Search

Democracy Links

Member's Off-site Blogs

shooting messengers .....

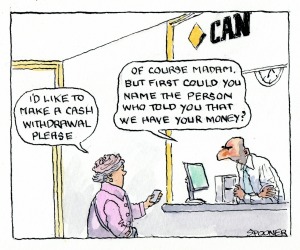

A consumer advocate who was spied on by the Commonwealth Bank now faces a legal action that should send shivers down the spines of whistle-blowers around the country.

The bank is funding a defamation action filed against the advocate, Michael Fraser, by a senior executive at the bank.

The legal action is understood to have used the discovery process to seek the names of CBA whistle-blowers and any relevant communications and correspondence with certain journalists, including myself. It is also believed to want access to all of Fraser's hard drives.

It has been touted by Fraser's lawyer, Stewart Levitt at Levitt Robinson, as a David versus Goliath case. A case where David has no money and Goliath is seeking retribution and deterrence.

"In this case David doesn't have two bob from what I can tell. He has never been able to commercialise what he is doing because he does a lot of things for nothing."

Levitt says there is no indication of the extent of the damages being sought. Indeed, in a second listing in the NSW Supreme Court justice Lucy McCallum last Friday directed that the parties mediate their dispute and didn't fix a date a date for hearing.

The bank executive Brendan French, general manager of customer relations, filed the legal action against consumer advocate Michael Fraser, alleging he defamed him.

French's amended statement of claim says some internet postings on Fraser's website defamed him, alleging he engaged in bullying and unethical practices in his role at the bank. French also alleges he was the subject of a vendetta as evidenced by a combination of telephone calls, voice messages, text messages and emails totalling more than 200 over a period of months.

The bank is funding the defamation but says it is not party to the proceedings and would not be provided with access to any materials discovered during the proceedings. "Our employees are entitled to use the court processes and the law of defamation to protect their reputation. As Mr French's legal action arises out of incidents that occurred while carrying out his role, CBA is funding Mr French's proceedings," a CBA spokesperson said. Fraser is defending the action.

Fraser splashed the front pages of The Sydney Morning Herald and The Age in October 2013 when CBA got caught red handed in a spying scandal, with senior politicians spied on and photographed by private detectives at a political fund raiser for Nationals senator John Williams, who had spearheaded a senate inquiry into the bank's financial planning scandal.

CBA hired global security firm G4S to conduct "Operation Lantern" on Fraser between August 28, 2013 and September 1, 2013.

The story came to light after a leaked internal bank memo to G4S revealed the bank requested the spying agency take photos of people Fraser met to "allow for the identification of individuals". The memo also revealed that the bank wanted to confirm if Fraser was receiving information from bank insiders, something that raised eyebrows at the time about the real motivation of the bank. "There is some suspicion Fraser is being fed information from another employee of the bank but 'we have not been able to confirm this'."

The bank defended its decision to spy on Fraser on the basis he was a "person who has conducted a systematic campaign of harassment, intimidation and threats to one of our employees over many months". That employee was French.

Fraser, who refers to himself as "the Arbitrator", said in the past couple of years he has represented dozens of aggrieved CBA customers, some of who allege loan fraud.

The case prompted Jeff Morris, who blew the whistle on CBA's financial planning scandal, to speak up about his experience as a whistle-blower at CBA.

"Throughout the financial planning scandal, CBA's focus was on hunting down and punishing the whistle-blowers, in contrast to rogue planners and the crooked managers who covered up for them, who in many cases were rewarded," he said.

"CBA trawled through whistle-blowers emails and subjected them to interrogation by CBA Group Security."

For Morris his experience of the "safe to speak up culture" claim by CBA for whistle-blowers is simply untrue.

Morris exposed the scandal in the bank which triggered a senate inquiry and subsequent apology from the CBA CEO Ian Narev to victims of rogue planners.

The topic of whistle-blowers and protecting their identity has been an issue of much discussion in Australia, particularly compared with how they are treated in the United States and some other countries, where they are lauded for the light they shine on wrongdoing and compensated for the damage to their career. In the US whistle-blowers receive a reward of up to 30 per cent through penalties and legal settlements.

Sadly Morris is living proof that whistle-blowers in Australia are essentially thrown to the wolves. He went to ASIC in late 2008 and was ignored for 16 months then left to negotiate his own exit from CBA.

There are no rewards or even compensation for whistle-blowers in Australia. Institutions are essentially free to deal with them as they wish. It is why any legal action that is used to track and track down a whistle-blower should be frowned on.

CBA funds defamation action against consumer advocate Michael Fraser

- By John Richardson at 14 Apr 2015 - 4:14pm

- John Richardson's blog

- Login or register to post comments

Recent comments

9 hours 3 min ago

9 hours 7 min ago

10 hours 15 min ago

10 hours 22 min ago

14 hours 25 min ago

17 hours 7 min ago

17 hours 23 min ago

20 hours 32 min ago

20 hours 39 min ago

20 hours 53 min ago