Search

Recent comments

- google bias...

10 hours 38 min ago - other games....

10 hours 41 min ago - נקמה (revenge)....

11 hours 41 min ago - "the west won!"....

13 hours 45 min ago - wagenknecht......

14 hours 26 min ago - the game of war....

16 hours 50 min ago - three packages....

18 hours 10 min ago - russian oil.....

18 hours 17 min ago - crime against peace....

1 day 2 hours ago - why is Germany supporting the ukrainian nazis?....

1 day 3 hours ago

Democracy Links

Member's Off-site Blogs

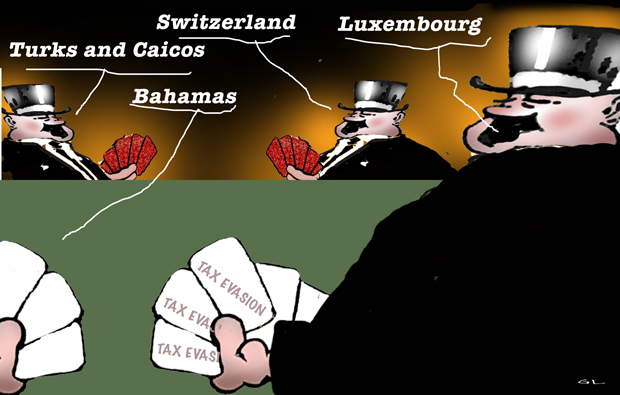

playing tax evasion...

People love how cheaply and efficiently Jeff Bezos sells and delivers product to their door. So much so that his net worth, as the founder and chief executive of Amazon, is about $US30 billion ($34 billion).

Yet Bezos concerns himself with how much time his employees spend going to the toilet. The workers in his many warehouses, known as pickers, are constantly monitored.

Bezos is a tax avoider. In Australia, Amazon may deliver goods cheaply and quickly, which is a significant good for consumers, but the company pays little tax on the hundreds of millions of turnover it has in Australia, while undermining local businesses small and large. Amazon prefers to leave tax paying to its customers.

Read more: http://www.smh.com.au/comment/corporate-scrooges-hide-trillions-of-dollars-20141116-11nq0b.html#ixzz3JNbC4SuE

- By Gus Leonisky at 18 Nov 2014 - 12:01pm

- Gus Leonisky's blog

- Login or register to post comments

a profitable industry...

High-quality tax lawyers are expensive and in demand. Tax avoidance is a massive industry. A corporate behemoth with a market capitalisation of, say, $172 billion, and with a long record of brazen denial and litigiousness on tax matters, can afford to wage "lawfare" with the Tax Office, paying high-quality lawyers (with a fraction of the money it saves on tax).

The challenge is for the Tax Office to mount a big case, and win it, and for the Abbott government to have the wit and the will to exploit a symbolic battle against Scrooge.

Read more: http://www.smh.com.au/comment/corporate-scrooges-hide-trillions-of-dollars-20141116-11nq0b.html#ixzz3JNjmexRV