Search

Recent comments

- a peace deal....

14 hours 27 min ago - peace now!

15 hours 52 min ago - a nasty romance....

15 hours 58 min ago - blackmail?.....

18 hours 29 min ago - ukraine's agony has not started yet....

1 day 11 hours ago - all defeated.....

1 day 12 hours ago - beyond crime.....

1 day 13 hours ago - the end....

1 day 13 hours ago - odessa....

1 day 14 hours ago - weitz....

1 day 16 hours ago

Democracy Links

Member's Off-site Blogs

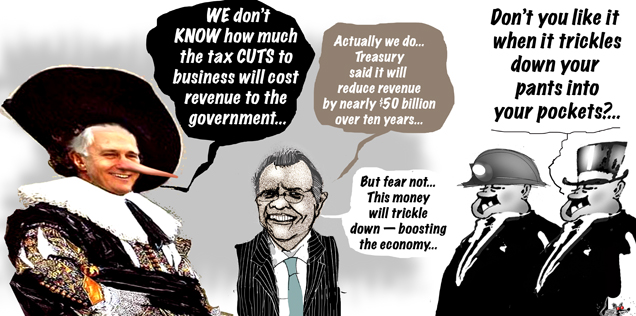

tricklely trickolo...

Mr Fraser said Treasurer Scott Morrison spoke to him personally at about 6pm on Thursday to instruct him to publish the full 10-year costings, following days of the government refusing to confirm the figure.

"You've finally been dragged kicking and screaming to fess up," Labor Senate leader Penny Wong said.

Mr Fraser said he had only been permitted to release the costing of two of the 11 prongs of the plan: reducing the company tax rate to 25 per cent, and increasing the threshold at which small businesses qualify for a lower tax rate.

On Thursday, Prime Minister Malcolm Turnbull refused to provide the figure during an awkward interview with Sky News, or during sustained questioning from Labor in Parliament.

Repeatedly asked by Sky News' David Speers to name the number, the Mr Turnbull at one point said Treasury "has not identified the dollar cost of that particular item".

One prong of the plan Mr Morrison did not permit Treasury to release was a move to increase the tax discount for unincorporated small businesses. The discount is currently 5 per cent and would increase to 16 per cent by 2026/27. Budget papers showed it would cost $450 million in the three years to 2019/20. Roger Brake, acting head of the Treasury's Revenue Group, confirmed Treasury had calculated that 10-year cost but had not been given the go-ahead to release it.

The $48.2 billion calculation does not include the 10-year cost of lifting the upper threshold of the 32.5 cent tax bracket to $87,000 from $80,000. That was estimated to cost $4 billion over the four-year forward estimates.

Senator Wong said it was clear the cost of the government's entire tax plan was "obviously going to be significantly more than the $48.2 billion".

The government argues the 10-year figure is immaterial because it is included in the Treasury's projection of the underlying cash balance, which shows the budget returning to surplus in 2020/21 and staying there.

Mr Morrison on Friday said it was not usual practice to put 10-year costings in the budget papers, but confirmed he had authorised Treasury to provide the information because it was "in the public interest"

Read more: http://www.smh.com.au/federal-politics/political-news/the-number-malcolm-turnbull-wouldnt-reveal-company-tax-cut-to-cost-48-billion-over-10-years-20160505-gonr8c.html#ixzz47qEQjlzq

Follow us: @smh on Twitter | sydneymorningherald on Facebook

- By Gus Leonisky at 6 May 2016 - 1:08pm

- Gus Leonisky's blog

- Login or register to post comments

like lying kids...

Treasury officials have revealed the Government's plan to cut the company tax rate to 25 per cent will cost $48.2 billion over 10 years.

The estimate from the Treasury Secretary comes after the Opposition pounced on the Coalition's refusal to outline the full cost of the proposal.

Treasury Secretary John Fraser told Senate Estimates it is not "standard practice" to release costings beyond four years, but said the 10-year company tax plan would cost tens of billions of dollars.

"The cost of these measures to 2026-27 is $48.2 billion in cash terms," Mr Fraser said.

"I note that as with all tax projections over ten years these costings have considerable uncertainty attached to them. I also note that the medium-term economic projections in the budget assume significant ongoing economic reforms."

Mr Fraser said the Treasurer Scott Morrison had authorised the release of the projection, but only after continued pressure from the Opposition.

read more: http://www.abc.net.au/news/2016-05-06/turnbulls-corporate-tax-cuts-under-scrutiny-by-treasury/7389426

ask kansas...

Trickle-Down Economics Has Ruined the Kansas Economy

And it threatens to launch a civil war within the state's Republican Party.—By Patrick Caldwell

| Wed May 4, 2016 6:00 AM EDT

Republicans have long sung the praises of trickle-down economics: Just cut taxes, and the economy will flourish as companies and individuals use the windfall to boost investment and create jobs. But a grand experiment in implementing those policies at the state level has revealed a far less rosy reality—and the consequences are threatening to spark a civil war among Republicans.

Kansas Gov. Sam Brownback, a Republican, launched an "experiment" in conservative policy after he was elected in 2010, drastically slashing the state's income taxes under the assumption that the move would kick-start Kansas' economy and rev up job creation. With help from Arthur Laffer, Ronald Reagan's mastermind of trickle-down economics, Brownback convinced lawmakers in the state to cut personal income tax rates across the board and eliminate the top tax bracket, with further reductions to come. Kansas also completely erased the income tax bills for the owners of certain "small" businesses, totaling 330,000 by this year and including a host of subsidiaries of Wichita-based Koch Industries. The Koch-funded organization Americans for Prosperity helped Brownback push the bill and has remained a staunch defender of the changes. The tax cuts were sold by Brownback with the idea that they would pay for themselves when a renewed economy boosted state revenues despite the lower rates.

Four years after those tax cuts first went into effect, the opposite has occurred. The promised explosion of private-sector growth hasn't come to pass, as the state's economy has generally lagged the rest of the nation. In March, the Kansas Department of Labor reported, the state had only 800 more private-sector jobs than a year prior. The loss of tax revenue has decimated the state budget, creating a fiscal crisis necessitating drastic cuts, since the state, unlike the federal government, can't run a deficit. As the Kansas City Star's editorial board recently highlighted, so far this fiscal year, Kansas is $420 million short of the revenue it had the year Brownback's tax cuts first went into effect.

read more: http://www.motherjones.com/politics/2016/05/sam-brownback-kansas-tax-cuts-trickle-down

see toon and read from top...