ of medevac, Rex Patrick says. All the day’s events, live

https://www.theguardian.com/australia-news/live/2019/nov/25/australia-ch...

Read from top.

the robot was working for the mafia...

Explosive new emails have revealed the Morrison government was warned its so-called robo-debt scheme was illegal and the ‘debts’ were not lawful.

Confidential emails between tax office officials, provided to a Senate committee on Thursday, reveal that the Department of Social Service had legal advice that thousands of debts raised were “not lawful debts”.

But it’s not yet clear how long ago that legal advice was received.

The November 19, 2019, email, from the Australian Taxation Office’s general counsel, Jonathan Todd, to the ATO commissioner, Chris Jordan, was marked “Sensitive: Legal”.

“In further discussion with the DSS, it appears that what you need to raise is: they have advised you that they have received legal advice that debts based solely upon DSS own income averaging of ATO annual tax data are not lawful debts (‘robo-debts’),” the email stated.

“They have also suspended the raising and recovery of robo-debts as of today.”

Read more:

https://thenewdaily.com.au/finance/welfare/2020/02/06/emails-robo-debt-i...

Read from top.

the robot does not apologise...

The Federal Government is refusing to apologise to people caught up in its controversial Robodebt scheme, despite conceding hundreds of millions of dollars in debt were racked up unlawfully.

The Government on Friday announced it would refund $721 million worth of debts it clawed back through the scheme.

Robodebt was the name given to an averaging process which saw data from the Australian Tax Office (ATO) matched with income reported to Centrelink by welfare recipients.

The scheme saw hundreds of thousands of people issued with computer-generated debt notices, some of which made demands for payment from people who did not owe the Government any money.

“What we do acknowledge is that using average annualised ATO data, which many governments have done, Labor and Liberal, has as it transpired, been shown to be an insufficient basis for raising those debts,” Attorney-General Christian Porter told the ABC’s Insiders on Sunday morning.

Read more:

https://thenewdaily.com.au/finance/welfare/2020/05/31/apology-refused-fo...

Read from top.

the robodebt creators should be in prison...

At the beginning of Australia's winter last year, Kath Madgwick read the last message she'd receive from her only child.

"I love you mum," her son Jarrad, 22, had texted.

Her son had made her extremely proud, wrote Ms Madgwick in a letter later read out to a parliamentary inquiry. A former school captain, and state-ranked swimmer, Jarrad had been a respectful young man, kind and helpful to others.

But in the year before his death, he had fallen on hard times. There had been a relationship break-up and bullying at work. Newly unemployed and struggling with his mental health, he moved back in with his mum.

He applied to join the army around the same time he applied for unemployment benefit.

When his claim was rejected, he was devastated. On the day of his suicide, he rang up Australia's welfare office to ask why.

"Um hello. I'm like in a pretty desperate situation here," he told the Centrelink officer.

"I've waited a month and I've jumped through all the hoops and I'm just wondering why I haven't even had an explanation? We can't afford rent and I'm thinking about stealing food… like, we need this money," he said.

After that call, Ms Madgwick says, Jarrad checked his welfare account. That was when he learnt that he owed A$2,000 (£1,100; $1,500) to the government. The debt was an apparent overpayment of a previous student benefit he had received - and this had barred his new claim.

"From then on, he was just distressed and inconsolable. But he was still desperately trying for jobs right up until the moment he left the house," Ms Madgwick told the BBC.

Later, it would emerge that Jarrad was one of more than half a million Australians caught up in the nation's so-called "Robodebt" scandal, which ran from 2016 to 2019.

This welfare policy, later ruled to be illegal, forced some of the county's poorest to pay off debts, many of which never existed in the first place. The government sent letters, often repeatedly, to citizens demanding they refund the "overpayments".

For those that could afford it, they withdrew savings or started repayment plans to pay off what was often thousands of dollars. For others, the financial shock came at the worst point in their lives.

Jarrad's mother contends that his debt was one of those that were miscalculated, but he did not live long enough to find this out. He died on 30 May 2019, taking his life in what his mother says was an impulsive act.

Ms Madgwick holds the government partly responsible for Jarrad's suicide.

"He just got himself worked up in those two hours over this proposed debt thinking that he wasn't going to get any Centrelink. He was desperate," she said.

'Vilifying the poor'Robodebt, officially known as the Online Compliance Intervention scheme, was introduced in 2015 by the conservative government, with the aim of saving A$1.7bn.

At the time, Minister for Human Services Alan Tudge said people were cheating the welfare system. "We'll find you, we'll track you down, you will have to pay those debts and you may end up in prison," he said.

But critics said the system was "a kind of criminalisation of those on welfare", part of a wider attempt by Australia's conservative government, prior to the pandemic, to slash the welfare net. The government was also criticised for upping requirements making it harder to receive a payment, controlling how recipients spend their money, and for proposals such as mandatory drug-testing of jobseekers.

Robodebt was just another policy vilifying the poor and vulnerable, this time through the use of technology, said social policy professor Ruth Phillips from the University of Sydney.

She notes it was part of a global trend of governments using tech to tighten their welfare systems. In India, the poor have to scan their fingerprints for food stamps. In the US, some states use a similar computer which trawls through decades of data to reclaim payments.

"It's all about the idea that we're surveilling you, and making sure you don't get overpaid your due," she told the BBC. "It's a terrible contradiction to the purpose of the welfare state [in Australia], which is actually to ensure that people have sufficient resources to survive in what is really a very wealthy country."

'I knew I was innocent'Robodebt replaced a previous system where bureaucrats had hand-checked records before contacting recipients. In Australia's means-based welfare system, people who receive a benefit typically have to report their income every two weeks. Robodebt matched those submissions with tax office data to find discrepancies.

Within the first year of its use, it found 10 times more instances of "cheating".

However, the vast majority of these cases were people who had done nothing wrong. Rather, the algorithm had relied on flawed maths: averaging the fortnightly income of a recipient.

But this simply did not work for people whose pay slips differed from week to week, like students working irregular shifts.

It was these people who were now accused of owing debt - and the onus was on them to prove that they had done nothing wrong.

Read more:

https://www.bbc.com/news/world-australia-54970253

Whoever invented robodebt should be in prison or in an asylum for sadistic loonies.

Read from top.

the robot invented itself?...

Robodebt is the perfect example of a stale and out-of-touch government, and this week’s billion-dollar settlement of a huge class action raises more questions than answers.

But it is also a sterling reminder of what we have failed to learn through a bungled and illegal government move that has created havoc and heartache.

Just consider these steps that have unfolded over the past few years as the government has refused to admit wrongdoing, or shown genuine remorse.

Firstly, the decision to embark on the Robodebt program showed little thought and even less rigour.

There has certainly been no evidence that those issues that have risen, since the fiasco unfolded, were considered red flags in the lead up to it being launched.

We need a Royal Commission

— Bill Shorten November 16, 2020

Secondly, the automation of a program that deals with humans who might be vulnerable defies what we should expect from a government that is either caring or in touch with the lives of those it represents.

Thirdly, a chunk of victims received their Robodebt letter on the eve of Christmas 2016.

Offices were shut, and they spent the holiday period in a state of panic. In any world, is that an appropriate course of action? And how would a public service, with any real understanding of people’s circumstances, plan such an untimely intervention?

Fourth, thousands of wrong recipients were hit up for repayments. How is this possibly the case, and where is the accountable and transparent investigation to ensure this is never repeated?

Fifth, taxpayers haven’t been able to recover debts owed because of the optics around it. That would simply highlight the government’s incompetence.

Just consider the amount of money involved. The Commonwealth agreed this week to pay out $112 million to 430,000 former welfare recipients as part of the $1.2 billion class action case.

This is why the Morrison Government won't hold anyone to account for robodebt.

Because it all comes back to Scott Morrison.

— Anthony Albanese November 18, 2020

That $1.2 billion figure includes $721 million in debts the government announced it would pay back earlier this year. It also includes the agreement to drop $398 million in debts.

Each class action member will receive, on average, about $280 in compensation.

The reason the government has been able to brush this under the carpet is because the obvious victims are probably people it thinks don’t and won’t vote for it.

But we are all victims because we are paying the cost of the original overpayments, the failure to recover them, the cost of a badly run scheme and the cost of mopping up the mess.

No royal commission. No real apology. But more than anything else, it’s the government’s response to its own incompetence that is particularly breathtaking.

Who is responsible? No one, it appears.

Read more:

https://thenewdaily.com.au/news/national/2020/11/19/madonna-king-robodebt/

Honey Alan Tudge and honey Christian Porter should be sacked for creating hardship to the most vulnerable people in this country. If they had an ounce of self-respect and moral fibre, they would fire themselves... but we live in times of irresponsibility and of nasty governments...

Read from top...

a scammy non-report.....

PwC was commissioned to do a report on Robodebt in 2017 but but can’t recall if it was finalised, or not, or why. What’s the scam?

PwC is the scam. PwC was effectively paid *not* to deliver the Robodebt report; to never “finalise” it, to keep it in draft form so nobody ever had to be accountable.

This was the Big4 consultancy the government used to attack poor people with its big “welfare report” a year earlier now deployed in the cover it up. Highlights from the testimony of PwC partner Shane West at the Royal Commission this week:

“No … I can’t recall.” “I don’t know.” “I’m not sure”. “I don’t recall”. “I’m not sure I can say whether or not it is”. “Sorry, I can’t think of one” “This is getting beyond my area of knowledge”. The series of short videos on this Twitter feed is worth watching for sheer obfuscation.

READ MORE:

https://michaelwest.com.au/pwc-and-the-robodebt-royal-commission-whats-the-scam/

READ FROM TOP.....

FREE JULIAN ASSANGE NOW....